-

AuthorSearch Results

-

February 13, 2024 at 1:51 pm #1544

In reply to: Forex Forum

February 13, 2024 at 1:49 pm #1542In reply to: Forex Forum

February 13, 2024 at 1:22 pm #1539In reply to: Forex Forum

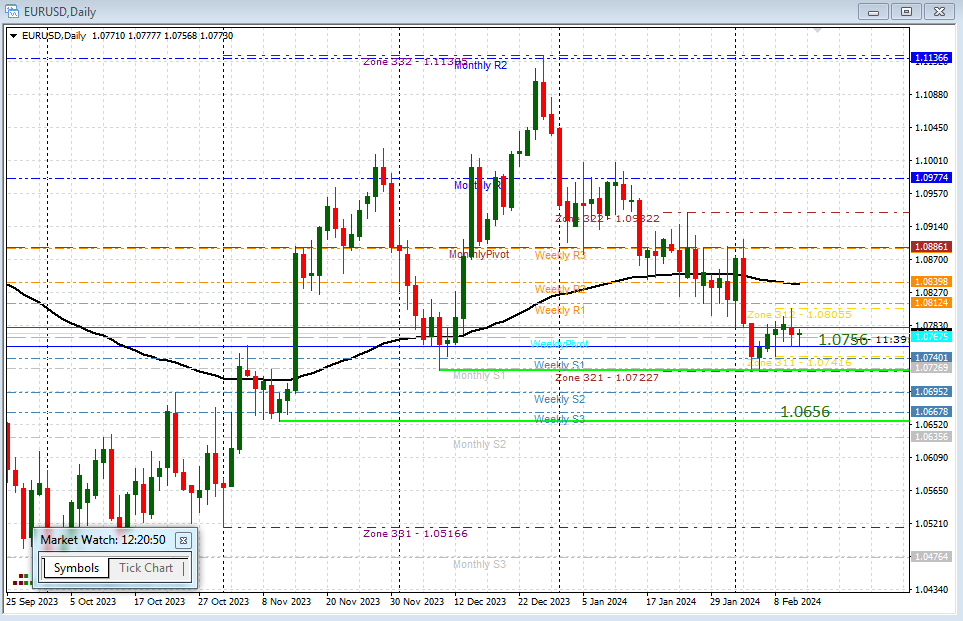

EURUSD

Resistances : 1.08050 1.08250

Supports : 1.07750 1.07200

I’ve been writing these numbers ( or very similar) almost 8 days. One can get lost in intraday swings and small moves, but when you move to a bit bigger time frame, things become clearer.

Two decades ago, I would declare fully confident that this is a Tail for Sale – but one also becomes if not smarter, but a bit wiser and way more experienced, so I am going to avoid calling big shots and stay with the reasonable.

Pattern wise, it is The Tail for Sale, so we should see a bit sharper move up, followed by even sharper decline. If happens , the main test will be the support at 1.07200…The pattern suggests that it will be broken and we’ll slide to 1.06000 area.

For a move up, serious change of the prevailing trend , we should see a sharp drop, and then we can talk about the big Bounce and change to the Up trend.

But more funny stuff have occurred on the market, and especially on this pair.

So we are going to follow it on Intraday level and when any real change happens, you’ll be the first to know.

