-

AuthorSearch Results

-

February 17, 2025 at 1:18 pm #19647

In reply to: Forex Forum

February 17, 2025 at 11:41 am #19642In reply to: Forex Forum

February 17, 2025 at 8:13 am #19637In reply to: Forex Forum

February 16, 2025 at 11:12 pm #19635In reply to: Forex Forum

February 16, 2025 at 11:31 am #19611In reply to: Forex Forum

It looks like there may NOT beanother tariff news opening week gap.

Meanwhile, Trump said his next focus is on car imports.

I found this in home web.

As of February 2025, the European Union (EU) imposes a 10% tariff on imported vehicles from the United States, while the U.S. applies a 2.5% tariff on European car imports. This disparity has been a point of contention in transatlantic trade relations. In response, the EU has proposed reducing its tariff on U.S. car imports to 2.5%, aligning with the U.S. rate, in an effort to ease trade tensions.

Additionally, President Donald Trump has announced plans to impose new tariffs on countries with value-added tax (VAT) systems, arguing that these taxes act as trade barriers disadvantaging U.S. exports. This policy could significantly impact the EU, where VAT rates average around 22%.

These developments indicate ongoing negotiations and potential changes in tariff structures affecting U.S.-EU automotive trade.

February 16, 2025 at 11:19 am #19608In reply to: Forex Forum

It looks like there may be another tariff news opening week gap.

Trump said his next focus is on car imports.

I found this in home web.

As of February 2025, the European Union (EU) imposes a 10% tariff on imported vehicles from the United States, while the U.S. applies a 2.5% tariff on European car imports. This disparity has been a point of contention in transatlantic trade relations. In response, the EU has proposed reducing its tariff on U.S. car imports to 2.5%, aligning with the U.S. rate, in an effort to ease trade tensions.

Additionally, President Donald Trump has announced plans to impose new tariffs on countries with value-added tax (VAT) systems, arguing that these taxes act as trade barriers disadvantaging U.S. exports. This policy could significantly impact the EU, where VAT rates average around 22%.

These developments indicate ongoing negotiations and potential changes in tariff structures affecting U.S.-EU automotive trade.

February 15, 2025 at 6:31 pm #19603In reply to: Forex Forum

Putin has something in him called Benevolence,.. not a wicked man or cruel man or madman as made out to be. Putin is the one who made a great success of Post USSR Russia… Let us not forget that.

In the early days they did not have money to pay the military but he grew the country out of those conditions and improved the quality of life in his country and many other nearby countries to a great extent and many of the best things are in store for Russia. If he had not sold a drop of oil to Europe from those days until today then where would Europe be now?

Other people need to not forget the good things he has done for their countries and their economies…

February 14, 2025 at 5:17 pm #19585In reply to: Forex Forum

February 14, 2025 at 4:36 pm #19581In reply to: Forex Forum

happy valentine’s vance

wsj – Vance Wields Threat of Sanctions, Military Action to Push Putin Into Ukraine Deal

In interview with The Wall Street Journal, vice president says Ukraine must have ‘sovereign independence’

By Bojan Pancevski and Alexander Ward,

Updated Feb. 14, 2025 8:00 am ETFebruary 14, 2025 at 3:59 pm #19577In reply to: Chart of The Week

