-

AuthorSearch Results

-

February 20, 2025 at 4:58 pm #19878

In reply to: Forex Forum

February 20, 2025 at 12:05 pm #19842In reply to: Forex Forum

Us OPEN

Trump suggests a trade deal with China is “possible”, USD/JPY briefly dipped below 150 ahead of US data & Fed speak

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

US President Trump remarked that a new trade deal with China is possible; EU’s Sefcovic says they are prepared to talk about reducing the 10% US auto tariff.

European bourses opened mixed but have gradually edged higher; US futures modestly lower.

USD is softer vs. peers, JPY benefits from yield dynamics, AUD boosted post-jobs.

USTs inch higher continuing post-FOMC price action while EGBs remain in the red.

Crude and metals benefit from the softer Dollar; Rio Tinto says “Near-term market conditions are expected to remain challenging in 2025”.

February 20, 2025 at 11:51 am #19839In reply to: Forex Forum

EURUSD Daily

On the edge – Support 1.04150 – Resistance 1.04450

Mere break of any of it won’t mean much – most important is how the day will close!

We’ll wait for Initial Jobless Claims today – Economic Data Calendar

February 20, 2025 at 10:45 am #19830

February 20, 2025 at 10:45 am #19830In reply to: Forex Forum

February 20, 2025 at 10:38 am #19829In reply to: Forex Forum

February 20, 2025 at 7:13 am #19827In reply to: Forex Forum

February 19, 2025 at 8:11 pm #19817In reply to: Forex Forum

EURUSD Daily – Update

So far support at 1.04050 proved worthy.

For tomorrow it is going to be around 1.04100/150

Resistance is at 1.04450

Without tomorrow’s bar , this is no man’s land right now – if there was not a possible trend line just below it, I would call this as a Sell.

However, my historical trend lines never fail – so we need to see what is going to happen tomorrow before any direction might be considered.

February 19, 2025 at 6:39 pm #19812

February 19, 2025 at 6:39 pm #19812In reply to: Forex Forum

February 19, 2025 at 6:13 pm #19811In reply to: Forex Forum

euro 1.0408

fomc’s minutes coming up at 2pmfed suits have been trumpeting no cuts unlees their confidence (hahaha whare is it at now on a scale of 0 – 5?) comes back somehow.

confidence in inflation heading back towards their crazy 2% notion.Once this fart blows out of the window, markets – at first perhaps slowly – will turn towards arguing about clarifying donald’s “in the nneighbourhood” of 25% tariffs.

February 19, 2025 at 6:01 pm #19809In reply to: Forex Forum

February 19, 2025 at 4:15 pm #19803In reply to: Forex Forum

February 19, 2025 at 1:26 pm #19789In reply to: Forex Forum

February 19, 2025 at 11:47 am #19785In reply to: Forex Forum

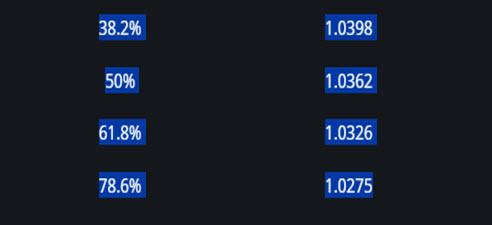

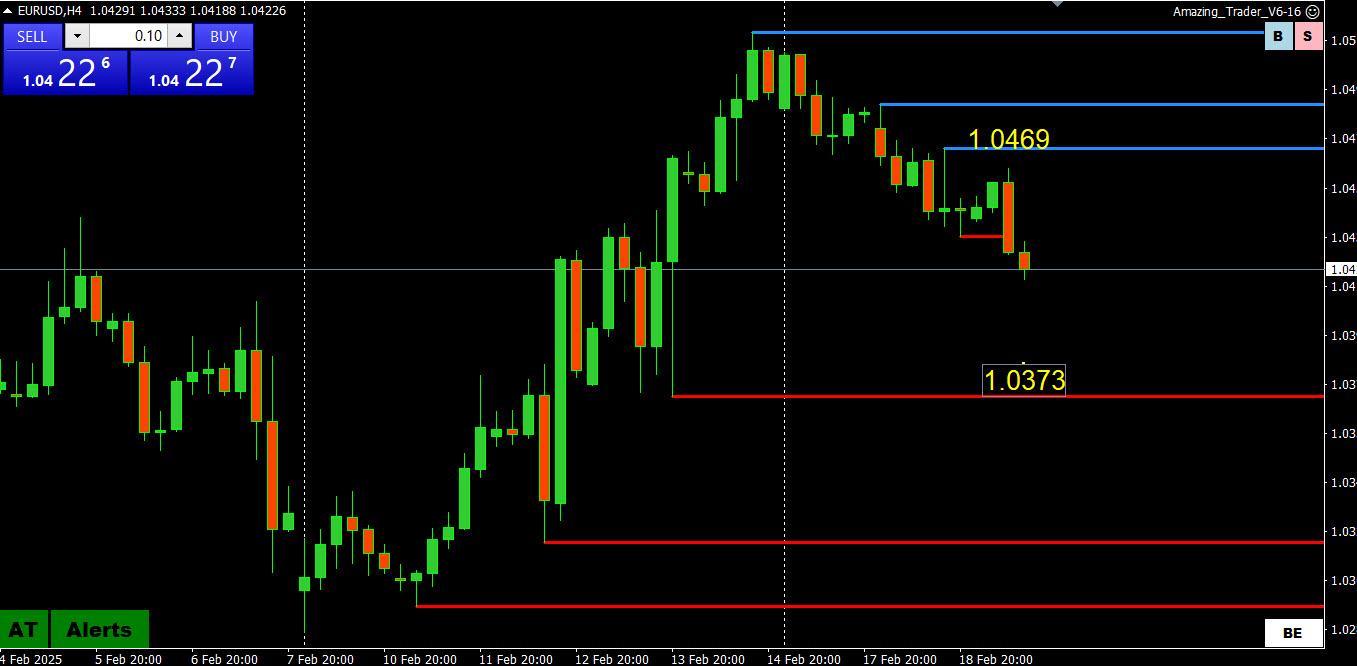

EURUSD 4 HOUR CHART – On the defensive below 1.05

Break of 1.0447 leaves a void to 1.0373 as next support… this also suggests no key stops until that level

