-

AuthorSearch Results

-

February 13, 2025 at 8:32 pm #19528

In reply to: Forex Forum

February 13, 2025 at 7:14 pm #19513In reply to: Forex Forum

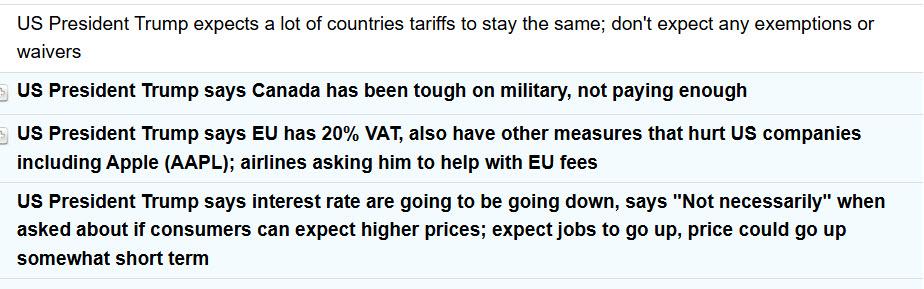

EURUSD spooked by VAT comment but has since bounced back. Here are some highlights

Source: Newsquawk.com

February 13, 2025 at 6:51 pm #19512In reply to: Forex Forum

February 13, 2025 at 2:24 pm #19486In reply to: Forex Forum

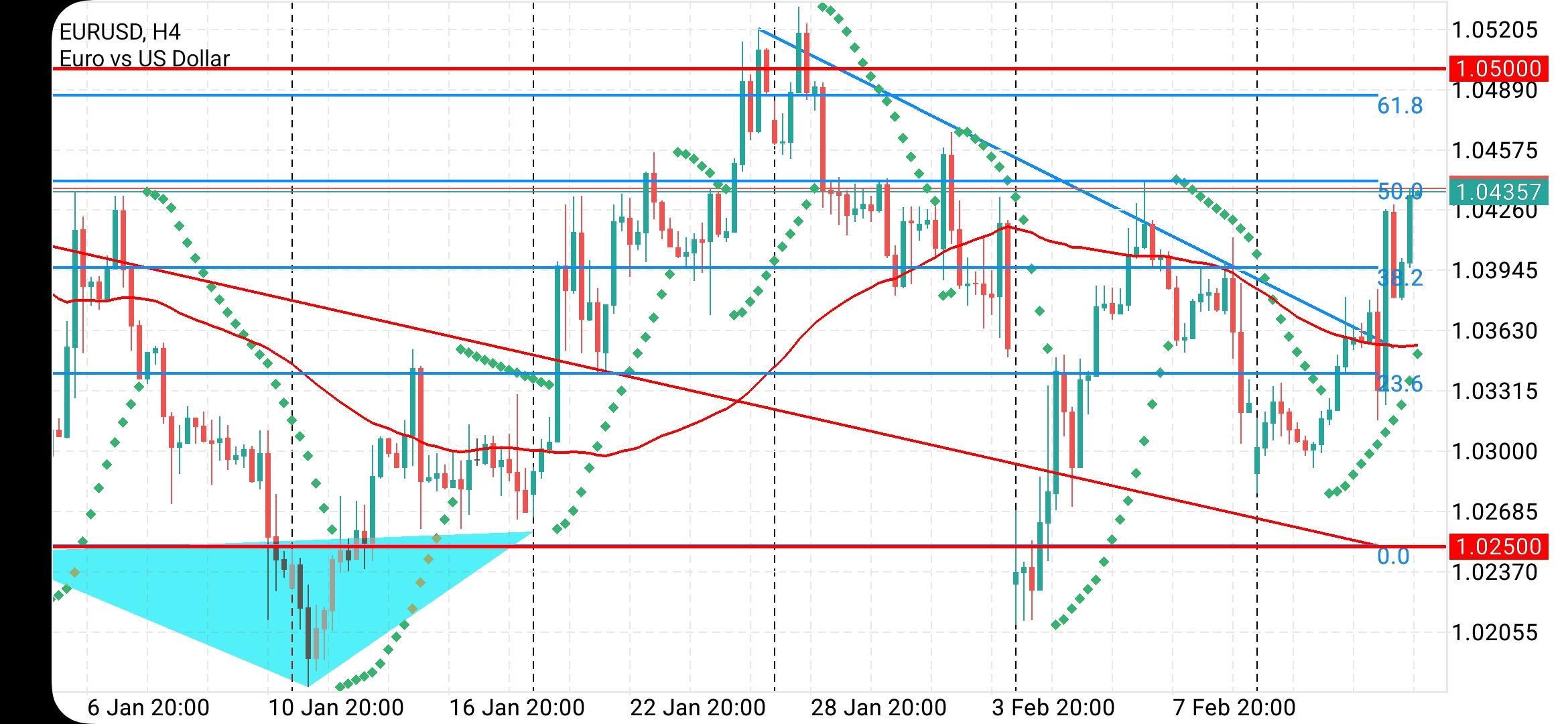

EURUSD 4h

What it means that EURUSD was rejected at 1.04400

I have mentioned last night 1.04450 as an important level that separates EUR from surging higher ( always take few pips up or down in consideration as I am trying to give you an insight way earlier , so levels are moving slightly with every passed hour )

We have now following supports:

1.03650 & 1.03400

If later one is lost, road would be open to 1.02100

Resistances are at: 1.04400 & 1.04700

The angle of this Support line below is one that usually comes during corrections and not Overall Direction – so this might be just a correction prior to continuation of the downtrend.

February 13, 2025 at 11:31 am #19474

February 13, 2025 at 11:31 am #19474In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

Talks to end the Ukraine war have partly cut across the hot U.S. inflation report for world markets, reining in both oil prices and capping aggravated U.S. borrowing rates – while also lifting the euro and European shares.

Morning Bid: Peace and prices – inflation vies with Ukraine talks

February 13, 2025 at 11:23 am #19473In reply to: Forex Forum

February 13, 2025 at 10:45 am #19471In reply to: Forex Forum

It is rare that we like toi give ourselves credit but I poated this article nearly 3 weeks ago and it took time for the markets to catch up to my puzzle.

Is the Trump Effect Impacting the EURUSD and the DAX?

Here is a question? Why has the EURUSD recovered and DAX at record levels given the risk of Trump tariffs. prospect of lower interest rates, an underperforming German economy and political uncertainty in Germany (and France)?

