-

AuthorSearch Results

-

February 15, 2024 at 5:18 pm #1649

In reply to: Forex Forum

From our friends @GTWO3 : March Euro futures are bullish under 107.50; the decline from 12/28 high has been long liquidation rather than new selling.

February 15, 2024 at 4:00 pm #1645In reply to: Forex Forum

February 15, 2024 at 2:47 pm #1640In reply to: Forex Forum

February 15, 2024 at 2:46 pm #1639In reply to: Forex Forum

February 15, 2024 at 2:38 pm #1638In reply to: Forex Forum

9:30 ny

DLRx 104.19 (somewhat down a bit) / 10-yr 4.212 / euro 1.0780observation: dlryen and us yield appear correlated

Looks like players are not done selling the dlr just yet

—-

13:15 – fed’s waller yaks – on dlr’s int’l role (hello janet, hello putin)

19:00 – bostics yaks on outlook and policy (yeah !, lol)February 15, 2024 at 2:32 pm #1637In reply to: Forex Forum

February 15, 2024 at 11:45 am #1626In reply to: Forex Forum

interest policy at fault and to blame ?

–

* For the whole of 2023, Japan’s nominal GDP grew 5.7% over 2023 to come in at 591.48 trillion yen, or $4.2 trillion based on the average exchange rate in 2023.* Germany on the other hand, saw its nominal GDP grow 6.3% to reach 4.12 trillion euros, or $4.46 trillion based on last year’s average exchange rate.

Japan is no longer the world’s third-largest economy as it slips into recession

February 15, 2024 at 11:15 am #1624In reply to: Forex Forum

February 15, 2024 at 10:48 am #1623In reply to: Forex Forum

EURUSD

After reaching the new low yesterday, another sideways to Up formation is in the creation.

Immediate support is at 1.07250/300

It is trying to reach 1.07650 , and it should, prior to the next leg down.

Albeit, we can see some brief tests of 1.07000 area, but we need that Uptick to be done , for the downtrend to continue in full force.

February 15, 2024 at 2:07 am #1619

February 15, 2024 at 2:07 am #1619In reply to: Forex Forum

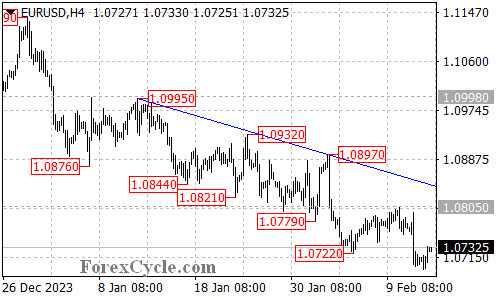

EURUSD Analysis: Downtrend Continues, Resistance and Downside Targets

The EURUSD pair remains below a falling trend line on the 4-hour chart, indicating the continuation of the downtrend from 1.1139.

As long as the price remains below the falling trend line, it is likely that the downside move will persist. The next target area for the pair would be around 1.0670, followed by 1.0600.

As long as the price remains below the falling trend line, it is likely that the downside move will persist. The next target area for the pair would be around 1.0670, followed by 1.0600.The initial resistance level is located at 1.0750. A breakthrough above this level would suggest a consolidation phase for the downtrend is underway. In such a scenario, the price could retest the 1.0805 resistance level. If this level is surpassed, it may trigger further upside movement towards the falling trend line.

It is important to note that only a break above the trend line resistance would indicate the completion of the downtrend.

In summary, the EURUSD pair remains in a downtrend, with the price staying below a falling trend line on the 4-hour chart. Downside targets have been identified, while resistance levels have also been highlighted for potential retracements. The completion of the downtrend would require a significant break above the trend line resistance.

