-

AuthorSearch Results

-

February 28, 2025 at 11:21 am #20230

In reply to: Forex Forum

looking ahead … (at month-end)

US 10-YR 4.252% -0.035

8:30 – personal consumption expenditures price index — the Federal Reserve’s preferred inflation metric“Economists polled by Dow Jones expect the measure of price changes for consumers to rise 0.3% from December for an annualized gain of 2.5%. Excluding volatile food and energy prices, so-called core PCE is expect to increase by 0.3% month over month and 2.6% year over year.”

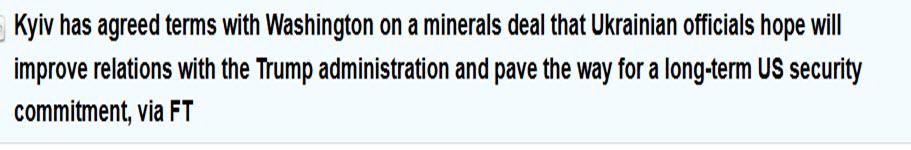

eurdlr 1.0390-ish, dlrchf .9029 gbpdlr 1.2590

tuesday march 4th = d day for President Trump’s 25% tariffs on things Canadian

dlrcad 1.4437February 28, 2025 at 10:05 am #20227In reply to: Forex Forum

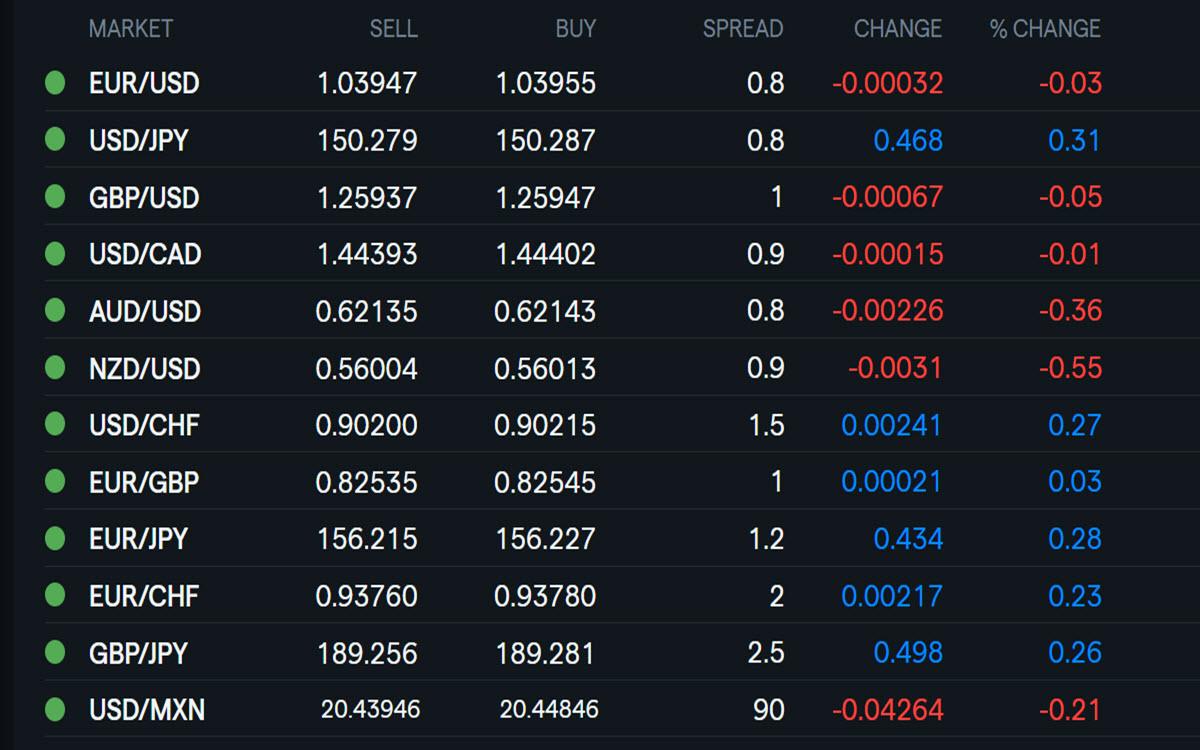

Using my platform as a HEATMAP

Liquidating markets across asset classes taking no prisoners.

The dollar holding firm at month end with USDJPY back above 150 and AUD and NZD underperforming. .

