-

AuthorSearch Results

-

February 11, 2025 at 7:42 pm #19379

In reply to: Forex Forum

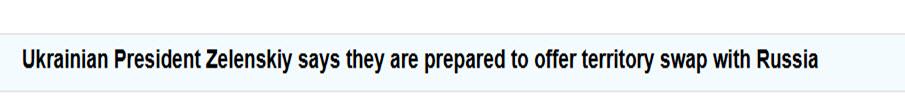

After reading this headline and seeing EURUSD spike higher it reminded me of this blog artcile (see below) which is worth A READ

Source: Newsquawk.com

Is the Trump Effect Impacting the EURUSD and the DAX?

Here is a question? Why has the EURUSD recovered and DAX at record levels given the risk of Trump tariffs. prospect of lower interest rates, an underperforming German economy and political uncertainty in Germany (and France)?

February 11, 2025 at 5:03 pm #19376

February 11, 2025 at 5:03 pm #19376In reply to: Forex Forum

February 11, 2025 at 4:44 pm #19375In reply to: Forex Forum

February 11, 2025 at 3:20 pm #19368In reply to: Forex Forum

February 11, 2025 at 2:31 pm #19363In reply to: Forex Forum

February 11, 2025 at 11:54 am #19338In reply to: Forex Forum

Newsquawk US Open

US equity futures & Bonds lower as markets digest Trump tariffs, Fed Chair Powell due

Good morning USA traders, hope your day is off to a great start! Here are the top 6 things you need to know for today’s

6 Things You Need to Know

US President Trump signed proclamations to reimpose a 25% tariff on steel and aluminium imports and declared there are no exceptions or exemptions, effective March 12th.

US President Trump said they are looking at tariffs on cars, pharmaceuticals and chips and will hold meetings over the next four weeks, while they will do reciprocal tariffs over the next two days; Trump also commented that tariffs on metals could go higher and he does not mind if other countries retaliate.

US President Trump is expected to sign executive orders on Tuesday at 15:00EST/20:00GMT.European stocks are indecisive as markets digest the latest tariffs; US futures are modestly lower.

DXY is a little lower but with price action contained as markets brace for more trade turmoil.

Bonds reel as Trump hits steel, BoE’s Bailey and Fed’s Powell are set to speak; crude gains whilst metals take a hit.