February 13, 2024 at 10:43 am #1533

February 13, 2024 at 10:43 am #1533In reply to: Forex Forum

February 13, 2024 at 10:30 am #1531In reply to: Forex Forum

February 12, 2024 at 10:19 pm #1525In reply to: Forex Forum

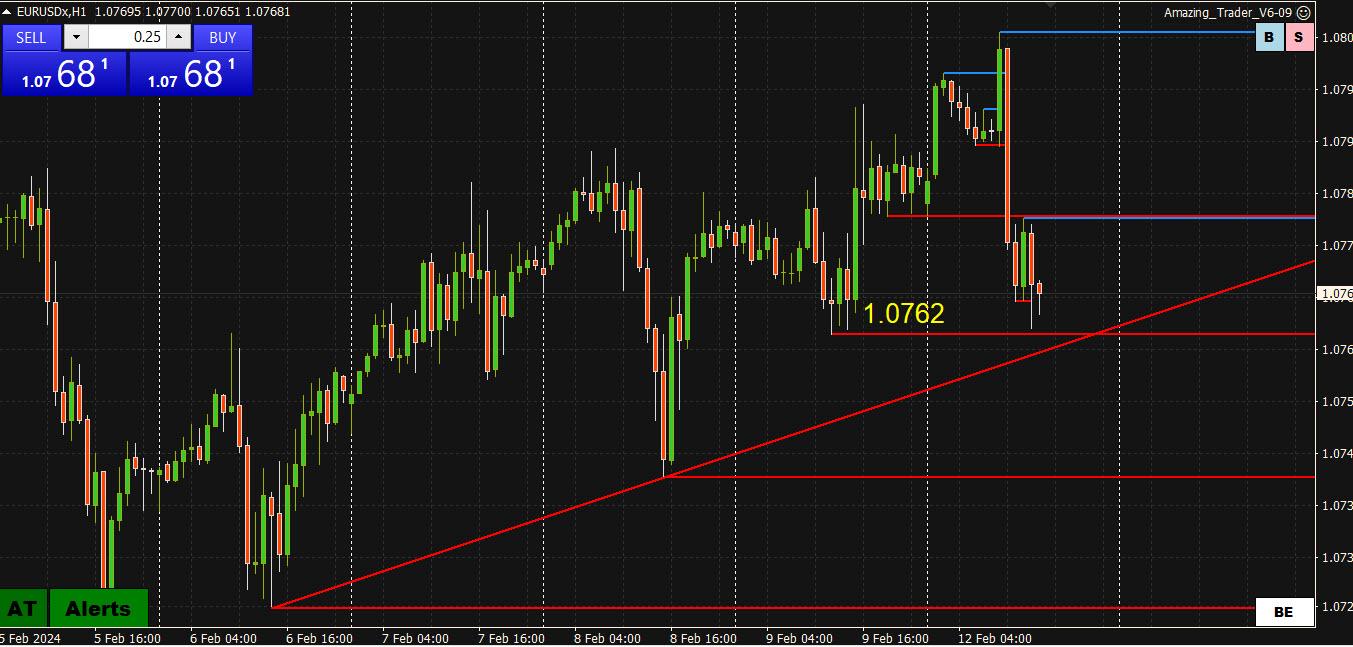

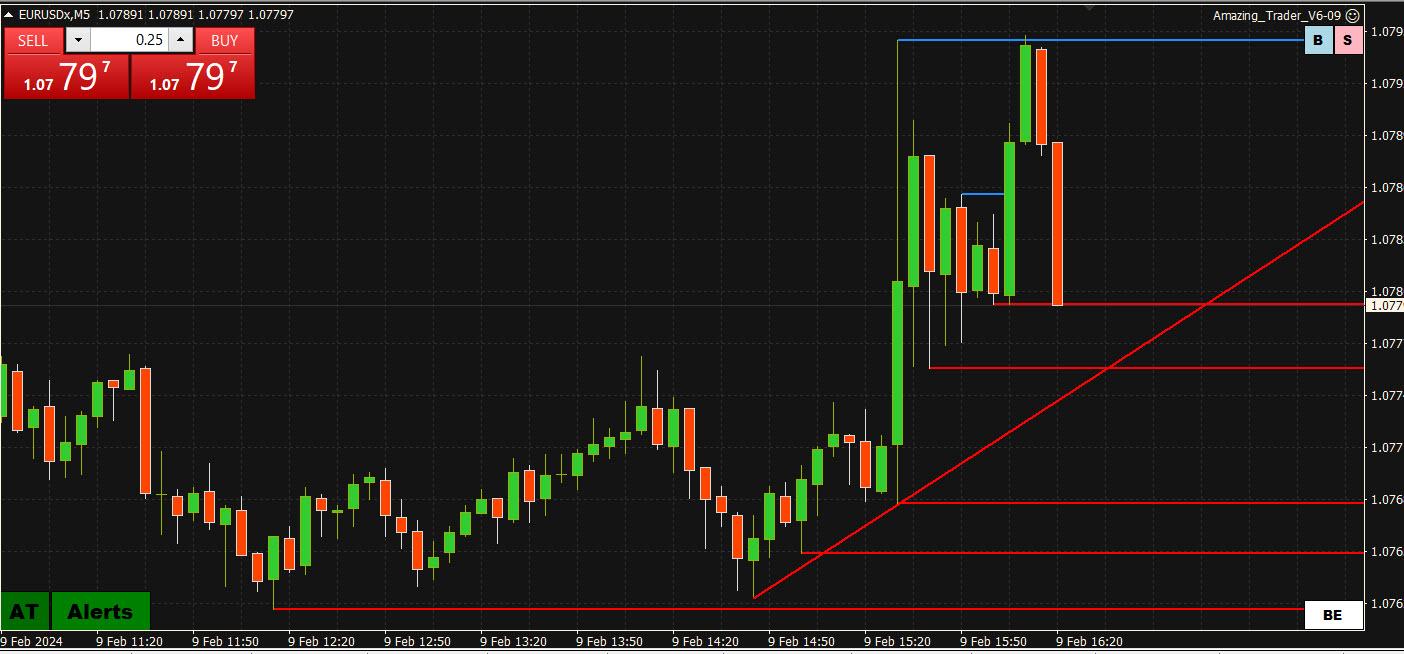

EURUSD Day ahead

Resistances at : 1.07800, 1.08050 and 1.08300

Supports at : 1.07550, 1.07400 and 1.07200

The difference between Tuesday and today is in possibility to see overnight slide towards supports.

Yet again we can witness euro buying , but generally we should visit 1.07200 – most important line right now – if bellow opens a road for 1.06000 area.

I prefer continued selling as long as downtrend line holds it’s ground.

February 12, 2024 at 7:08 pm #1508

February 12, 2024 at 7:08 pm #1508In reply to: Forex Forum

February 12, 2024 at 3:29 pm #1499In reply to: Forex Forum

Re: my post from the last night :

EURUSD Day ahead

Resistances : 1.07950 and 1.08350/400

Supports : 1.07800 , 1.07700 and 1.07200

Judging by the current pattern, we should see the attack at the supports tomorrow, but expect as always for Europe to do some buying early euro morning…if they break through 1.07950 we should see at least 1.08200 ( depending on how they spent their weekends…)

Same goes for other two postings – JPY and GBP….Bellow is a current chart for EURUSD

February 12, 2024 at 12:21 pm #1475

February 12, 2024 at 12:21 pm #1475In reply to: Forex Forum

February 11, 2024 at 9:11 pm #1460In reply to: Forex Forum

EURUSD Day ahead

Resistances : 1.07950 and 1.08350/400

Supports : 1.07800 , 1.07700 and 1.07200

Judging by the current pattern, we should see the attack at the supports tomorrow, but expect as always for Europe to do some buying early euro morning…if they break through 1.07950 we should see at least 1.08200 ( depending on how they spent their weekends…)