Watch month end rebalancing flows to see whether a risk of dollar buying (hard to say how much has already taken place) given weaker stocks. I read bank report earlier in the week indicating it expects EURUSD selling given the underperformance of US stocks relative to European stocks

This is not an exact science so keep an eye on what looks like real money flows, especially ahead of the 4 PM month end London fixing

Elsewhere;

Golfdextending its retreat.

Cryptos down sharply

US bond yields falling further but off earlier lows.

US stocks finding some support but the day is young.

Looking ahead

US PCE (watch the core reading) is the key data release… See a detailed preview

Watch for Trump comments, especially after the carnage triggered by his tariff comments yesterday.

February 27, 2025 at 11:04 pm #20226In reply to: Forex Forum

February 27, 2025 at 7:56 pm #20205In reply to: Forex Forum

February 27, 2025 at 3:11 pm #20182In reply to: Forex Forum

Quick recap

EURUSD break of 1.0450..highly suggests 5 day pattern around 1.05 will be broken … 1.0400 is key support, then 1.0372

JPY getting safe haven flows… USDJPY brief move above 150 smacked back below it

GBPUSDF follows EURUSD with a lag (EURGBP lower)… UK so far escaping the tariff wrath of Trump

Stocks hit, boind yields off early highs

February 27, 2025 at 2:24 pm #20176In reply to: Forex Forum

i alerted to be wary of headlines today and Trump did not disappooint.

Now post headline USD highs are key day resistance levelsa s only through there would trigger fredh stops.

EURUSD upside limited while below 1.0450-60

USDCAD stays bid while above the 1.4376 breakout level.

TrumP speaks again at the presser with the UK PM in the afternoon

February 27, 2025 at 1:36 pm #20171In reply to: Forex Forum

February 27, 2025 at 11:44 am #20168In reply to: Forex Forum

US OPEN

NVIDIA +1% in pre-market after Q4 results, a pick up in yields lift the Dollar ahead of US data

Good morning USA traders, hope your day is off to a great start!

Here are the top 4 things you need to know for today’s market.

4 Things You Need to KnowNVIDIA +1.1% in US pre-market after headline beats whilst Q1 gross margins are seen easing.

European bourses on the backfoot with sentiment hit in Europe amid Trump’s EU tariff threats; US futures gain.Pick-up in US yields provides reprieve for USD, USD/JPY eyes a test of 150.

Crude trims recent losses but metals pressured by a firmer Dollar.

<p style=”text-align: center;”><strong><a href=”https://newsquawk.com?fpr=c3imf”>Try Newsquawk for 7 Days Free</a></strong></p>

