-

AuthorSearch Results

-

February 26, 2024 at 2:53 pm #2059

In reply to: Forex Forum

February 26, 2024 at 2:22 pm #2053In reply to: Forex Forum

February 26, 2024 at 12:47 pm #2048In reply to: Forex Forum

EURUSD Intraday

1.08600 – 1.08800 Resistance zone

Supports are at 1.08400 and 1.08350

We have two highs up there, with the later one a bit lower….does it mean something ?? Not necessarily – it all depends on next few hours – if we start a correction from here, it might be able to surmount the highs and continue it’s Up move. Otherwise it might just run out of steam .

One idea can be Buying it in 1.08350/400 area with the Stop just below 300 , for the test of previous highs…so risking 5 pips for possible 30-40. Problem is the time and lack of any serious data today…nothing to move it sharply…

February 26, 2024 at 11:44 am #2044

February 26, 2024 at 11:44 am #2044In reply to: Forex Forum

February 26, 2024 at 11:30 am #2043In reply to: Forex Forum

February 25, 2024 at 9:01 pm #2021In reply to: Forex Forum

EURUSD – Outlook for tomorrow

Support at 1.08050 and 1.07800 – bellow would open a way for test of 1.07450

Resistance in 1.08800 / 1.09000 area

As much as a correction to down is needed, it still can first try Up tomorrow morning.

This is not a good place for Buying, and still no reason to Sell it.

We’ll go with smaller time frames , and follow as it develops.

February 25, 2024 at 10:47 am #2014

February 25, 2024 at 10:47 am #2014In reply to: Forex Forum

Week Ahead: EURGBP

EURGBP Daily Chart

The consolidation range is clear at .8498-.8578

This suggests .8500 will remain pivotal as only a firm break would open the door to another leg down.

On the other hand, only a firm break of .8578 would suggest the low is in for now/

Why am I highlighting EURGBP?

1) If you trade EURUSD and/or GBPUSD, you need to keep an eye on EURGBP as flows involving this cross often have an impact on price moves in EURUSD and GBPUSD

2) Month end (Feb 29): I have observed increased activity in EURGBP at month end, which in turn often sees erratic flows not only in the cross but in EURUSD and GBPUSD. So keep a close eye at month end as it can offer trading opportunities in respective pairs as well as in EURGBP. In this regard, watch price action throughout the day but especially leading up to and around the 4 PM London fixing.

February 23, 2024 at 3:37 pm #1993In reply to: Forex Forum

February 23, 2024 at 3:14 pm #1991In reply to: Forex Forum

February 23, 2024 at 1:41 pm #1988In reply to: Forex Forum

NVIDIA – Whole planet talks about it….it is Viral…it is Hysterical

Even my wife asking about it ( and she couldn’t give a **** about it ) …my younger daughter asks about it ( at least she is just worried if the price for her next generation graphic card will go up )

Till yesterday it was Gold – half a planet bought it on the top….

Now the other half will buy NVIDIA stocks …on the top

Me….I don’t give a flying ****….EUR goes up, EUR goes down…that makes my day…

February 23, 2024 at 9:22 am #1975In reply to: Forex Forum

February 22, 2024 at 2:38 pm #1934In reply to: Forex Forum

February 22, 2024 at 2:10 pm #1930In reply to: Forex Forum

February 22, 2024 at 12:02 pm #1923In reply to: Forex Forum

this peasant would like ideas on how trade this:

Reuters Explainer

–

Why huge European Central Bank losses matterFRANKFURT (Reuters) – The European Central Bank chalked up another large financial loss in 2023, burning through the last of its provisions, and said more losses are forthcoming as high rates push up interest payments to banks.

While the bank said it can operate effectively “regardless of any losses”, the accounts have broader implications – from reputation and independence to state finances. …/.

somehow, knowing my european princes, reputation and independence are not a part of their calculus.

and when it comes to state finances, again by my own understanding, for them it is “my way or a beating” dictatesTIA for ideas

