-

AuthorSearch Results

-

March 3, 2025 at 4:47 pm #20344

In reply to: Forex Forum

March 3, 2025 at 2:35 pm #20339In reply to: Forex Forum

March 3, 2025 at 1:59 pm #20336In reply to: Forex Forum

March 3, 2025 at 1:53 pm #20335In reply to: Forex Forum

DAX – Ger30

The close above 22.530 signals another attempt Up is on its way – Monday – Said that on Friday…but did not expect what happened at the end.

However, very strong fundamental factors overwrites it all – EU decision to arm to the teeth and mostly from local sources means that the whole Industry will get a big boost now – everyone in the chain of armaments production will enjoy it.

This is not just a temporary move, but something that will lead overall industrial development in Europe.

As for the DAX, new target is set up – 24.150

Support is at 22.950 & 22.450

March 3, 2025 at 1:50 pm #20334

March 3, 2025 at 1:50 pm #20334In reply to: Forex Forum

March 3, 2025 at 1:30 pm #20333In reply to: Forex Forum

March 3, 2025 at 1:03 pm #20330In reply to: Forex Forum

EURUSD 4h

Start of the week with an Uptick Gap – this is going to be one of those crazy weeks…lots of Major Events , and each one can change the overall picture within ten seconds.

So I am going to avoid trying to guess how it’s going to go – I’ll stick with day in and day out predictions.

Right now:

Supports: 1.04450, 1.04050 & 1.03600

Resistances: 1.04750, 1.04900 & 1.05300

1.04750 is a Major intraday level to watch – if EUR goes above it and finds a footing, the road to 1.06 area is open again.

Loss of 1.03600 will drive it straight to the 1.02250

March 3, 2025 at 12:16 pm #20325

March 3, 2025 at 12:16 pm #20325In reply to: Forex Forum

March 3, 2025 at 11:56 am #20324In reply to: Forex Forum

UAS OPEN

US futures gain, USD lower & EUR benefits post EZ HICP, EGBs sink amid expectations of EU defence spending

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European indices at session highs, Defence stocks roar on EU spending talks. US futures also gain, with the RTY outperforming.

USD is on the backfoot as tariff deadline looms; EUR benefits from hotter-than-expected EZ HICP.

Bonds are weighed on by developments around geopols/defence, currently at session lows.

Crude clipped from APAC highs, Precious metals continue to benefit from the geopolitical risk-premia and softer Dollar.

March 3, 2025 at 10:48 am #20320In reply to: Forex Forum

USDJPY 1 HOUR – 150-151

Tested just outside both sides of 150-151 with JPY crosses (weaker) keeping it above 150.

The key level is on the upside as there is about a 1 JPY void (151.94) above it.

While within 150-151, pivotal 150.50 seta the tine.

As I have noted, when you see two currencies moving in opposite directions (e.g. EURJPY) it indicates real money cross currency flows.

March 3, 2025 at 10:32 am #20319In reply to: Forex Forum

March 3, 2025 at 10:18 am #20318In reply to: Forex Forum

New month, new ball game

Using my platform as a HEATMAP shows::

USD trading weaker… opening week gaps (EURUSD, GBPUSD) remain unfilled

Risk on start for stocks

Geopolitics a factor… Europe trying to take the lead in bid to find a peace plan for Ukraine-Russia war

Next key data release: ISM manufacturing PMI

Tuesday is Trump Tariff day for Canada, Mexico and China..

March 3, 2025 at 1:12 am #20316In reply to: Forex Forum

March 3, 2025 at 1:00 am #20315In reply to: Forex Forum

…Reports of Europe taking the lead for a peace deal…

EU must ‘urgently’ rearm and turn Ukraine into ‘steel porcupine,’ says von der Leyen

and

British Prime Minister Keir Starmer said European leaders on Sunday agreed to steps to beef defence efforts and secure peace in Ukraine and stability across the continent at a summit staged as a show of support for President Volodymyr Zelenskyy.

But he said that the support and buy in of the US was essential to make the plan work.

March 3, 2025 at 12:15 am #20314In reply to: Forex Forum

March 2, 2025 at 11:43 pm #20313In reply to: Forex Forum

March 2, 2025 at 11:26 pm #20311In reply to: Forex Forum

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Economic data releases in the coming week will focus heavily on PMI surveys across Asia, Europe, and the United States, providing insight into early 2025 growth momentum. In Asia, attention centers on February PMIs after January data were clouded by Lunar New Year timing, while South Korea reports inflation, industrial production, and retail sales. Chinese inflation is due over the weekend, likely showing continued subdued price pressures. Meanwhile, Australia’s busy calendar includes fourth-quarter GDP, retail sales, and trade figures; the Reserve Bank of Australia’s latest meeting minutes will draw special interest following its first policy rate cut since 2020.

