-

AuthorSearch Results

-

April 2, 2024 at 3:41 pm #3916

In reply to: Forex Forum

April 2, 2024 at 3:27 pm #3915In reply to: Forex Forum

April 2, 2024 at 2:27 pm #3909In reply to: Forex Forum

April 2, 2024 at 12:31 pm #3903In reply to: Forex Forum

JP re CHF (thanks for asking) I think in the short term against the usd it’s closer to the end than the beginning, as in 9150-9250 should see it run out of gas to some degree. Longer term (months) I have no problem with seeing it back to 1.0000 ish.

I see a smoother path forward for a weaker CHF against the crosses.

The thing that may potentially slow its weakness is some are saying we should be enetering a period of high volatility over the next 1-2 months which maybe could see some safe haven flows into the CHF.

I’m not a huge fan of posting trades after the fact (I’ve been outside busy lately) but last week I switched out of short chf positions and am currently only short eur/usd. Reason being thinking being closer to the end than the beginning (short term) maybe its a prudent risk reward move…. Maybe…

April 2, 2024 at 10:58 am #3897In reply to: Forex Forum

April 2, 2024 at 10:20 am #3892In reply to: Forex Forum

EURUSD 15 MIN CHART

It is only a 20 pip range so far, too tight to last. Price action is typical for the start of a quarter, especially this one after a 4 day weekend, as the market re-liquifies.

As the chart shows, 2 red AT lines drawn off the low indicate a shift in risk to the upside that has seen a move up but faces resistance at 1.0744.

Not seen on this chart, the gap in price after the ISM report yesterday is to 1.0772. The key target on the downside remains at 1.0694.

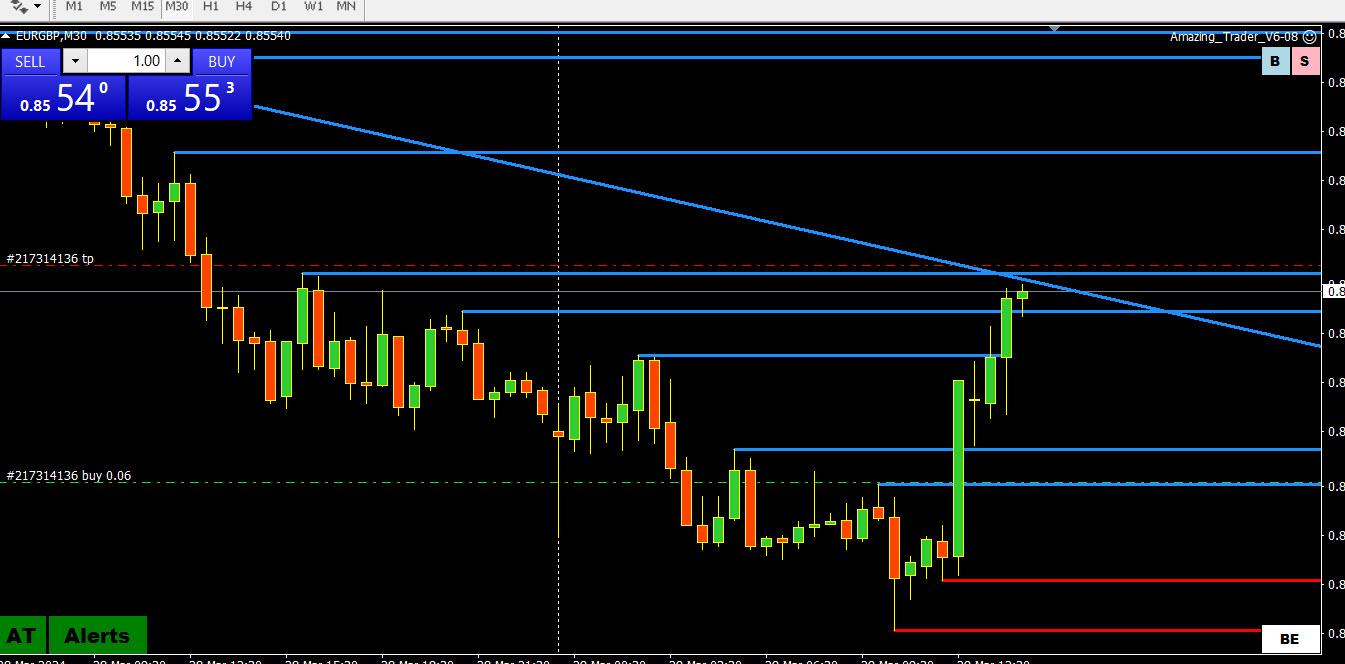

Note while steadying vs the dollar, EUR is trading soft on some of its crosses (e.g. eurgbp, eurcad)

April 2, 2024 at 9:57 am #3890In reply to: Forex Forum

It feels more like the start of a new year than the start of the second quarter.