February 27, 2025 at 10:06 am #20164In reply to: Forex Forum

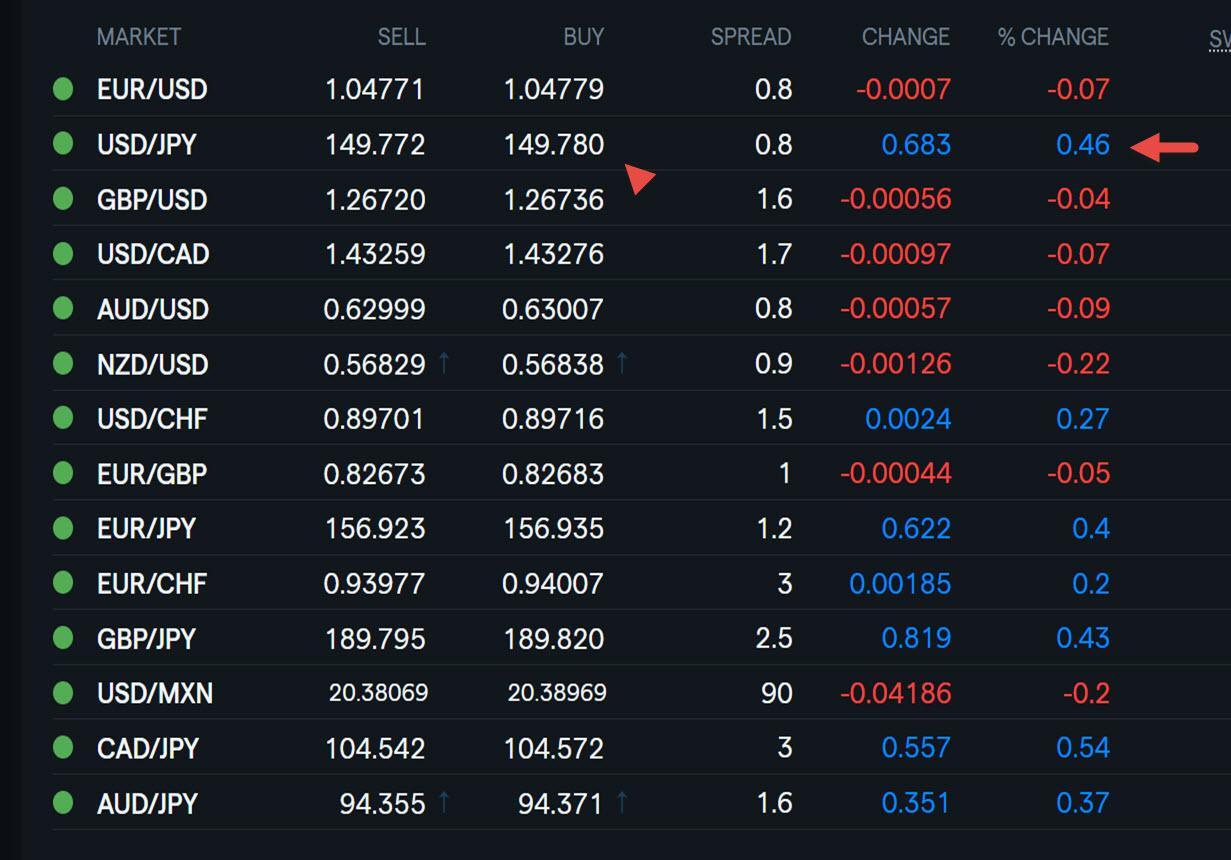

EURUSD 4 HOUR CHART – -FOCUS ON 1.05

EURUSD is back below 1.05 following a double top at 1.0528 yesterday and yet to test 1.05, which has printed 5 days in a row.

While a break of this pattern would send a bearish signal it would only be confirmed if 1.0449=50 is firmly broken.

Meanwhile, there is a full day ahead for this pattern to be extended or fail.

Range so far today: 1.0459-92

February 27, 2025 at 9:41 am #20162In reply to: Forex Forum

Using my platform as a HEATMAP shows

The dollar trading a touch firmer day before month end gyrations.

EURUSD yet to print 1.05 and extend its 5 day pattern around this level

USDJPY the outperformer after again finding support in the 148s but is still below 150.

Elsewhere

Gold is weaker

US bond yields are up after a sharp fall to 4.25% (10 yr) yesterday

Stocks up a touch

Watch for

US economic data durable goods 2nd GDP revision, weekly jobless claims) : see our Economic Daya Calendar

Trump speak: Watch headlines on tariffs after conflicting talk yesterday on Mexico and Canada

Trump due to speak in the morning and then an afternoon presser with the UK PM

February 26, 2025 at 5:39 pm #20140In reply to: Forex Forum

February 26, 2025 at 1:53 pm #20125In reply to: Forex Forum

This article is almost like deja vu looking at the current EURUSD pattern aroiund 1.05

February 26, 2025 at 11:43 am #20121In reply to: Forex Forum

US OPEN

NQ bid ahead of NVIDIA earnings; USD gains & copper benefits on Trump tariff investigations.

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses gain and currently reside at highs; US futures also stronger with NQ outperforming ahead of key NVIDIA results.DXY attempts to claw back recent losses, EUR/USD lingers around 1.05.

USTs are off lows but remain in the red while EGBs inch higher.

Crude choppy, gas subdued, but metals hold a positive bias as the complex digests Trump tariff investigations into copper.

February 26, 2025 at 9:59 am #20113In reply to: Forex Forum

EURUSD DAILY CHART – -1.05 trading pattern

1.05 level has traded for 5th day in a row (and 7 out of past 9 days)

NOTE 1.05 is one of my key pivotal levels. The longer the pattern around a pivotal level goes on the greater the risk of a directional move once it ends.

