-

AuthorSearch Results

-

February 24, 2025 at 10:16 am #19993

In reply to: Forex Forum

Using my platform as a HEATMAP

Dollar close to unchanged after post-German election trading.

Focus on the EU and EURUSD after the German election results were about as expected.

Initial positive reaction was partly driven by hope a new government would remove the debt brake and more spending would boost the Econ. Perhaps on second thought is the reality of trying to put together and then govern with a three party coalition from opposite sides of the political spectrum.

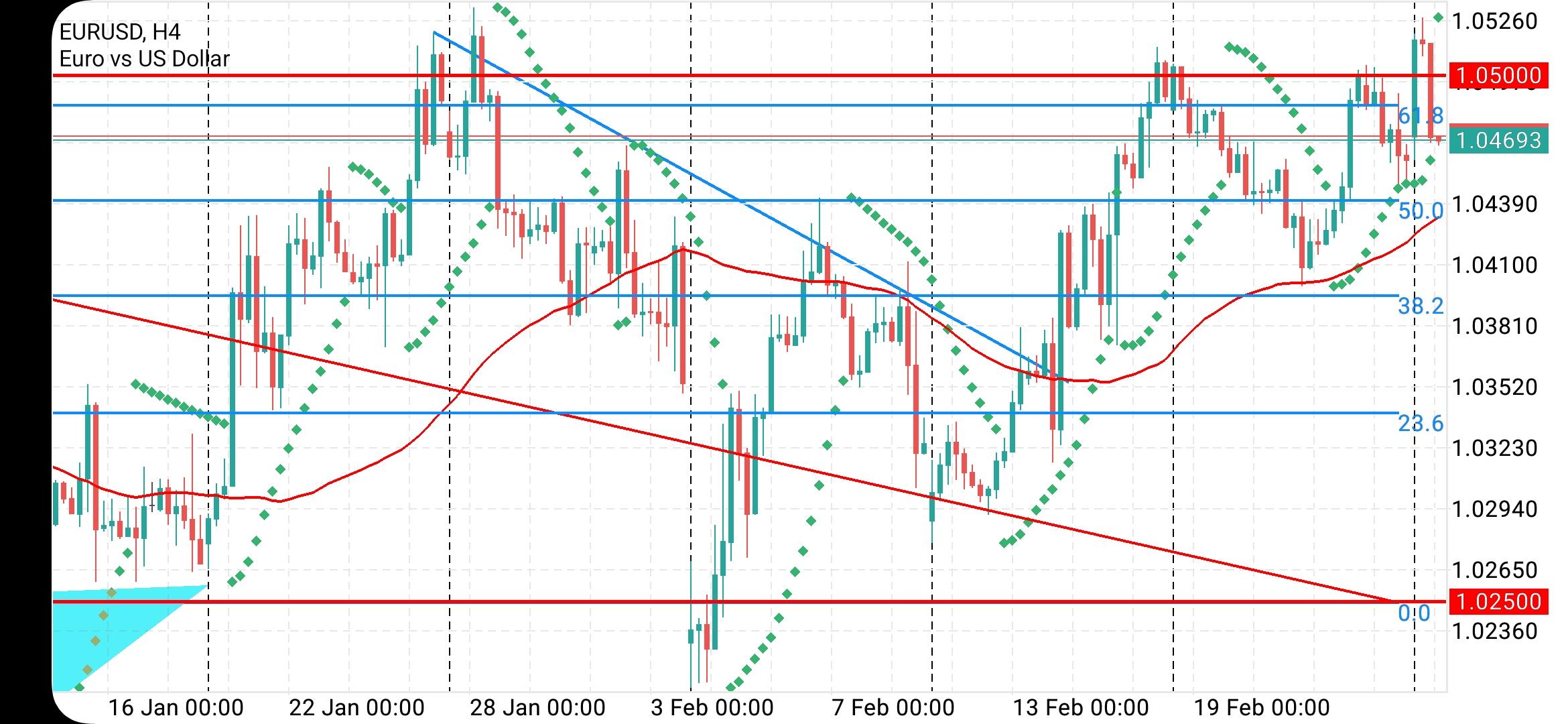

EURUSD is back to square one after failing to hold 1.05+

Modest bounce in USDJPY but still below 150

European and US stocks up

Gold up modestly

Light data day

February 24, 2025 at 10:10 am #19991In reply to: Forex Forum

February 23, 2025 at 10:27 pm #19985In reply to: Forex Forum

February 23, 2025 at 10:08 pm #19983In reply to: Forex Forum

February 23, 2025 at 8:30 pm #19980In reply to: Forex Forum

POOF! … the end

“Zelenskyy ‘willing to step down’ in return for Ukraine’s NATO accession

The Ukrainian president said that he is focused on Ukraine’s security today and called for further guarantees from Europe and the US.” – euronewscould not step down fast enough. but nooooo he still tries to set conditions