The key focus will be on US data and how the bond market reacts.

Powell speaks tomorrow.

USDJPY remains in a 151-152 range, betterment bid in the upper half. I read that any intervention should it occur would target a 5 yen drop. I also read that the effects of intervention would be short-lived.

EURUSD stays soft but tight range, suggests a cautious approach awaiting key data from mid-week on

April 2, 2024 at 1:28 am #3889In reply to: Forex Forum

April 1, 2024 at 7:12 pm #3887In reply to: Forex Forum

April 1, 2024 at 4:07 pm #3871In reply to: Forex Forum

I think there’s two levels to be aware of wrt eur/usd forming a base. The first is nearby around 1.0725-1.0690….

The second is lower down around 1.0550.

Both would form a right shoulder for an inverted S-H-S if things are destined to play out that way.

Personally I think there’s enough divergence and other stuff going on that would say it doesn’t. But one never knows….

April 1, 2024 at 3:41 pm #3870In reply to: Forex Forum

April 1, 2024 at 2:20 pm #3865In reply to: Forex Forum

Dow futures have drifted lower overnight but there is limited liquidity below current price. It is showing in Usd as it is holding, which is consistent. It is my experience it would require something significant for futures to move down further much, so the potential for futures to hold and Eur to catch a bid are present. Quite risky though, a Warren Buffet buy when they are selling trade if you have the courage. Prefer to see the open in stocks and the data on this Monday out of responsibility.

April 1, 2024 at 6:57 am #3848In reply to: Forex Forum

Holiday almost everywhere in EU markets today. Here’s the monthly outlook from Alpha Picks for EUR/USD. Apologies if taking up too much space…

The ECB will be meeting on April 11th, and this should play out interestingly. Looking at the EURO on the 1 month time frame is where we will begin. We have observed massive demand for put buying relative to calls, and I do believe that this will continue to be the case into the ECB meeting as the market starts to anticipate a much more dovish ECB relative to the FED. This should start to put some downside on the EUR/USD. Hence, there is anticipation for this sideways chop in EUR/USD spot to start to fade, and for the EUR to move lower relative to USD. Implied vol on the one month has started to rise with a 40bps rise in implied vol now sitting at 5.40 vols.

Looking at the EUR/USD 1m Risk Reversal 25 delta, we are now witnessing rollover. Currently, we are seeing more buying of puts than calls. However, since COVID the overall level is relatively in line with where the options activity has been. Looking at the implied vol. this is also relatively low, and it does not appear that anything interesting is happening on the vol front with vol continuing to remain relatively suppressed.

Regarding the meeting for the ECB. I would expect the potential of witnessing the demand for puts to outstrip the demand for call buying, and potentially adding to some downside in the EUR/USD which over the last 3 months has been stuck in a range between 1.07-1.10.

Now observing the EURO, we witness something rather interesting happening with the term structure. We are only just starting to see widening until further out the maturity of the term structure. This implies that there is a macro risk that is being priced into the EURO, and thus traders are cautious about the outlook. This is driven by low expectations for growth, low productivity, and geopolitical issues within the Red Sea that seem more likely to hurt the EU compared to the US. Once again supporting the thesis that we should observe weakness in the EURO overall.April 1, 2024 at 12:31 am #3847In reply to: Forex Forum

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Japan’s quarterly Tankan survey will open the week amid expectations for slowing at large manufacturers. Slowing is expected for US nonfarm payroll growth on Friday to a still strong 200,000 in March from 275,000 in February; wage pressures are also seen slowing but still overheated. Likewise, slowing is expected for Canadian employment on Friday to a very solid 25,000 from February’s 40,700.

Inflation data from Europe will be Tuesday’s and Wednesday’s focus, first from German where some cooling is expected for March then from the Eurozone as a whole where only marginal cooling is the call, to 2.5 from 2.6 percent overall and to 3.0 from 3.1 percent for the narrow core.

Policy news will include the Bank of Canada’s business outlook survey on Monday and minutes from the Reserve Bank of Australia on Tuesday

Evonoday

March 31, 2024 at 3:22 pm #3836In reply to: Forex Forum

March 31, 2024 at 3:06 pm #3835In reply to: Forex Forum

March 31, 2024 at 1:59 pm #3833In reply to: Forex Forum

March 29, 2024 at 1:45 pm #3793In reply to: Forex Forum

March 29, 2024 at 12:46 pm #3783In reply to: Forex Forum

March 28, 2024 at 3:12 pm #3752In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View