Always check the Economic Calendar, to be sure you are not engaging when you shouldn’t.

February 11, 2024 at 8:56 pm #1459

February 11, 2024 at 8:56 pm #1459In reply to: Forex Forum

THIS WEEK’S MARKET-MOVING EVENTS (all days local) – Economic Calendar

US consumer prices on Tuesday lead the week’s calendar, expected to remain steady on the month for the core but to slow on the year both overall and for the core. India’s CPI on Monday is expected to cool.

Tuesday will open with UK average hourly earnings (part of the labour market report) where noticeable cooling is expected. UK’s CPI will follow on Wednesday where the headline annual rate is expected to climb 2 tenths to 4.2 percent.

The first estimate for UK fourth-quarter GDP will be a Thursday highlight and is expected to come in unchanged on the quarter but rise 0.4 percent on the year. UK retail sales for the month of January will be posted on Friday and are expected to rebound from a weak November. Sizable contraction is expected for Eurozone industrial production on Wednesday.

US retail sales and industrial production are both on Thursday and both are expected to be flat (all data for January). On Friday, US consumer sentiment for February is expected to edge further higher after surging in January.

Econoday

February 10, 2024 at 3:09 pm #1432In reply to: Forex Forum

EU countries agree on new debt rules after Franco-German quarrel

Negotiators from the European Parliament and European Union member states have agreed on reforms to the bloc’s debt rules after long negotiations.

Belgian Finance Minister Vincent Van Peteghem said that the new rules “will safeguard balanced and sustainable public finances, strengthen the focus on structural reforms, and foster investments, growth and job creation throughout the EU.”