Current range -1.0400/50-1.0530/34

February 26, 2025 at 9:47 am #20112In reply to: Forex Forum

Using my platform as a HEATMAP

Dollar trading a touch firmer bu

EURUSD continues its trade around 1.05

USDCAD remains bid awaiting the March 4 tariff deadline

AUDUSD slips after CPI raises talk of another rate cut

Stocks up a touch waiting for Nvidia earnings after the close

Trump holds first cabinet meeting, watch for headlines

February 26, 2025 at 9:42 am #20111In reply to: Forex Forum

Month-end FX hedge rebalancing expectations

Banks are releasing their month end rebalancing expectations for February and there is a consensus for USD demand.Deutsche Bank’s model signals for February, based on current equity performance, suggest a reasonable shift toward USD buying. The largest relative outperformance is most pronounced versus European equities and therefore points towards EUR/USD supply.

In combination with the standard corporate month-end flows being more USD positive, sales of EUR/USD are one of Deutsche’s higher conviction views for the week ahead from a flow prospective.

The bank also notes how this is the first time in a while that the U.S. equity underperformance has been versus all of the rest-of-the-world indices that they track. This adds to its more bullish USD bias in the short term, especially due to the lack of other news flow for the week ahead.

Deutsche also highlights its seasonality charts and a sizable selling of NZD/USD on the day before month end, February 27, of 0.58% on average over the last 10 years. AUD/USD also shows a skew towards average selling on the month end date itself (February 28) and the day before.

February 26, 2025 at 9:30 am #20109In reply to: Forex Forum

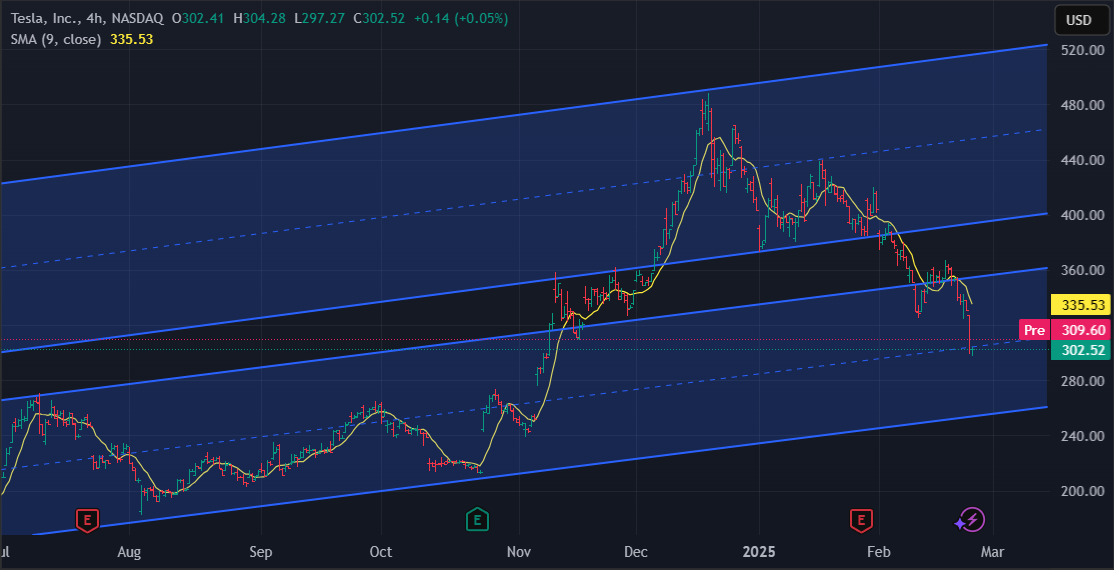

Tesla – TSLA

Something to spice up this dull EUR morning…

Tesla Has Lost $400 Billion In Value During Trump Presidency. What the Charts Say Comes Next

Data Shows Europe Sales Are Down 45%

Charts are clear – Tesla tried to hold on 350 level, but banana slide was too slippery for it.We are looking at 255 as a potentially base building level, unless….Tesla just slides through it as well.

Some support might be seen between 295 and 310, but resistance at 325 is looming dangerously.

For those of us that are endlessly in love with V6 Turbo engines it is a very pleasing development, but those of you that hold this losing stock is painful…I know…time to change your driving habits…

February 25, 2025 at 9:35 pm #20095

February 25, 2025 at 9:35 pm #20095In reply to: Forex Forum

Out a bit earlier… giving EURUSD some support as market starts to factor in the Russia-Ukraine war end game

February 25, 2025 at 8:08 pm #20088In reply to: Forex Forum

February 25, 2025 at 6:42 pm #20085In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View