February 13, 2025 at 9:55 am #19468In reply to: Forex Forum

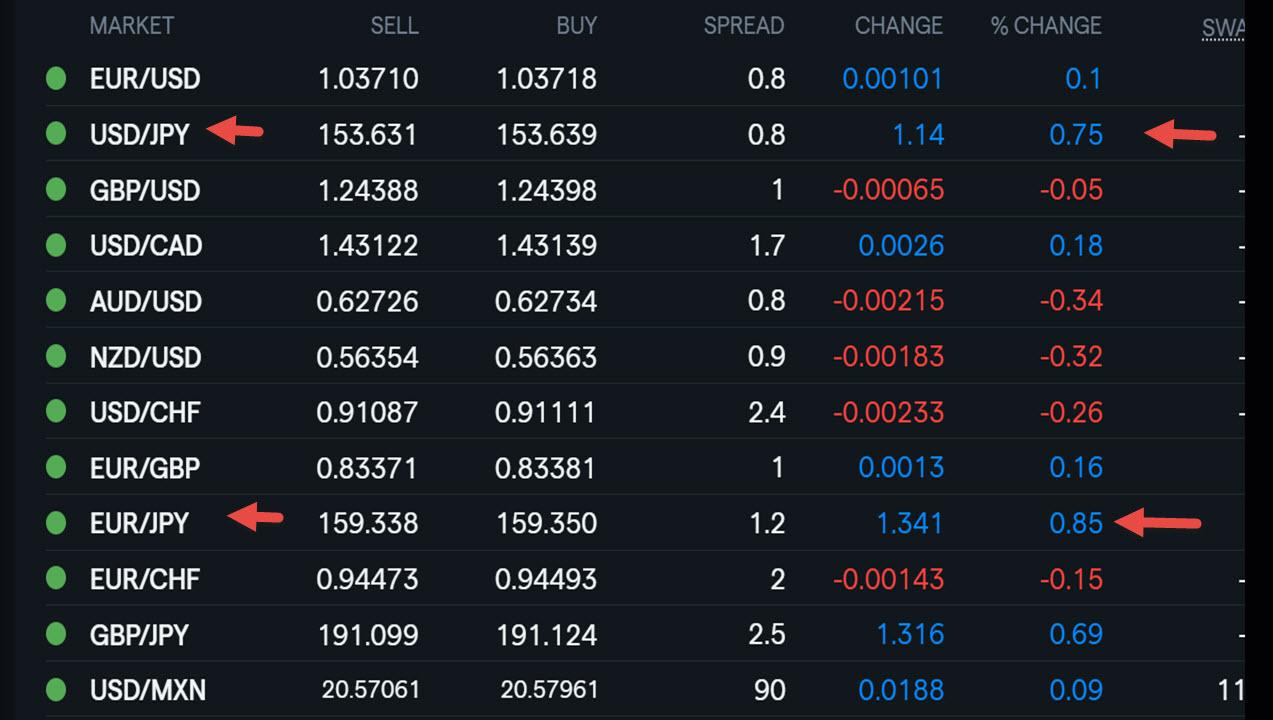

Using my platform as a HEATMAP

Focus on EURUSD and hopes for an end to the Ukraine war….So, another day of headline roulette where EURUSD should find support below the market.

USDSJPY, as suggested yesterday, found 155 too tough.

Data focus on PPI after hotter CPI yesterday.

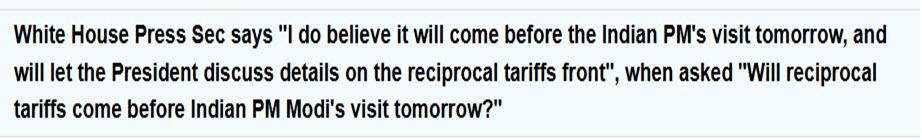

Other focus today will be on whether Trump announces details on reciprocal tariffs.

February 13, 2025 at 6:19 am #19464In reply to: Forex Forum

February 12, 2025 at 8:59 pm #19441In reply to: Forex Forum

February 12, 2025 at 7:56 pm #19436In reply to: Forex Forum

Hedline whipsaq continues… out a little while ago and will have everyone glued to the TV and headlines on Thursday.

It also cyt short the EURUSDF rally that paused just below a key AT level at 1.9432 (high 1.0430, lasr 1.0389)

