-

AuthorSearch Results

-

March 6, 2025 at 11:26 am #20500

In reply to: Forex Forum

March 6, 2025 at 11:10 am #20499In reply to: Forex Forum

EURJPY 4 HOUR CHART – Holds major resistance

With EURJPY one of the drivers of the EURUSD rally (among other crosses), it pays to take a look as the cross has backed off after a test of the major 161.17 level (see chart).

This has helped steady EURUSD while USDJPY slipped below 148.

Minor support 159.40 and 158.70

March 6, 2025 at 10:22 am #20497In reply to: Forex Forum

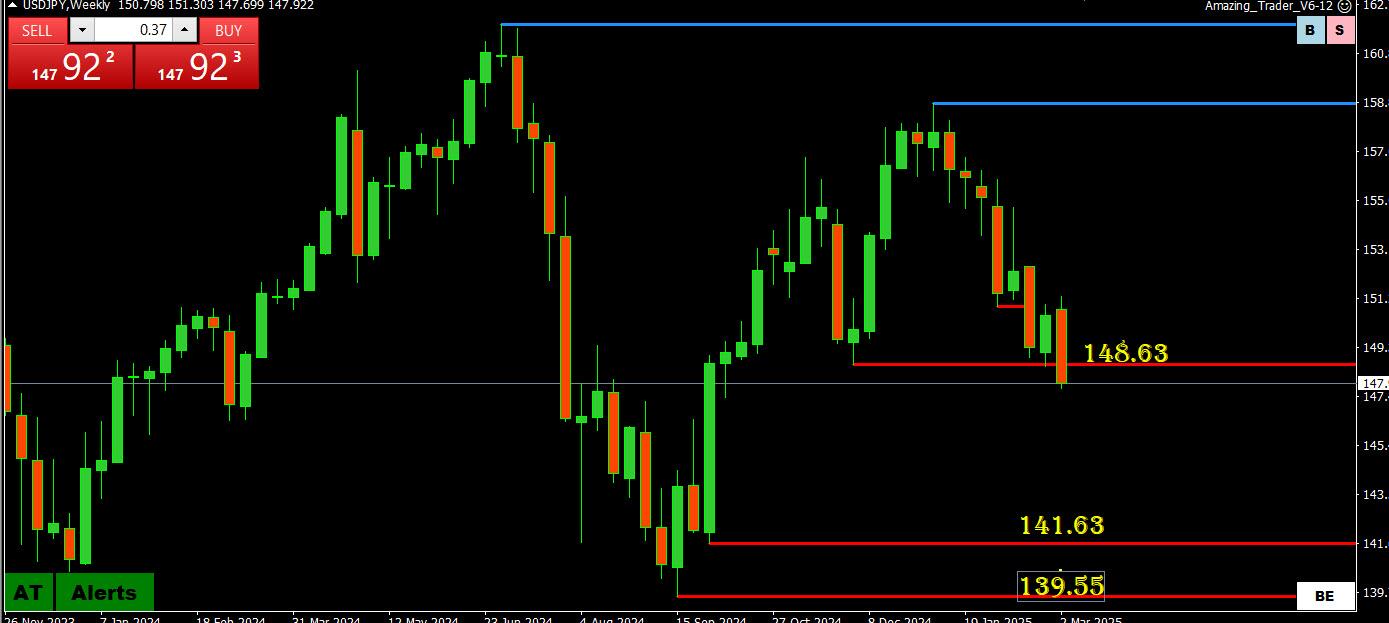

USDJPY WEEKLY CHART – Black hole

After lagging and at times diverging the past few days vs the EUR, JPY has firmed, both vs the dollar and on its crosses,

As you can see by this weekly chart, there is a large black hole on the downside, leaving the focus on the pivotal 148 level to set the tone and dictate whether it can make a run at 146.50 and 145.00 or not..

As I have noted, when you see a big move in USDJPY, especially when it diverges with what others are trading vs the USD, it generally involves a real money cross flow.

Intra=day range: 147.70-149.33

March 6, 2025 at 9:59 am #20494In reply to: Forex Forum

EURUSD DAILY CHART – Watch 1.08

With the breakout through 1.0630 leaving little until the next target at 1.0936, 1.08 is one of those pivotal levels that will dictate whether the market can build further momentum to make a run at it.

Next focus is on the ECB meeting where a 25bps rate cut is a done deal. Key will be forward guidance in light of the sharp rise in bond yields following the increased government spending plans on defense announced this week.

In any case, while 1.08 will set the tone, there should be support on any decent dip as long as it trades above 1.0630.

