-

AuthorSearch Results

-

March 11, 2025 at 1:02 pm #20736

In reply to: Forex Forum

March 11, 2025 at 12:44 pm #20735In reply to: Forex Forum

USDJPY 4 HOUR CHART – Watch EURJPY

As I have noted many times, when you see the JPY diverge vs how other currencies are trading vs the dollar you can assume a cross flow is behind the move.

This was the case earlier where EURUSD was bid and so was USDJPY. (Note a firmer EURJPY).)

Looking at the chart, you can see how 147.79 resistance capped the upside.

Only back above this level and 148+ would suggest a greater retracement risk.

On the downside, below 146.50-55 would be needed to start a fresh leg down.

Otherwise range is essentially 146.50-147.80.with one eye on EURJPY and the other on the risk mood set by US stocks

March 11, 2025 at 11:10 am #20730In reply to: Forex Forum

US OPEN

Sentiment improves modestly after Monday’s hefty losses, and DXY hits fresh YTD low awaiting further Trump updates

Good morning USA traders, hope your day is off to a great start!

Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

· European bourses are mixed; US futures are firmer attempting to consolidate following the prior day’s hefty losses.

· DXY hits a fresh YTD low as EUR/USD reclaimed 1.09 on German defence spending optimism.

· USTs hold near unchanged while Bunds slump on the latest fiscal updates.

· Commodities broadly supported by a diving Dollar; XAU back above USD 2.9k.

March 11, 2025 at 9:11 am #20723In reply to: Forex Forum

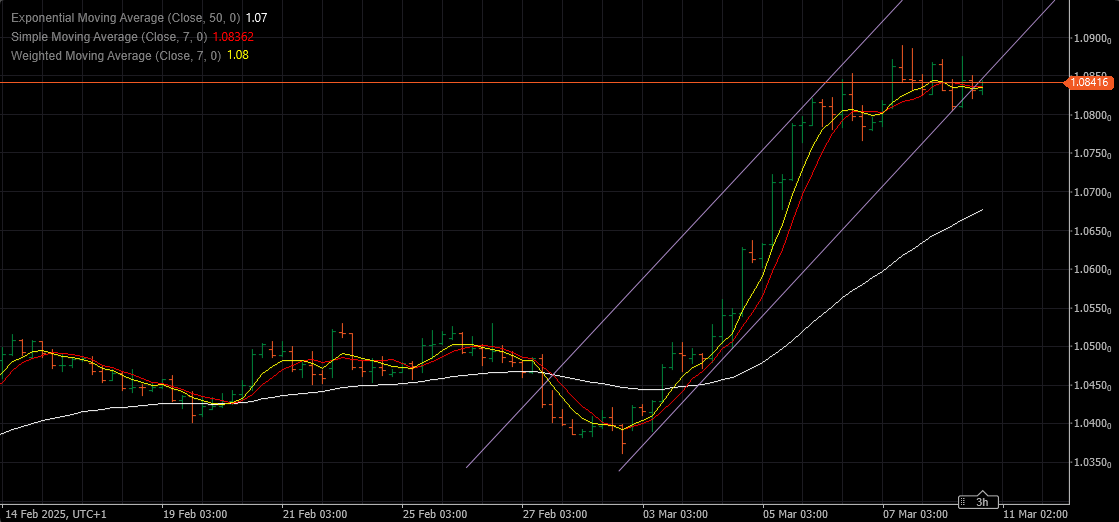

EURUSD WEEKLY CHART – 1.10 LOOMS

As I pointed out in Will EURUSD Make a Run for 1.10? the break of 1.0630 exposed a bid until 1.0936, a potential tough obstacle.

Above 1.0936 would expose 1.10, 1.1214 and the major 1.1284 level.

On the downside, look for a strong bid while above the former 1.0888 high with support as long as it trades above 1.0835.