February 14, 2024 at 4:58 pm #1613In reply to: Forex Forum

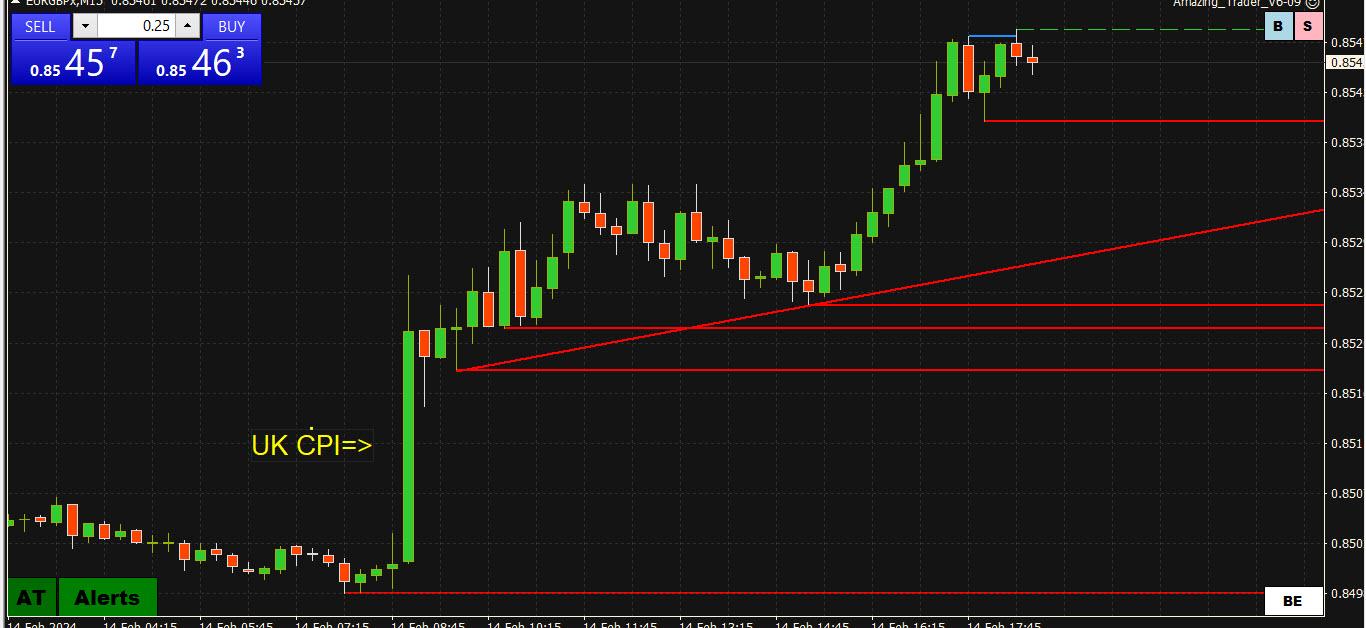

EURGBP firmer => weaker GBPUSD => firmer EURUSD

The GBP’s reaction in GBP (weaker) to a miss in UK CPI underscores an ultra-sensitivity to any data that shifts expectations of rate cuts.

Look at this EURGBP chart where demand for the cross is one reason why EURUSD has taken on a bid.

EURGBO 15-minute chart’

EURGBP => weaker GBPUSD => former EURUSD

The GBP’s reaction in GBP (weaker) to a miss in UK CPI underscores an ultra-sensitivity to any data that shifts expectations of rate cuts.

Look at this EURGBP chart where demand for the cross is one reason why EURUSD has taken on a bid.

I call this “Using crosses to help trade spot fx“”

EURGBO 15-minute chart’

February 14, 2024 at 3:39 pm #1607

February 14, 2024 at 3:39 pm #1607In reply to: Forex Forum

February 14, 2024 at 3:22 pm #1605In reply to: Forex Forum

February 14, 2024 at 12:43 pm #1591In reply to: Forex Forum

February 14, 2024 at 10:55 am #1584In reply to: Forex Forum

EURUSD

The pair behaved on the dot in last 24h.

Now what we have next…for the move to continue Down, it has to stay bellow 1.07100 !

1.07200 is of course the Major resistance , but for the slide to continue in coming hours we need that 1.07100 to hold.

As you can see from the chart, the target is in 1.05900 area – Do Not be overly greedy.

We have today some interesting data – Economic Calendar – stay away just prior to it !

Happy hunting.

February 14, 2024 at 2:51 am #1576

February 14, 2024 at 2:51 am #1576In reply to: Forex Forum

EURUSD Analysis: Break Below Support and Potential Further Decline

The EURUSD pair has broken below the 1.0723 support level and extended its downward movement from 1.1139, reaching as low as 1.0700.