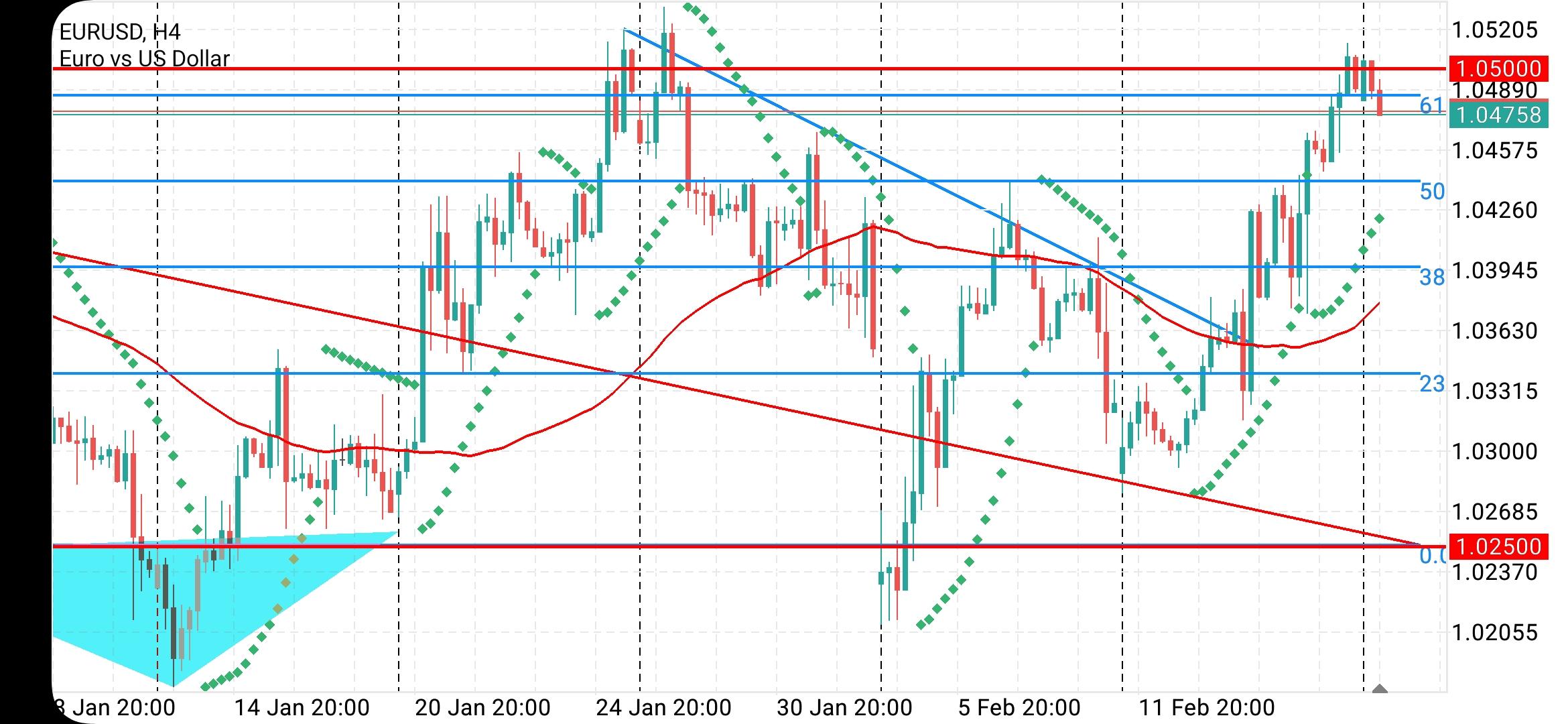

Trading Chart of the Week: EURUSD\4 Hour (scroll down for the Daily Chart)

I had my choice of charts to post as it is easy to look back in hindsight.

I picked out a EURUSD 4 hour chart, not because I trade that time frame but use it to help identify what side to trade on shorter time frame charts.

What do you notice in this chart in a week that was filled with news headlines that caused whipsaw spikes (up and down) on both sides. It wasn’t until later Thursday that upward momentum (i.e. rising red lines) took over.

The red lines are from my Amazing Trader (AT) charting algo and are like ladders, in this case, building to the upside. Only if the most recent red line that preceded a new high is broken, downside is limited and risk is still pointed up.

The strategy is explained and illustrated in the AT trading guide that comes along with a subscription. You can try to apply the same logic yourself but a lot better using AT as the pattern repeats in all time frames and with any instrument you broker has on its MT4 platform

Contact me at jay@localhost for details on a half price access.