February 23, 2025 at 4:49 pm #19978In reply to: Forex Forum

February 23, 2025 at 4:04 pm #19975In reply to: Forex Forum

February 22, 2025 at 10:06 am #19953In reply to: Forex Forum

EurJpy

Trend week down,

Anticipate spill over selling early next week

that once it breaks x (to be determined)– btw for those that still want to buy the dips as they have all this past week I say

beware because we could get a decent quick run to 146ish and later to 135 and 120.I am no longer targetting the 128-132 level

BTW

note that the almost exact same levels are cropping up for UsdJpy

which if I am right means EurUsd has no place to run to either up nor down.

– We shall see

February 21, 2025 at 6:45 pm #19934In reply to: Forex Forum

February 21, 2025 at 5:48 pm #19931In reply to: Forex Forum

February 21, 2025 at 4:27 pm #19926In reply to: Forex Forum

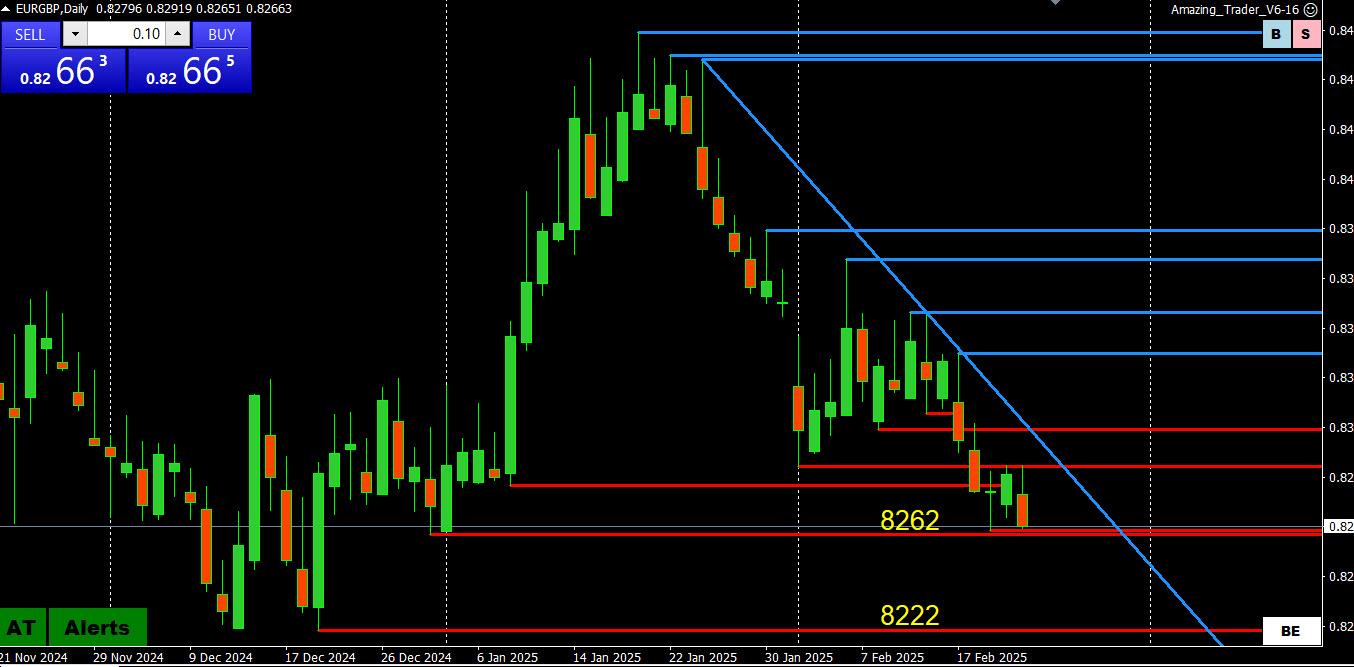

EURGBP DAILY CHART – Weighing on EURUSD

I got an email calling this Freaky Friday but there is some logic behind EURUSD falling (tests 1.0450, holding so far) despite weak US data1. EURJPY selling (biggest weight)

2. EURGBP selling (adding to it)

10-year bund is down 7bps while 10 year gilt is up 3bps

GER30 is down for the 3rd day after coming very close to 23000.

There could also be some flows ahead of the German election.