In Europe, the key event is the European Central Bank’s policy meeting, with a widely expected 25-basis-point rate cut as Eurozone data remain soft. February PMI readings are expected to confirm ongoing sluggishness, while Germany will release volatile manufacturing orders data. Across the Atlantic, the United States will feature February employment data and the Fed’s Beige Book. Analysts will watch for any signs of government job cuts in the federal data, though the consensus points to another month of moderate payroll gains and a stable unemployment rate around 4.0%. The U.S. trade balance may widen further after a rush of imports ahead of anticipated tariffs, and overall economic signals will remain sensitive to evolving policy developments.

\

Econoday

March 2, 2025 at 10:48 pm #20310In reply to: Forex Forum

February 28, 2025 at 3:56 pm #20244In reply to: Forex Forum

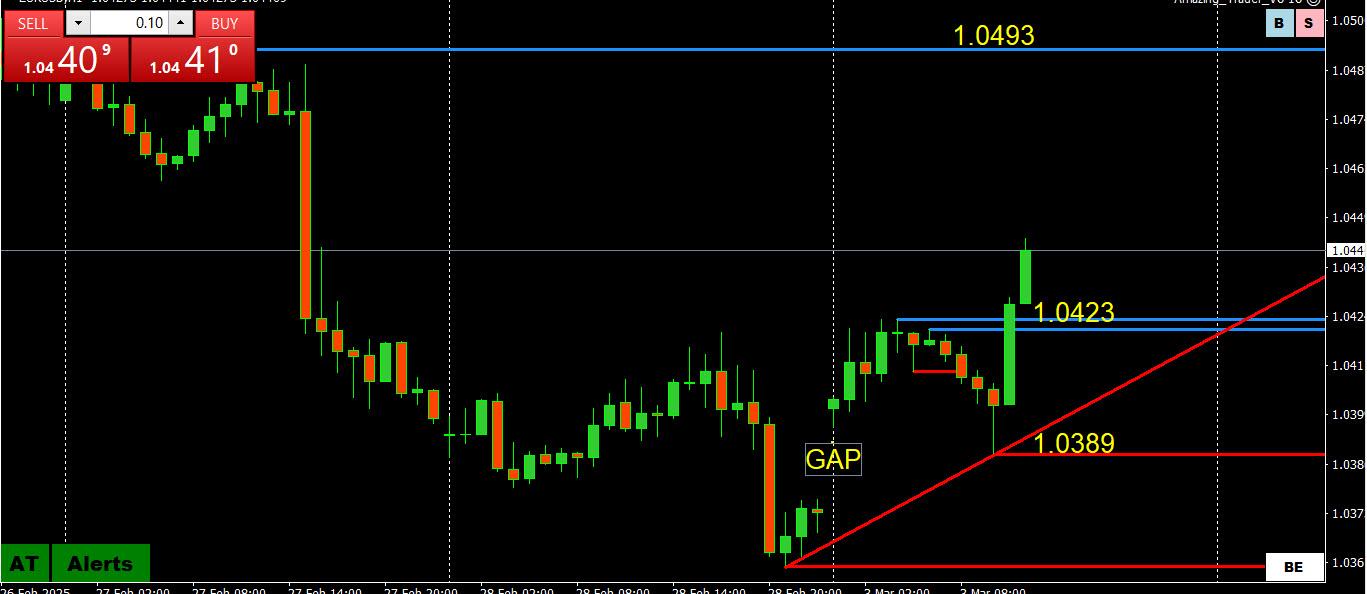

EURUSD 1 HOUR CHART – Upside capped

1.0418 AMAZING TRADER resistance so far capping the upside.

1.0400 former key support_is pivtoal

Beware of Trump headlines although focus today should be on Zelensxky’s meeting.

February 28, 2025 at 11:36 am #20231In reply to: Forex Forum

US OPEN

ES/NQ gain ahead of US PCE, sentiment hit amid trade angst but off worst levels

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are in the red, but with sentiment off lows; ES/NQ gain ahead of US PCE.

USD remains underpinned by trade angst; Antipodeans lag given the risk-tone.

Bonds bid after Trump’s latest on tariffs & tech pressure, though benchmarks are off highs.

Commodities lower on month end and ahead of weekend uncertainty.

-

AuthorSearch Results

© 2024 Global View