-

AuthorSearch Results

-

February 6, 2025 at 11:43 am #19113

In reply to: Forex Forum

NEWSQUAWK US OPEN

Stocks gain, USD bid ahead of jobless claims, GBP lower with the BoE in vieW

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses at highs; US futures edge higher ahead of a slew of earnings.

USD attempts to recoup lost ground, EUR/USD back below 1.04, GBP awaits BoE.

Bonds in the red but off lows via a strong French auction & stagflationary UK data amid reports of a UK Cabinet reshuffle.

Metals trade mixed amid the Dollar but crude holds an upward bias.

February 6, 2025 at 11:06 am #19109In reply to: Forex Forum

February 6, 2025 at 10:32 am #19105In reply to: Forex Forum

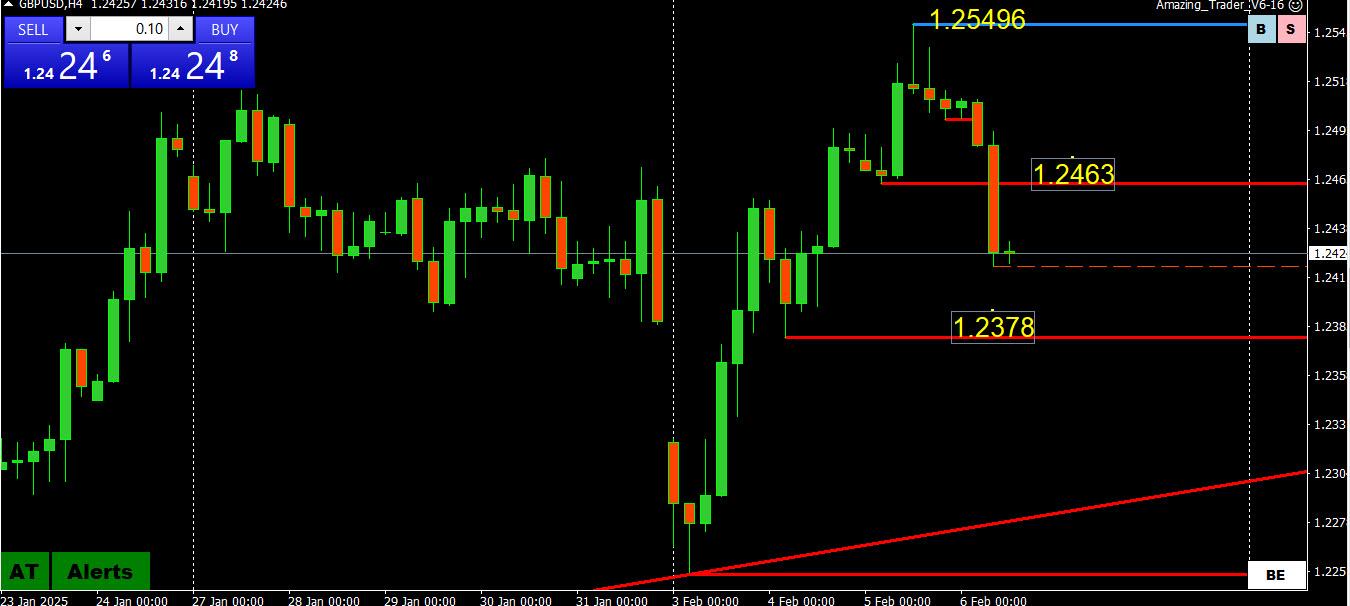

GBPUSD 4 HOUR CHART – Waiting for the BOE

My only question is why was GBPUSD bid at this time yesterday with a rate cut looming today.

What caught my eye at this time was the Power of 50 level after a high at 1.25496, so there is a method to my madness.

Note, a clue of a vulnerable GBPUSD, as I pointed out yesterday was GBP weakness vs the EUR and JPY, evident again today.

Back to charts

Move below 1.2463 breaks the upward momentum… back above this level would put 1.25 in play again.

Below 1.2378 would shift the risk back to this week’s low.

Re the BOE, a rate cut is widely expected and will not be a surprise.

February 6, 2025 at 10:09 am #19104In reply to: Forex Forum

Using my planform as a HEATMAP

Dollar is trading firmerm except vs JPY… but well within this week’s wide ranges

USDJPY back above 152 after brief dip below this pivotal level

GBPUSD softer ahead of expected BOE rate cut (note GBPJPY, EURGBP)

Bond yields are higher after plunging yesterday

Stocks are trading slightly firmer

Gold has backed off from yesterday’s record 2882 high… indicator of tariff sentiment?

