-

AuthorSearch Results

-

March 1, 2024 at 2:09 pm #2311

In reply to: Forex Forum

S/P 500 futures are either going to form a double top around 5122 today or blow through it to set new levels of price. 5070-80 is the area to hold the bid, nearby contract opened Asia bid but fell to hold a closer in 5090 pivot, currently 5100. Eur tends to move with US stocks on a risk on/off basis. 10yr yield at 42.70 is right in the middle of the recent range 42.20 – 43.50. DXY showing much sturdier than yields and showing signs of strength that could stick overall into next week. Headed into the weekend one might believe the risk appetite would be not so hot with so much geo-political/war risk present. Currently positioned lightly on the sell side of Usd/Chf from this morning’s high minus 2 pips with a tight stop.

March 1, 2024 at 12:49 pm #2308In reply to: Forex Forum

March 1, 2024 at 11:51 am #2298In reply to: Forex Forum

March 1, 2024 at 11:24 am #2297In reply to: Forex Forum

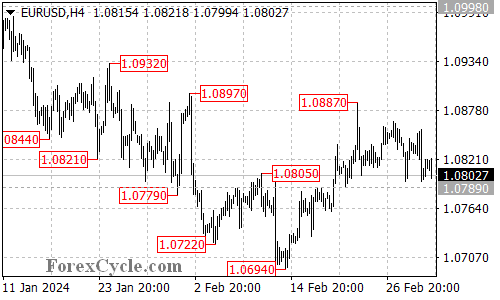

EURUSD Analysis: Key Support and Resistance Levels to Watch

The EURUSD pair is currently testing the 1.0789 support level once again. A breakdown below this level would suggest that the upside move from 1.0694 has concluded at 1.0887. In such a scenario, the next target levels would be at 1.0750, followed by 1.0694.

However, if the 1.0789 support level holds, the pullback from 1.0887 could potentially be a consolidation phase for the uptrend from 1.0694. In this case, another rise towards the 1.0950 level is still possible after the consolidation.

The initial resistance level is at 1.0840. A breakthrough of this level could potentially take the price to the next resistance level at 1.0887. Above this level, the price could aim for 1.0950.

March 1, 2024 at 10:39 am #2293In reply to: Forex Forum

CHF should continue to be the weakest link….

Meanwhile eur looks like it could do a little kerplunk of its own as the hourly chart over the last week looks more and more like down moves are more impulsive while up moves more corrective AND shallower (or whatever the inverse of shallow is when it refers to higher)…

March 1, 2024 at 10:39 am #2292In reply to: Forex Forum

February 29, 2024 at 8:06 pm #2280In reply to: Forex Forum

February 29, 2024 at 5:23 pm #2272In reply to: Forex Forum

AnonymousFebruary 29, 2024 at 4:23 pm #2268In reply to: Forex Forum

February 29, 2024 at 4:17 pm #2267In reply to: Forex Forum

February 29, 2024 at 3:26 pm #2262In reply to: Forex Forum

Clearly risk on, but stalling at the moment. Buy stops worked beautifully now looking to re-enter lower on the risk currencies (Eur-Aud etc). Not biting on the buy side of UsdJpy going forward due to BoJ, worked yesterday but sell stops turned out to be more appropriate. Seller of UsdJpy going forward even if I have to wait for buy side of the market to run out of steam.

February 29, 2024 at 8:55 am #2226In reply to: Forex Forum

February 29, 2024 at 7:38 am #2224In reply to: Forex Forum

February 29, 2024 at 6:32 am #2222In reply to: Forex Forum

A look at the day ahead in European and global markets from Kevin Buckland

European investors are due for a super-sized helping of inflation data, with a side of bitcoin, on a day when Asian equities offered few trading cues and currencies were stable – with the notable exception of the Japanese yen.

February 29, 2024 at 3:26 am #2220In reply to: Forex Forum

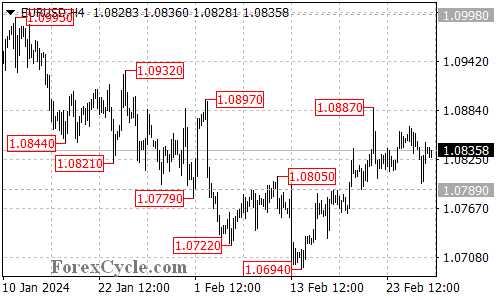

EURUSD Analysis: Sideways Move Continues, Key Levels to Watch

The EURUSD pair failed to break below the 1.0789 support level and has been moving sideways within a trading range between 1.0789 and 1.0887. This suggests that the pair is still in the uptrend from 1.0694, and the sideways move is likely a consolidation phase for the uptrend.

As long as the 1.0789 support level holds, the upside move could be expected to resume. A breakthrough of the 1.0887 resistance level could trigger further upside movement towards the 1.0950 area.

On the downside, a breakdown below 1.0789 would confirm that the upside move from 1.0694 has already completed at 1.0887. In this case, the next target would be at 1.0750, followed by 1.0694.

February 28, 2024 at 7:20 pm #2209In reply to: Forex Forum

AnonymousFebruary 28, 2024 at 7:20 pm #2208In reply to: Forex Forum

EURUSD 4h

Resistance at 1.08500 – if rejected at it, we are going in maybe not very deep correction, but still a correction phase for at least 24h.

But if 1.08500 gives a way, just to be stopped at either 1.08650 or 1.08900, we are going slowly to turn Down.

Support at 1.08300 and 1.07850 – bellow which we target 1.07000 and the whole previous Up move becomes questionable.

Close tonight above 1.08300 calls for retest of previous high, but not more than that…and that is my experience, instincts and pattern recognition talking.

February 28, 2024 at 7:09 pm #2206

February 28, 2024 at 7:09 pm #2206In reply to: Forex Forum

February 28, 2024 at 5:34 pm #2195In reply to: Forex Forum

February 28, 2024 at 5:04 pm #2194In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View