Using FIBOS, 1.0398 = 38.2%

Treating 1.04-1.05 as the range, 1.0450 sets the tone.

Back above 1.0469 would be needed to break downward momentum.

February 19, 2025 at 11:46 am #19784In reply to: Forex Forum

February 19, 2025 at 11:30 am #19783In reply to: Forex Forum

Thia ia worth reading

A look at the day ahead in U.S. and global markets from Mike Dolan

Even though Wall Street stocks lag world markets this year, the S&P500 still managed to wring out another record high on Tuesday – with a mix of new tariff threats, housing updates and Federal Reserve minutes to digest later today.

A confusing and turbulent start to the year has seen global investors’ attention switch away from pricey U.S. equity to cheaper European stocks and Chinese tech – with this week’s talks on ending the Ukraine war and Germany’s weekend election catalyzing interest in the former.

February 19, 2025 at 11:09 am #19782In reply to: Forex Forum

February 19, 2025 at 10:24 am #19779In reply to: Forex Forum

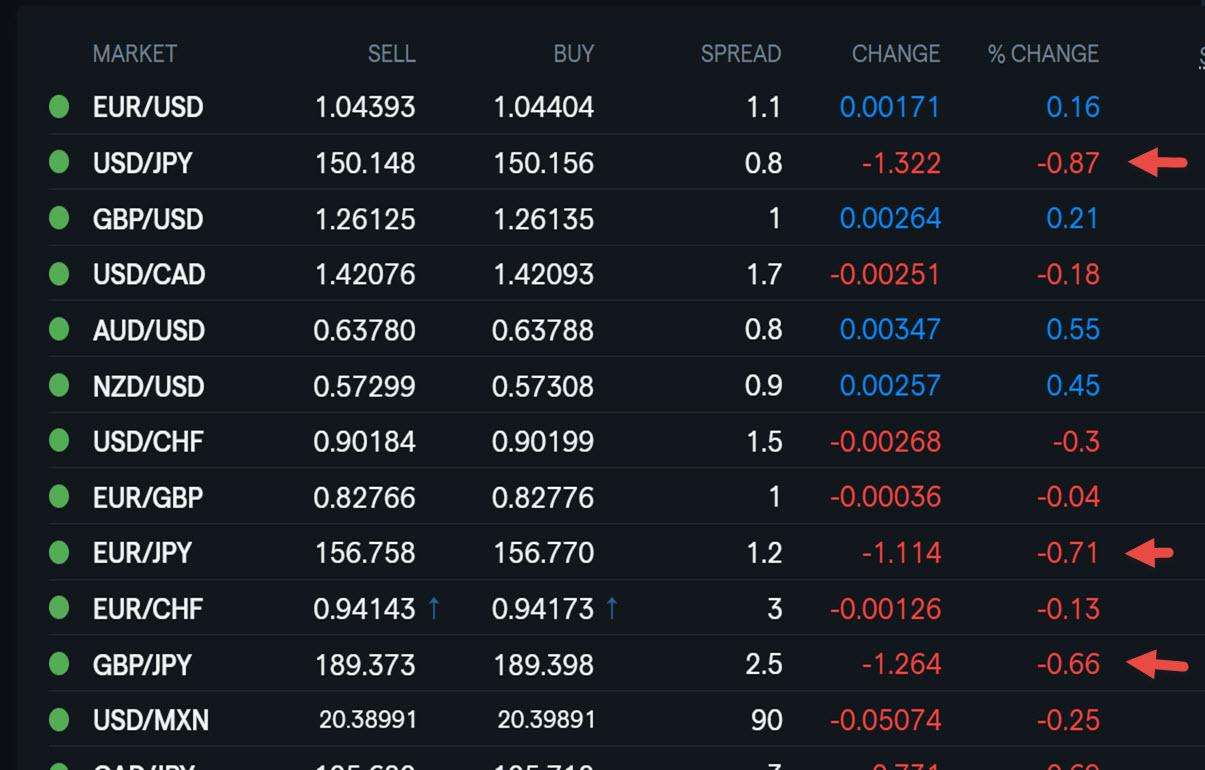

Using my platform as a HEATMAP

Mixed USD, new record high for GOLD

EURUSD soft below 1.0450, EUR weak on crosses (e.g. vs JPY,GBP)

USDJPY failed again above 152 but downside so far contained…US bond yields tick higher again

Highlights;

Trump vows 25% tariffs on imported cars, pharmaceuticals, semiconductor chips… deadline April 2

UK inflation hotter than expected

Trump push for Ukraine peace deal, tariffs unsettles Europe but DAX unfazed

February 19, 2025 at 10:08 am #19777In reply to: Forex Forum

February 19, 2025 at 8:17 am #19773In reply to: Forex Forum

February 18, 2025 at 6:12 pm #19745In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View