February 10, 2024 at 1:02 pm #1430In reply to: Forex Forum

February 9, 2024 at 5:23 pm #1420In reply to: Forex Forum

February 9, 2024 at 2:25 pm #1407In reply to: Forex Forum

February 9, 2024 at 1:39 pm #1401In reply to: Forex Forum

February 9, 2024 at 10:41 am #1390In reply to: Forex Forum

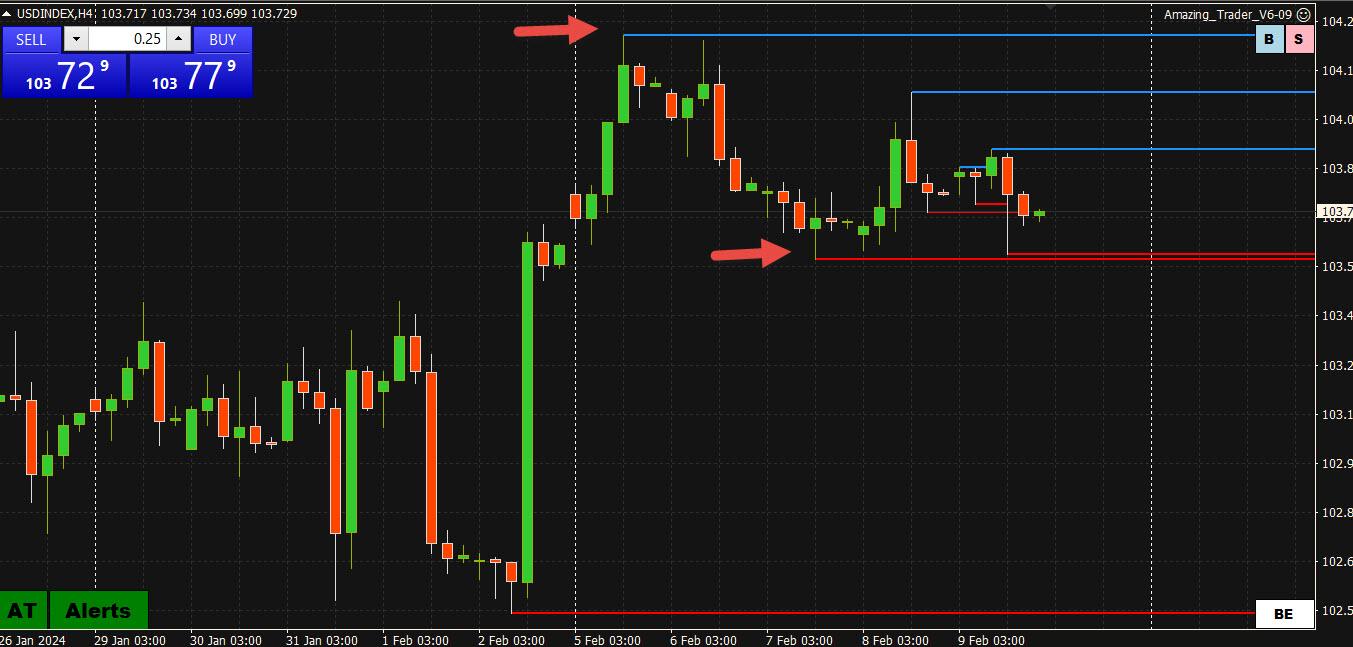

JPY and CHF officials have recently voiced more policy clarity which has underscored rate differentials as a more predominant driver. EUR and USD officials have been more well we’ll see maybe sooner but probably later not sure how much we’re following the data but sometimes the data is questionable but have to see…

February 9, 2024 at 10:31 am #1389In reply to: Forex Forum

February 8, 2024 at 7:50 pm #1382In reply to: Forex Forum

February 8, 2024 at 6:06 pm #1379In reply to: Forex Forum

EURUSD Daily view

Resistances are at 1.07900 and 1.08450/500 – break of would open the road for Up Trend and the test of Major 1.11000 area. That would be a game changer.

Supports are waiting at 1.07550 and 1.07150 , break of targets directly ( ideally ) 1.06100 over period of 2-3 days.

Outcome for tomorrow – if we get a close bellow 1.07700 tonight, there is a higher possibility for immediate continuation of the down move. There is always a possibility to see uptick up to 1.08200 , and then down.

-

AuthorSearch Results

© 2024 Global View

%

%