February 22, 2024 at 11:46 am #1921In reply to: Forex Forum

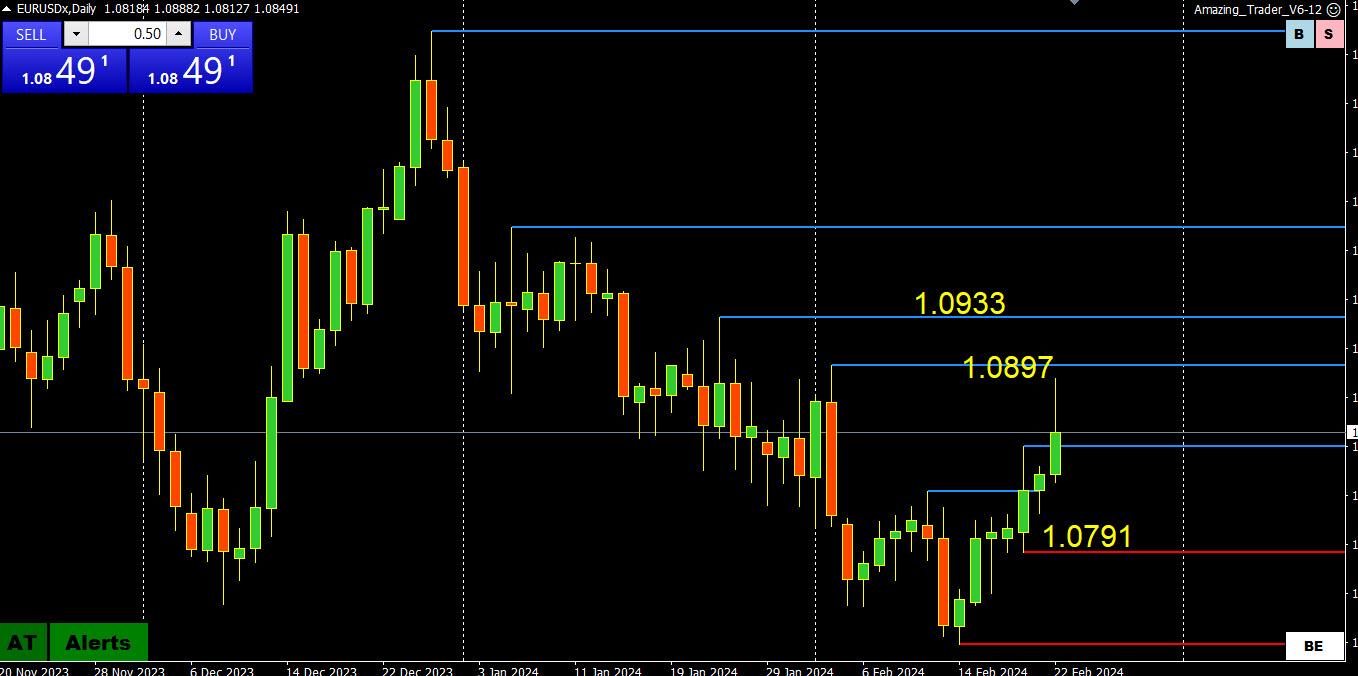

EURUSD Daily Chart

Flash PMI whipsaw day: Up on stringer French flash PMI, down on weaker German PMI

The solid break of 1.0805 saw a move up that came within 9 pips of the target at 1.0897

If 1.08=1.09 has replaced the 1.07-1.08 range then 1.0850 is the obvious bias setter.

Technicals are still positive, expect support if 1.0840 holds

If not then it is back to 1.0800-20

February 21, 2024 at 11:36 pm #1899In reply to: Forex Forum

February 21, 2024 at 8:25 pm #1897In reply to: Forex Forum

\EURUSD 4-hour chart: Inside day on Wednesday.

Good update Bobby. I will add my thoughts

I asked the question last week whether EURUSD is bid or bid in an offered market?

Looking at this chart technicals support the former but only if 1.0761 holds and 1.08+, trades, which would suggest there is more room on the upside.

Resistance comes in at 1.0824-39, the letter is the high for the week and then a void until 1.0897

‘February 21, 2024 at 7:44 pm #1891In reply to: Forex Forum

EURUSD Day Ahead

Looking at the Daily chart, seeing a Pattern emerging that is calling for further Upside move.

Support at 1.07950 and it is quite possible to be revisited tomorrow, so Buying at that level seems prudent, for the move to 1.08500 and even 1.08875.

Tomorrow we have some important data – check Economic Calendar –

Maintain Stops , avoid being dragged into the data !

February 21, 2024 at 5:33 pm #1874

February 21, 2024 at 5:33 pm #1874In reply to: Forex Forum

February 21, 2024 at 5:25 pm #1873In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View