Intra-day range so fat 1.0780-1.0822 (almost a symmetric 20 pip range around 1.08),

March 6, 2025 at 9:51 am #20493In reply to: Forex Forum

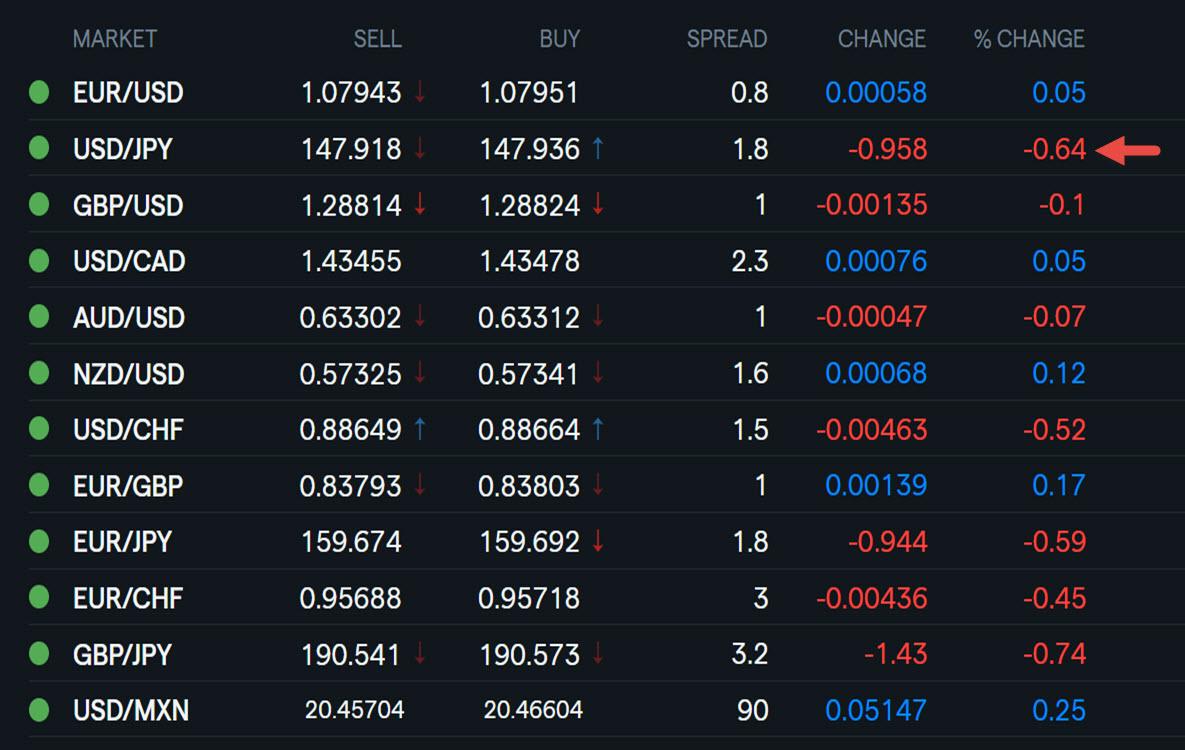

Using my platform as a HEATMAP shows

The dollar traded softer overnight before some caution set in ahead of the ECB decision. Most currencies are currently showing only modest changes except the JPY, which has been the outperformer (extended low below 148).

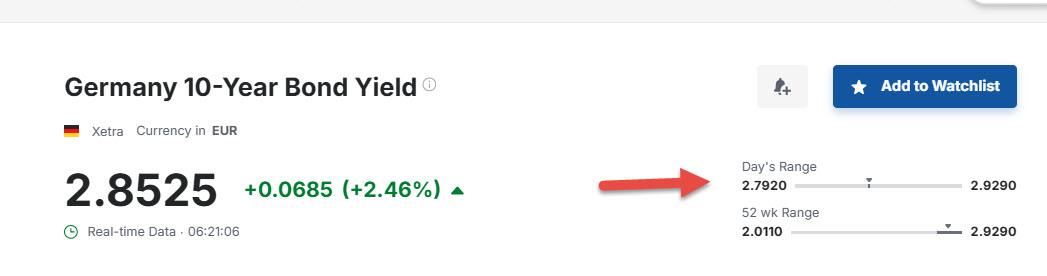

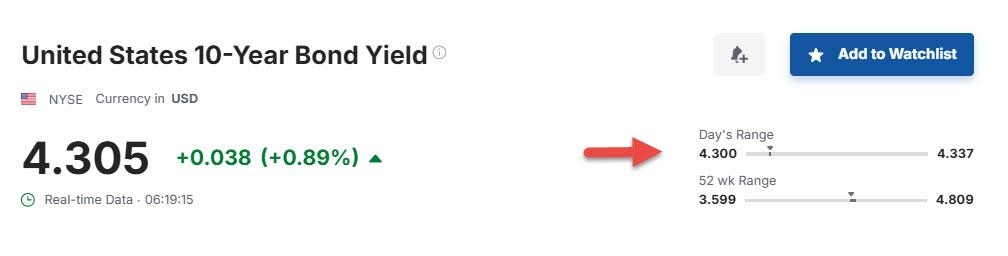

Key focus is on the bond market where higher German yields are pulling other country yields higher as well.