EURUSD Daily chart, looking ahead

Pivotal level 1.05, will set the tone going forward

Key chart level: 1.0534, upsodee limited unless regained.

Not much on the downside so using shorter time frames,,,

1.0514 = double to

1.0447 (suggests using 1.0450) is pivotal … below it shifts focus ftom 1.05…. above it keeps te focus om 1.05

February 14, 2025 at 12:44 pm #19566In reply to: Forex Forum

Europe to bat away U.S. tariffs, weaker currency to help

Another day, another story on tariffs.This time, U.S. President Trump has tasked his economics team with devising plans for reciprocal tariffs on every country that taxes U.S. imports, starting from April.

While that may look bad for Europe on the surface, Barclays is sanguine about the possible impact, especially as the delayed implementation opens the door for negotiation.

“The actual hit to growth is likely manageable and largely offset by weaker EURUSD,” Barclays says.

The staples, autos and chemicals sectors exhibit the widest tariff gaps, Barclays notes, so they would be most exposed to reciprocal tariffs, but these sectors have underperformed since the U.S. election.

“Some of the earnings downside is arguably priced in already,” Barclays notes.

February 14, 2025 at 12:29 pm #19563In reply to: Forex Forum

February 14, 2025 at 11:37 am #19562In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

As world stocks got a fresh lift, the U.S. dollar has retreated to its lowest of the year so far on a mix of reversing U.S. Treasury yields and another delay in tariff implementation.

Multiple cross-currents have hit macro markets this week – a whipsaw effect from two big U.S. inflation reports, Washington’s push for Ukraine peace talks alongside threats of sweeping tariffs and another heavy schedule of corporate earnings and Treasury debt sales.

But as Friday trading gets underway, the net impact on the dollar index has been to sink it to its lowest in almost two months – driven in part by a benign take on January’s U.S. producer price report and a Ukraine-related rally in the euro.

Morning Bid: Unloved dollar hit by tariff delays, yield recoil

February 14, 2025 at 11:35 am #19561In reply to: Forex Forum

NEWSQYAWK US OPEN’

Indices mixed amid varied Russia/Ukraine commentary, USD lower ahead of Retail Sales

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses & US futures began the session mixed but have deteriorated on geopols; Luxury lifted by Hermes post-earnings.

USD remains pressured post-Trump tariff announcement, Antipodeans lead.

Bonds retain a bearish biasbut are off lows as geopolitics drives recent price action

Gas continues to deflate, crude rangebound & metals advance.

Russia has said its officials are not attending the Munich conference, US VP Vance & Ukraine’s Zelensky set to meet at 11:00EST; recent remarks from Zelensky have tempered recent optimism

Source: Newsquawk.com

February 14, 2025 at 11:14 am #19560In reply to: Forex Forum

February 14, 2025 at 10:29 am #19559In reply to: Forex Forum

February 14, 2025 at 9:21 am #19556In reply to: Forex Forum

February 14, 2025 at 6:36 am #19555In reply to: Forex Forum

February 13, 2025 at 9:30 pm #19535In reply to: Forex Forum

Many have seen me say when there is a geopolitical event or crisis, markets tend to price in the worst-case outcome and reassess later. The Trump tariff soap opera feels like a combination of the two (geopolitical event/crisis)..

After President Trump took office markets started to price in the worst-case impact of tariffs (e.g. inflation/higher bond yields/trade war, etc).

EURUSD, for example, set its low at 1.01777 on January 13 and one month later it has had an erratic recovery that has 1.05 on its radar, helped by hope for an end to the Ukraine war.

My point is if you take a step back after the frenetic headline driven whipsaw trading seen each day this week, there is some logic to the price action. The worst-case outcome does not appear will materialize

As you can see in forex, equities and bonds, markets have adjusted accordingly to reality. At a minimum, a two-way risk has been restored to what looked like might become a one-way street.

February 13, 2025 at 8:36 pm #19531In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View