Based on this development, it is likely that further decline could be expected in the coming days, with the next target area around 1.0670, followed by 1.0600.

The initial resistance level is located at 1.0750. A breakthrough above this level could lead to a retest of the 1.0805 resistance level. If this resistance is surpassed, it may trigger additional upside movement towards the falling trend line on the 4-hour chart.

In summary, the EURUSD pair has broken below key support levels, indicating a potential continuation of the downward trend. The next targets for decline have been identified, while resistance levels have also been highlighted for potential retracements.

February 14, 2024 at 1:10 am #1574In reply to: Forex Forum

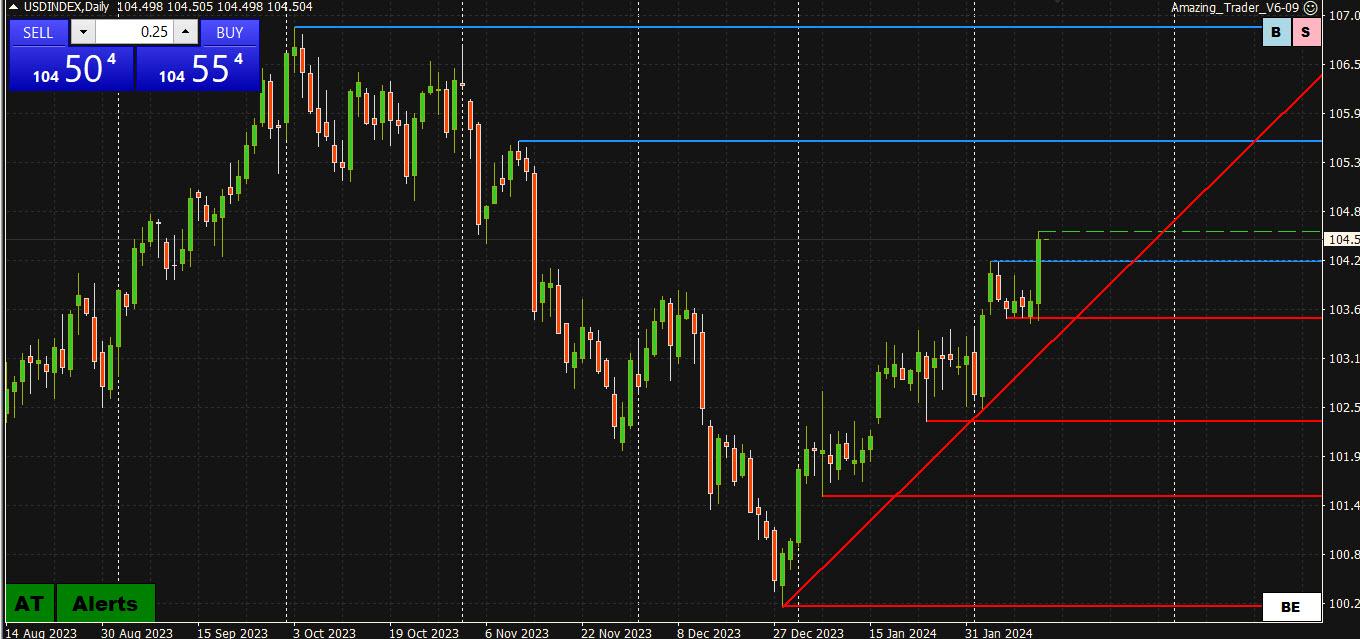

USDX (US Dollar Index

If you don’t trade it, why do traders track the USDX?

With the EURO representing 57.6% of the index, it can be used as a quasi EURUSD as the correlation between EzURUSD and USDX is very high.

USDX Daily Chart

New high for the year.

Trend = strong up (note rising red lines)

Targets at blue lines as long as the most recent ted Lind holds ax support

(contact me to learn more)

1.0694February 13, 2024 at 8:28 pm #1568

1.0694February 13, 2024 at 8:28 pm #1568In reply to: Forex Forum

February 13, 2024 at 7:19 pm #1564In reply to: Forex Forum

February 13, 2024 at 2:39 pm #1549In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View