-

AuthorSearch Results

-

February 19, 2024 at 1:13 pm #1756

In reply to: Forex Forum

EURUSD

From yesterday’s Week Ahead :

EURUSD Week Ahead

Resistances at : 1.07900 , 1.08350 and 1.09250

Supports at : 1.07400, 1.07200 and 1.06950

Pattern wise, Resistance at 1.07900 should Hold, and Down move should continue…

They came, they touched and they bumped ( 1.07894)

We need it to go through 1.07500 to confirm the pattern and continue down.

Let’s see how it’s played…

February 19, 2024 at 10:45 am #1747

February 19, 2024 at 10:45 am #1747In reply to: Forex Forum

This article is worth trading as it covers the week ahead

Morning Bid: China markets look like they need another holiday

February 18, 2024 at 10:56 pm #1742In reply to: Forex Forum

EURUSD daily chart – major trend down but consolidating

EURUSD daily chart – major trend down but consolidating1.0805 is the key level as it appears not just on the daily but on multipole time grant charts

There is a trendline at 1.0793 but 1.0805 is the key on top.

Only a firm break and 1.08+ then being established would suggest the low (1.0696) is ion for now.

Take your pick of support within 1.07-1.98 with 1.0730 being the only one worth noting ahead of the key low.

February 18, 2024 at 9:43 pm #1738In reply to: Forex Forum

February 17, 2024 at 9:20 pm #1718In reply to: Forex Forum

Elvira Nabiullina, Bank of Russia representing President Putin VS Janet Yellen, US Sec of the Treasury representing President Biden

• Says leaders see value of tapping ‘economic value’ of assets

• Treasury chief also urges House to pass aid bill for UkraineYellen had lunch with ECB President Christine Lagarde Monday in Washington and met with German Chancellor Olaf Scholz last week alongside President Joe Biden.

“These are topics I’ve discussed,” she said. “I’m not going to elaborate on private conversations, but all of us recognize that an ongoing, committed support for Ukraine is essential.”Yellen DFiscussed Russian Asset Seizure With European Leaders Bbrg Feb 14, 2024

Oh … and lest I forget about the “on the other hand” ….“There are a range of risks involved and potential adverse repercussions, and we’re studying those very carefully and thinking through how these can be mitigated,” Yellen said

February 17, 2024 at 4:01 pm #1707In reply to: Forex Forum

EURUSD Week Ahead

Resistances at : 1.07900 , 1.08350 and 1.09250

Supports at : 1.07400, 1.07200 and 1.06950

Pattern wise, Resistance at 1.07900 should Hold, and Down move should continue…but is it going to happen like that this time ?? Well, this Down trend that started on 27.12.2023. doesn’t have the usual angle for it…although it is very similar , still…makes me cautious…

1.07900 is The Major point right now, as break of it would lead the pair straight to 1.09250 , even 1.09400 . Mind you, we would still be in Sell mode !

Now let’s talk about the Ideal development – Res at 1.07900 holds it’s ground – we have a sharp drop to 1.07 area and continue down , with the 1.05600 in cross hairs.

So let’s see how it develops on Monday….

February 17, 2024 at 1:05 pm #1702

February 17, 2024 at 1:05 pm #1702In reply to: Forex Forum

Elvira Nabiullina, Bank of Russia

–

“Essentially, (confiscation) is a breach of the basic principles of central bank reserve protection,” Nabiullina said. “In international law, this is one of the key, basic principles of immunity of central bank assets from coercive measures of seizure.“In our view, deviation from this principle, will lead to the, albeit gradual, undermining of the system of international finance and the position of reserve currencies in the world.”

Confiscating Russia’s assets would send negative signal, says central bank Reuters, February 16, 2024