Try Newsquawk for 7 Days Free

February 11, 2025 at 5:36 am #19328In reply to: Forex Forum

February 10, 2025 at 4:52 pm #19299In reply to: Forex Forum

February 10, 2025 at 4:24 pm #19297In reply to: Forex Forum

February 10, 2025 at 2:34 pm #19287In reply to: Forex Forum

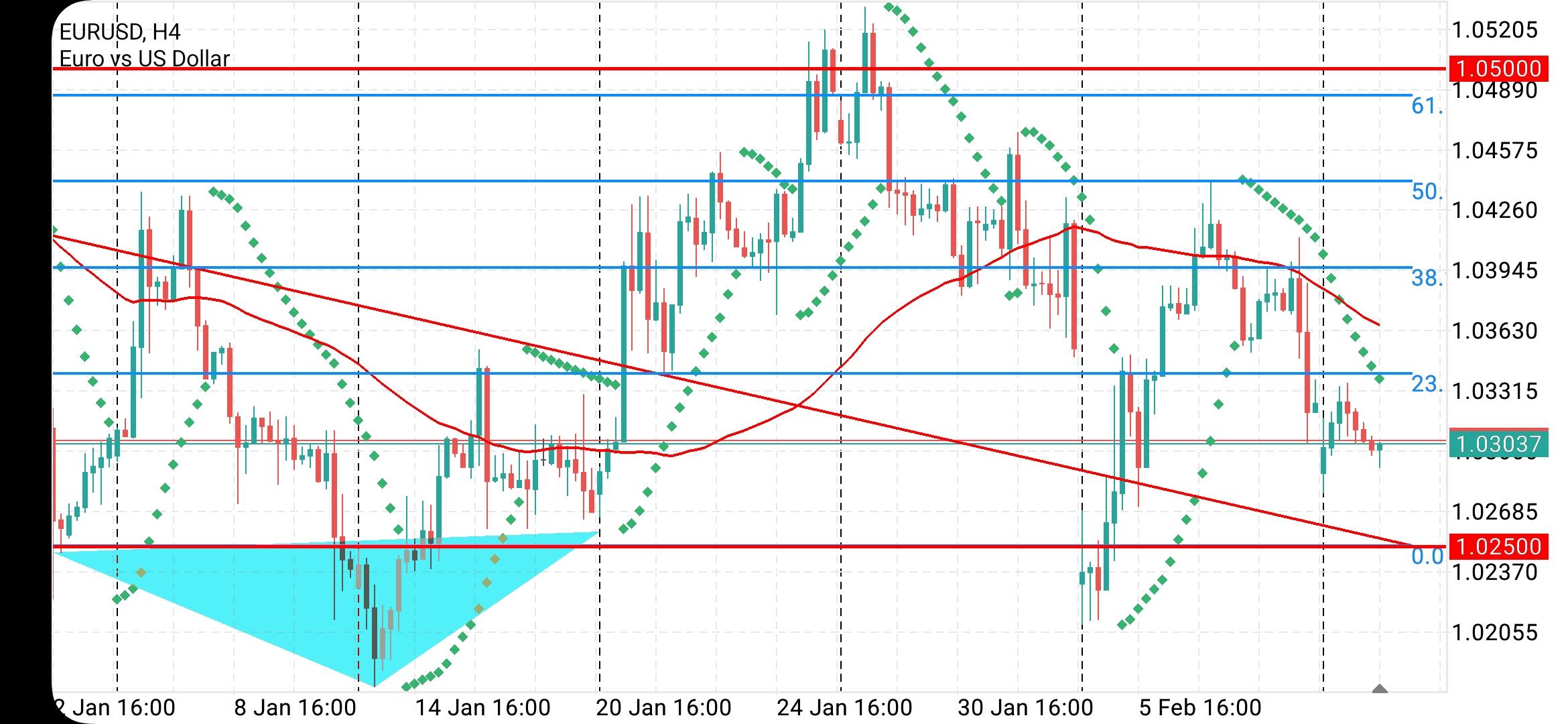

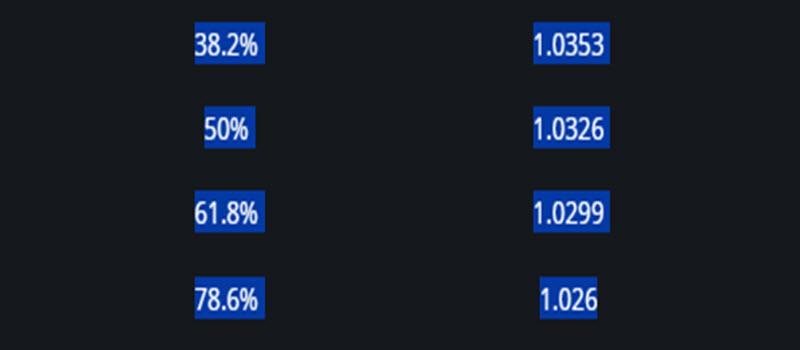

EURUSD Daily

Supports: 1.02800, 1.02100 & 1.01800

Resistances: 1.03500, 1.03800 & 1.04100

As long as EUR holds below 1.03100 probability is growing for next leg down and attack at 1.01800

I might be boring with this support at 1.01800, but if taken out there is an abyss waiting – with next bus stop at around 0.99400.

Do not underestimate break of Parity – it might be quite an interesting development 😀

Only close tonight above 1.03500 would change this current situation.

February 10, 2025 at 5:02 am #19266

February 10, 2025 at 5:02 am #19266In reply to: Forex Forum

February 9, 2025 at 9:29 pm #19253In reply to: Forex Forum

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

On Monday, Chinese CPI is expected to pick up to show a year on year increase of 0.5 percent for January, propelled by Lunar New Year demand, after barely rising by 0.1 percent in December. For Chinese PPI, no change in the deflationary trend is seen with wholesale prices down 2.4 percent in January after a 2.3 percent decline in December.

On Wednesday, headline and core US CPI are both expected up 0.3 percent on the month, not a pretty picture for an inflation-weary market. Food and energy prices have been rising, along with vehicles and shelter costs, the usual suspects. Total CPI is seen up 2.9 percent and core up 3.2 percent on year.

On Thursday, for German CPI, forecasters see no change in the final reading for January from the preliminary report at down 0.2 percent on the month and up 2.3 percent on year. For UK monthly GDP, the consensus looks for monthly GDP up a marginal 0.1 percent again in December after the same 0.1 percent rise in November. For UK quarterly GDP, no growth is the call for Q4 from Q3, with a 1.1 percent rise from a year ago in Q4. Eurozone industrial production is expected down 0.2 percent in December after a 0.2 percent increase in November. Output is expected down 2.7 percent on year.

In the US on Thursday, jobless claims are expected to fall back to 215,000 in the latest week after rising unexpectedly by 11,000 to 219,000 a week ago. For US PPI-FD, the consensus sees an increase of 0.2 percent on the month and a gain of 3.2 percent on the year. Ex-food & energy, PPI-FD is seen up 0.3 percent and up 3.3 percent on the year.