February 5, 2025 at 7:31 pm #19075In reply to: Forex Forum

February 5, 2025 at 4:18 pm #19051In reply to: Forex Forum

February 5, 2025 at 2:33 pm #19046In reply to: Forex Forum

February 5, 2025 at 2:27 pm #19045In reply to: Forex Forum

February 5, 2025 at 11:59 am #19031In reply to: Forex Forum

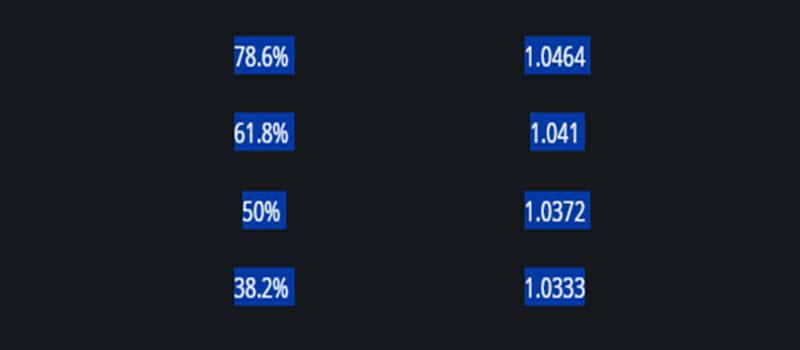

EURUSD Daily

Supports: 1.04000, 1.03700 & 1.03200

Resistances: 1.04300, 1.04500 & 1.04650

Intraday direction – Up

Possible reach on the Up side – 1.05050

Downside – 1.02700

That 1.02700 is the historical angle that holds the uptrend – once lost we see new low.

On the Big picture – we are in downtrend – as long as it stays below 1.06150

However, unless 1.01800 taken out, EUR can form a bottom here.

February 5, 2025 at 11:51 am #19029

February 5, 2025 at 11:51 am #19029In reply to: Forex Forum

February 5, 2025 at 11:29 am #19027In reply to: Forex Forum

NEWSQUAWK US OPEN

USD lower and Bonds gain ahead of ISM Services, NQ hit as China mulls a probe into AAPL, GOOGL -7% post-earnings

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses mostly lower; NQ underperforms with GOOGL -7% & AMD -8% post-earnings, AAPL -2.5% as China mulls a probe on its App Store.

EU prepares to target US big tech if US President Trump pursues tariffs against the EU, according to FT.

Dollar dragged lower again, JPY is boosted by wage data, EUR/USD above 1.04.

Bonds bid as AAPL reports hit sentiment and into Bessent’s first Quarterly Refunding.

Gold continues to print record highs on lingering uncertainty; crude on the backfoot despite the firmer Dollar.

February 5, 2025 at 9:56 am #19022In reply to: Forex Forum

Using my platform as a HEATMAP

USD is down across the board, led by the JPY (breaka below 153.70 and 153.14)

Outside week in USDCAD but still above 1.4260

Outside week in USDMXN by just one pip (double bottom around 20.29-30)

EURUSD completes 61.8% retracement at 1.0410 (high 1.0417), next res 1.0434

Gold continues its march into record high territory

Trade war with China heats up, EU threaten retaliation against tech

US stocks slip

US 10 year currently below 4.50%

February 5, 2025 at 12:49 am #19018In reply to: Forex Forum

February 4, 2025 at 4:27 pm #19004In reply to: Forex Forum

February 4, 2025 at 4:11 pm #19002In reply to: Forex Forum

February 4, 2025 at 12:57 pm #18992In reply to: Forex Forum

February 4, 2025 at 11:57 am #18990In reply to: Forex Forum

NEWSQUAWK US IOEN

US equity futures modestly lower, Crude softer, Bonds and USD await tariff updates

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

New 10% tariffs on China exports to the US have taken effect; China is to levy countermeasures on some US imported products with 15% tariffs on coal and LNG, as well as 10% tariff on oil, agricultural machines and some autos from the US.

European bourses trade tentatively, Tech buoyed by strength in Infineon; US futures are modestly lower.

DXY is flat, JPY underperforms, unwinding the prior day’s strength, and Antipodeans lag.

Bonds pullback but remain above Monday’s lows as we await tariff updates from US/China.

Crude softer amid Canada/Mexico tariff delays and China tariff retaliation.

February 4, 2025 at 10:39 am #18988In reply to: Forex Forum

February 4, 2025 at 10:17 am #18985In reply to: Forex Forum

Using my platform as a HEATMAP shows

It feels like the day after a quick moving storm raced through my town with only damage to those caught in its swirling winds.

With Canada and Mexico getting a one month reprieve, focus was on targeted tariffs announced by China in retaliation to the U.S. levies.

FX shrugged off an initial pop in the dollar while US stocks remain down on the day.

Next up on the tariff hit list is the EU. While EURUSD is holding its bounce, there is a headline risk at any time if Trump’s attention shifts to the EU.

EURUSD has filled its opening week gap at 1.0350, also the bias setter, and only above it would suggest more legs to its rebound.

February 3, 2025 at 12:03 pm #18938In reply to: Forex Forum

NEWSQUAWK US OPEN

USD surges and stocks dip after post-Trump actions; RTY underperforms

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

Trump signed a tariff order that confirms 25% tariffs on Mexico and Canada (with the exception of 10% on Canadian energy products) and 10% additional tariffs on top of existing levies for China.

Canada has announced retaliatory action, Mexico is expected to announce its measures later today, China is to challenge tariffs at the WTO.

European bourses sink as markets react to Trump tariffs and threatens the EU; RTY underperforms.

USD surges and Bonds gain post-Trump tariff actions, JPY bolstered by safe-haven appeal, EUR/USD sits on a 1.02 handle.

Crude firmer, precious metals subdued, but base metals slip on tariffs and Chinese PMI miss.

-

AuthorSearch Results

© 2024 Global View