Source: Newsquawk.comFebruary 12, 2025 at 5:14 pm #19431In reply to: Forex Forum

February 12, 2025 at 4:30 pm #19428In reply to: Forex Forum

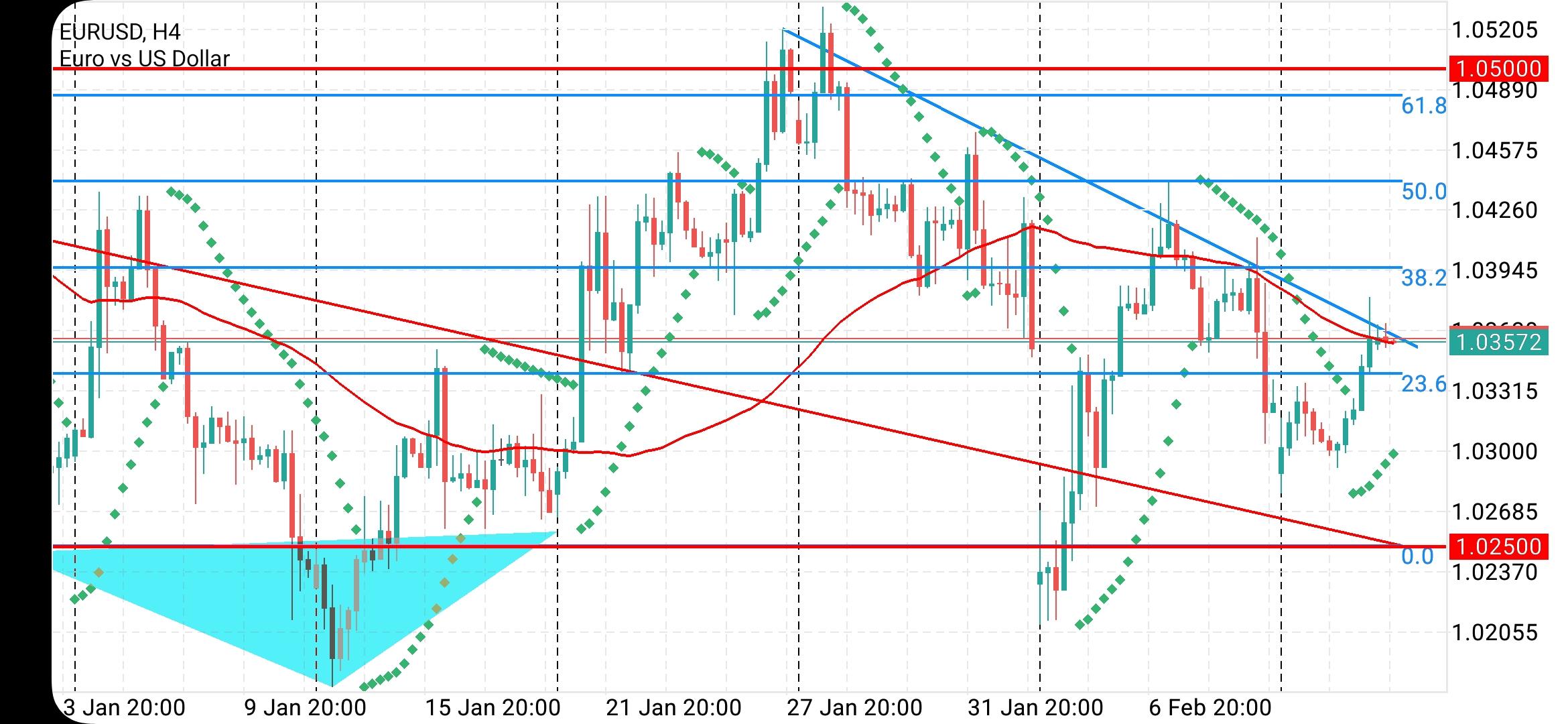

EURUSD 4h Update

EUR bounced sharply and reached 1.03800 once again.

Now the question is how is it going to Close this bar in about hour and half.

Options:

– Close above 1.03600 – Bullish – it would go way above 1.03800 and change the Daily direction to Up

– Close below 1.03500 – Bearish – Another leg down testing at least 1.02900

Later tonight I’ll reassess the situation and post another update

February 12, 2025 at 4:11 pm #19426

February 12, 2025 at 4:11 pm #19426In reply to: Forex Forum

February 12, 2025 at 2:35 pm #19421In reply to: Forex Forum

February 12, 2025 at 1:49 pm #19420In reply to: Forex Forum

February 12, 2025 at 12:07 pm #19416In reply to: Forex Forum

February 12, 2025 at 11:48 am #19415In reply to: Forex Forum

NEWsQUAWK US OPEN

USD and USTs steady ahead of US CPI while crude slips; reports suggest optimism surrounding Middle Eastern talks

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

US President Trump responded “We’ll see” when asked if reciprocal tariffs are still coming on Wednesday.

European bourses hold an upward tilt pre-US CPI and with tariffs capping optimism; US futures are mixed.

USD steady ahead of CPI, JPY is on the backfoot given the yield environment.

USTs trade steady ahead of CPI, German yields continue their march higher.

Crude slips on inventories which saw a surprise build in headline crude stockpiles, reports suggest there is “some optimism about reaching a solution” on Middle Eastern talks

February 12, 2025 at 10:15 am #19409In reply to: Forex Forum

Using my playing as a HEAztMAP

Tug-of-warUSDJPY up

JPY weaker on crosses (EURJPY leading)

USD mixed elsewhere,

EURUSD high 1.0380. vs 1.0385, where it was trading when reciprocal tariffs news hit last Friday

Next up: US CPI … see detailed preview

February 12, 2025 at 7:12 am #19408In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View