On Friday, US retail sales, the consensus looks for an unusual flat reading on the month, with sales up 0.3 percent ex-autos. Lower auto sales dampened the result along with nasty winter weather. For US industrial production, forecasters expect a moderate 0.3 percent rise after a good gain of 0.9 percent in December. Capacity utilization is seen ticking up to 77.7 percent from 77.6 in December. That rate remains about 2 percentage points below average

Econoday

February 7, 2025 at 1:46 pm #19184In reply to: Forex Forum

February 7, 2025 at 1:28 pm #19179In reply to: Forex Forum

February 6, 2025 at 6:09 pm #19129In reply to: Forex Forum

February 6, 2025 at 4:16 pm #19125In reply to: Forex Forum

February 6, 2025 at 4:11 pm #19124In reply to: Trading Tip of The Week

Trading Tip 8:A Warning to All Traders: Your Stop May Not Be a Stop

Anyone who has survived the forex trading wars and is still trading knows how important stops are to preserve capital and staying in the game.

As I noted in Use stops and Live to Trade Another Day

Stops are a necessary evil for any trader who wants to stay in the game. Some traders may try to avoid using stops but all it takes is one surprise headline and the game is over..

Stops are like an insurance policy to protect against a trade not working out. A stop is also protection against a surprise or an unexpected event

When a stop is not a stop

However, there are times when a stop is not a stop but an invitation to lose more than planned or even to see an account wiped out.

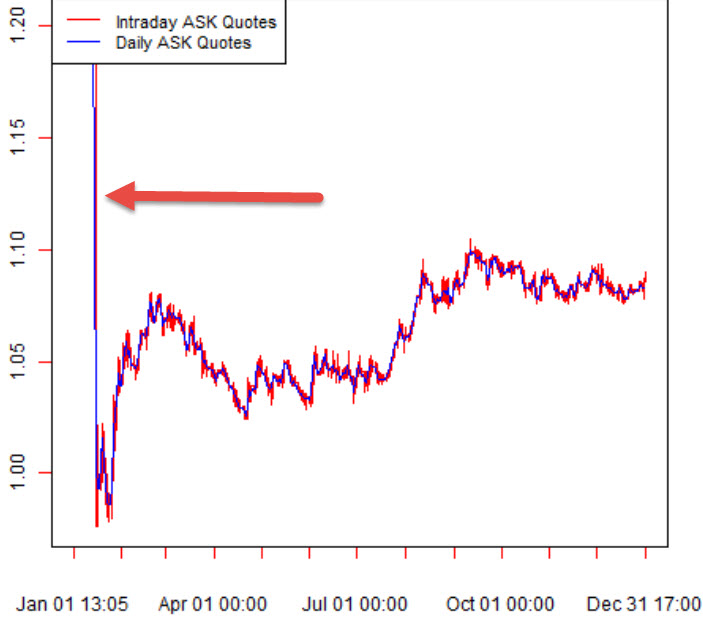

In the history of trading there are times when a currency, for example, gaps in a straight line and stops are executed far away from where they are placed. While not the norm, there are enough instances to have left the floor littered with blown accounts.

The one that comes to mind occurred on January 15, 2015 when the Swiss National Bank pulled its bid supporting EURCHF at 1.20 and what followed was a true black hole. No stop was safe and in fact many traders found themselves with negative margins when their positions were closed out, some as much as 20+% away from their stop level.. The range for that day was 1.2020-.8643 with most of the move occurring in minutes although there is a debate as to where the actual low was depending on the broker.

Source Quantitative Finance

While this was an extreme case to say the least it underscores when a stop is not a stop. Whether a stop is executed 50 pips, 100 pips, 200 pips or more from where it is placed, the results can be disastrous depending on the amount of leverage used

Time for traders to beware

This brings us to today’s market where attention is clearly focused on the results of the US election. As liquidity thins with trading driven by election headlines, even if you call the vote correctly you could easily get stopped out on a false start as news algos will rule the market. The issue is not getting stopped out but at what price.

A Warning to All Traders: Your Stop May Not Be a Stop

Now, to be clear, I am not suggesting to trade without a stop loss. Just be aware that the next few days will not be business as usual. There is a reason why implied options volatility has soared in currencies like the EURO and Mexican Peso to levels not seen since the 2016 U.S. presidential election.

So as a warning to all traders, especially those relatively new to the game, your stop may not be a stop as you are used to but don’t trade without one. Either reduce your leverage and widen your stop or sit back, enjoy the fireworks and look to trade once the dust settles.

Addendum: Feb 3, 2025

This USDCAD 5 minute chart is a good illustration of when a stop isn’t a stop in a news headline driven market.

Note, the last candle where stops were likely run on both sides.

Ask where stops were filled in this 5 minute candle.?

1.4584 => 1.4g24 _. 1.4520 => 1.4572 (close)

A Warning to All Traders: Your Stop May Not Be a Stop

Get Your FREE Trial of The Amazing Trader HERE

February 6, 2025 at 2:41 pm #19120In reply to: Forex Forum

February 6, 2025 at 2:17 pm #19118In reply to: Forex Forum

February 6, 2025 at 1:36 pm #19117In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View