Pivotal levels to watch end in 8: EURUSD 1.08, USDJPY 148.

Light U.S. calendar (weekly jobless claims) ahead of the key .S. jobs report on Friday

US stocks currently down, bond yields up…not a good comination

Keep on eye on headlines, specifically tariff replayed

March 5, 2025 at 10:09 pm #20480In reply to: Forex Forum

March 5, 2025 at 6:07 pm #20471In reply to: Forex Forum

EURUSD Weekly

EUR goes straight for 1.08300 –important support that turned to resistance.

It is the last test/hurdle , before it opens for attack at 1.11800 – Major Resistance and downtrend line, and if so I don’t think that it will hold this time.

We might be in for some serious EUR rally.

But as I said on Monday – this week is filled with data/news/statements that can turn it all in a second.

However, if I understood Trump well, we will be talking “weak dollar” for quite some time from now on.

March 5, 2025 at 4:36 pm #20469

March 5, 2025 at 4:36 pm #20469In reply to: Forex Forum

March 5, 2025 at 2:35 pm #20465In reply to: Forex Forum

March 5, 2025 at 12:48 pm #20461In reply to: Forex Forum

NFP week

–

headlines likely to kick market around in light of “incoming data” this week in the form of ADP, ISM, factory orders and then NFP on friday.Eur/Usd 1.0710 atm, HoD 1.0722 (and 200dma)

question is what is the player appetite to push the puppy higher or will players consolidate gains and bag some profits to say towards 1.06March 5, 2025 at 11:38 am #20459In reply to: Forex Forum

US OPEN

Global Sentiment lifted on tariff optimism, European stocks at highs & Bunds hammered on German spending plansGood morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

Sentiment lifted after the US Commerce Secretary suggested Trump could potentially reduce tariffs on Canada and Mexico, perhaps as soon as Wednesday.

European bourses at session highs; DAX 40 +3% outperforms; US equity futures broadly higher with the RTY +1.2%.

EUR surges on German spending plans, DXY around 1.05 after breaking below its 200DMA.

Bunds battered by Merz’s fiscal reform, USTs await data and tariff updates.

Crude subdued continuing recent action & failing to benefit from China’s support which has bolstered base metals.March 5, 2025 at 11:08 am #20458In reply to: Forex Forum

March 5, 2025 at 10:27 am #20456In reply to: Forex Forum

March 5, 2025 at 10:17 am #20455In reply to: Forex Forum

Random thought:

I think a lot of corporates hedged long EURUSD exposures and some hedge funds used EUR as a favored funding currency.

If true, what we are seeing are position adjustments, squeeze on EUR shorts on a shift in fundamental factors (i.e. German loosening debt break, more EU defense spending, light at the end of the Russia-Ukraine war).

March 5, 2025 at 10:10 am #20453In reply to: Forex Forum

March 5, 2025 at 10:01 am #20450In reply to: Forex Forum

EURUSD 4h

Frankly I hate it when they do it all overnight…

Target / Resistance waiting at 1.07350/400

Supports: 1.06950, 1.06750 & 1.06200

This is the Prime example of one of those: you got the direction right, you got the levels even better…but timing…timing sucks…and you can only eat your 6.

So you sit back, try to relax and not rush into something that will hurt you.

March 5, 2025 at 9:37 am #20445

March 5, 2025 at 9:37 am #20445In reply to: Forex Forum

March 5, 2025 at 9:30 am #20444In reply to: Forex Forum

Using my platform as a HEATMAP shoes

The dollar trading weaker, led by the EURUSD, which is in a breakout mode.\

EUR firmer on crosses as well.

USDJPY failed to hold a move above 150.

German bond yields are sharply higher after deal to ease debt restraints (otherwise known as the debt brake)

DAX is up sharply as well.

Zelensky kisses up to Trump by showing a willingness to negotiate a peace deal.

Trump’s address to Congress unveiled no new policies.

.Trade war still on but CAD and MXN rebound suggest caution and hope it may be a negotiating tactic

Date calendar: US ADP employment and ISM services PMI.

March 5, 2025 at 8:35 am #20443In reply to: Forex Forum

March 4, 2025 at 8:21 pm #20427In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View