February 16, 2024 at 10:50 pm #1700In reply to: Forex Forum

February 16, 2024 at 7:21 pm #1689In reply to: Forex Forum

February 16, 2024 at 6:54 pm #1688In reply to: Forex Forum

February 16, 2024 at 5:37 pm #1686In reply to: Forex Forum

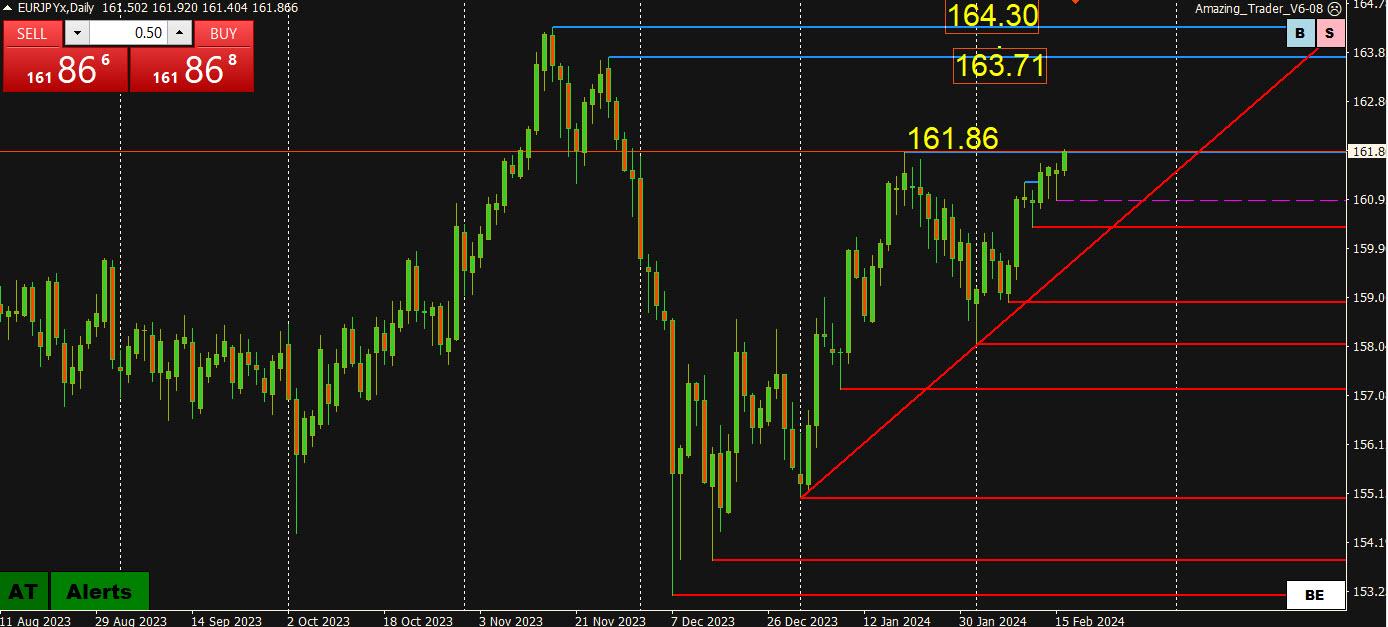

Our friends @GTWO3 are looking for EUR/JPY to turn lower from the 162.00 area as the rally from 12/27 is short covering rather than new buyers …

February 16, 2024 at 4:57 pm #1685In reply to: Forex Forum

EURJPY Daily Chart

Testing res at 161.86

Question is can EURJPY make a run at…

Key res 163.71 and 164.30

To do so, either USDJPY would need to move sharply higher, EURUSD would need to move sharply higher, a combination of the two or EURUSD would need to lag a sharp move up in USDJPY. It’s simple algebra.

Whatever the case, given broader USD trends, it would probably take JPY weakness for the key EURJPY resistance to come into play.

February 16, 2024 at 3:59 pm #1681In reply to: Forex Forum

February 16, 2024 at 3:57 pm #1680In reply to: Forex Forum

February 16, 2024 at 3:25 pm #1675In reply to: Forex Forum

February 16, 2024 at 2:01 pm #1674In reply to: Forex Forum

February 16, 2024 at 12:52 pm #1666In reply to: Forex Forum

February 16, 2024 at 12:37 pm #1665In reply to: Forex Forum

EURUSD – looking at the chart bellow, and in my own station, I have to admit that time wise – Rule of Thumb – there is a chance for the pair to break Up and change two months old trend ( Daily chart)

I am pretty sure that the solution will present itself after today’s data.

But what I also see is the fact that on the Monthly chart, the pattern suggests that we are in the early stages of a New Downtrend creation, that if comes through will open the road for as low as 0.75 area…Lots , I know…

Of course this is not helping in our daily trades, but just wanted to shine some light on the issue.

What I know for sure ( from the experience ) is that we can break above that downtrend line, even spend some time above 1.08 , but if that happens , 1.09450 will come up as a next level for unloading the EUR….and then we’ll all see clear downtrend forming .

February 16, 2024 at 11:59 am #1664In reply to: Forex Forum

February 16, 2024 at 11:42 am #1663In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View