Whatever the case, .8262 is a key support with next level at .8222

Note, EURJPY selling is a greater weight on EURUSD

February 21, 2025 at 1:28 pm #19910In reply to: Forex Forum

Yes, German Elections is another important moment, but I don’t think that the fate of EUR is in their hands…any more…Trumps dealings with Russia / Ukraine is way more important.

Aside feelings of honourable European politicians ( finally someone to make them sweat and lose some sleep) , if Trump manages it till the end, Europe as a region/continent will get another chance.

It all falls back to question of Gas and Minerals coming from Russia- so Europe might ( will ) lose this one – as in the eyes of local politicians Piece is a loss…but Europe will win in many ways…

Of course waves will be felt for months to come, but we like to say : every miracle lasts three days…

February 21, 2025 at 12:59 pm #19908In reply to: Forex Forum

EURUSD Daily

Is it going to be the decision day today for EUR?

Supports at : 1.04600 & 1.04350

Resistances at: 1.05050 & 1.05550

Data today should finally gives us a clue – Economic Data Calendar

February 21, 2025 at 11:43 am #19905

February 21, 2025 at 11:43 am #19905In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

Wall Street nursed a bruising on Walmart (NYSE:WMT)’s downbeat results, casting a cloud over the U.S. consumer just as more buoyant European markets awaited the weekend’s German election.

Another blizzard of often conflicting influences from geopolitics, trade, monetary policy and corporate earnings barrelled into world markets over the past 24 hours.

But it was the retailing giant’s miss on its sales and profit forecasts – citing the turbulent political environment and trade uncertainties ahead – that cut deepest.

February 21, 2025 at 11:30 am #19903In reply to: Forex Forum

US OPEN

EUR weighed on by PMIs & JPY hit by Ueda remarks, Commodities are pressured by the firmer Dollar ahead of US PMIs

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly higher after paring initial pressure following dire French PMIs; US futures are modestly mixed.

DXY attempts to recoup lost ground, EUR weighed on by PMIs, JPY hit by Ueda remarks.

BoJ Governor Ueda said if markets make abnormal moves, the BoJ stands ready to respond nimbly, such as through market operations, to smooth market moves.

Bunds bolstered by soft PMI metrics; Commodities are pressured by the firmer Dollar.

February 21, 2025 at 9:58 am #19900In reply to: Forex Forum

Using my platform as a HEATMAP

Dollar is firmer after yesterday’s sell-off

Led by USDJPY which had bounced back above 150 but remains below yesterday’s 150.91 breakdown level.

Only news I have seen is a pushback by several officials on rising JGB yields (10 year hit a 15+ year high)

EURUSD backed off from 1.05 awaiting Sunday’s German elections…. 1.0450 = neutral while within 1.04-1.05

Stocks steady after yesterday’s sell offs.

Gold extended its retreat from yesterday from a new record high but so far contained after testing 2918 support (low 2917).

Highlights:

Flash EZ and UK PMIs

Japan CPI (hotter but ignored)

See our Economic Calendar for upcoming US data

TGIF

February 21, 2025 at 9:43 am #19897In reply to: Forex Forum

February 20, 2025 at 9:38 pm #19891In reply to: Forex Forum

February 20, 2025 at 8:04 pm #19885In reply to: Forex Forum

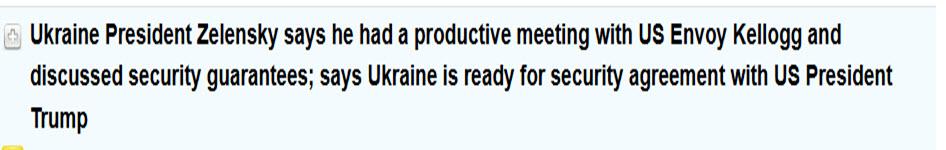

With EURUSD back to 1.05, I scanned the news for any headlines. The only one I came up with was this one from earlier

Source: Newsquawk.com

February 20, 2025 at 7:18 pm #19881In reply to: Forex Forum

Russia-Ukraine Peace deal.

*Shakes head* there won’t be a peace deal… that’s just what is…

It is prudent in many ways and for many peaceful reasons to reintegrate Ukraine back into Russia and then get Russia to join the EU, and while that is being done the former USSR countries get reintegrated back one by one. Russia would remain communist yes… but a modern and kinder variation of communism with the bad parts of it removed… they are traditional and sentimental family people and dislike misbehavior.

Like that EU can produce everything under the sun for the US,.. even for example. Cotton which US traditionally would buy from Europe…

We can have global commerce and world peace like that…

-

AuthorSearch Results

© 2024 Global View