March 11, 2025 at 8:59 am #20722In reply to: Forex Forum

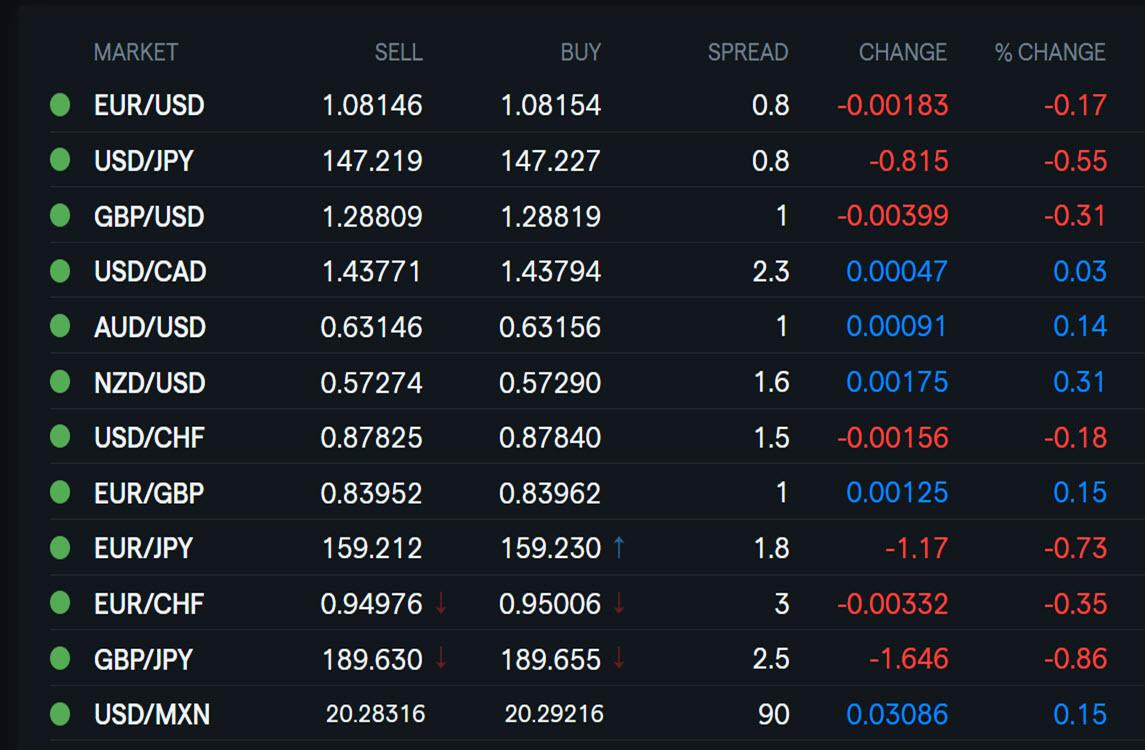

Using my platform as a HEATMAP shows

EURUSD, which lagged yesterday jumping back into the lead, extending its high above 1.09.

Others following with a lag except cUSDJPY, which is about unchanged after leading yesterday as stocks steadied overnight.

A very light calendar today leaves the focus on US stocks to set the risk mood and headline news.

March 11, 2025 at 8:46 am #20721In reply to: Forex Forum

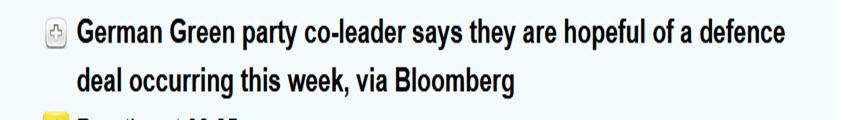

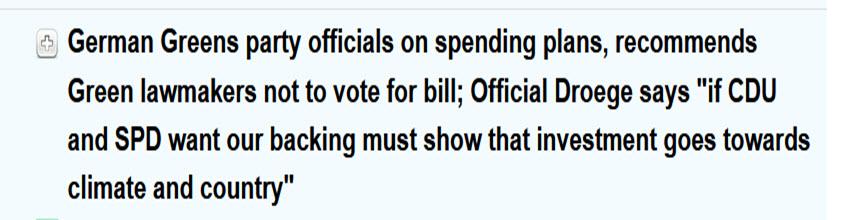

This headline, which came out earlier, may be helping to give EUR a kift

March 10, 2025 at 5:45 pm #20676

March 10, 2025 at 5:45 pm #20676In reply to: Forex Forum

March 10, 2025 at 1:47 pm #20644In reply to: Forex Forum

March 10, 2025 at 12:38 pm #20636In reply to: Forex Forum

EURUSD 4h

Supports: 1.08450, 1.08300 & 1.08200

Resistance: 1.08750, 1.08900 & 1.09650

Next 4h Bar is crucial for the direction – if it manages to go above 1.08900 and stay above it, EUR will continue Up.

In such a case target is in 1.10600 area.

If not, we should be watching everything between 1.05600 & 1.06400 down there.

March 10, 2025 at 11:30 am #20634

March 10, 2025 at 11:30 am #20634In reply to: Forex Forum

EURUSD brief black hole reaction to German news

EURUSS 15 MINUTE CHART — Headline risk

News Algo headline reaction then back to square one (1.0850)

March 10, 2025 at 9:36 am #20629In reply to: Forex Forum

EURUSD bounce just now from above 1.08 would need a solid 1.0850+ to shift the focus away from 1.08 and back to the 1.0888 high.

Bounce in EURJPY just now seemed to coincide with a modest bounce in US stocks off the lows.

In the current environment, look for stock market bounces to lack follow through, for exampole, as long as US500 stays below 5800

March 10, 2025 at 9:11 am #20628In reply to: Forex Forum

Using my platform as a HEATMAP

Mixed start to the week

EURUSD backing off towards (but still above) 1.08.… USDJPY weaker ==> EURJPY weaker (GBPJPY as well) asa JPY gets safe haven flows.

AUDUSD, NZDUSD a touch firmer, USDCAD about unchanged

Tariffs, trade war risk, recession talk weighing on US equities

The Savvy Trader was ahead of the curve when he wrote this article’

Is the U.S. headed for a recession by the Savvy Trader?

Light calendar so another headline watching day after Trump weekend comments (scroll below) added to a risk off mood

March 9, 2025 at 9:16 pm #20624In reply to: Forex Forum

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

This week’s economic outlook focuses on key global trends. In Asia, China may introduce stimulus measures following its National People’s Congress, as policymakers shift to a “moderately loose” monetary stance. Meanwhile, India and Australia monitor inflation and confidence data for signs of economic shifts. In Europe, Germany’s struggling manufacturing sector remains a concern, though potential defense spending increases could offer future support. The Eurozone continues battling weak industrial output. In the U.S., recession risks are rising as job growth slows, inflation remains high, and consumer sentiment declines. The Fed is expected to hold interest rates steady as uncertainty looms.

Econoday

March 9, 2025 at 8:36 pm #20623In reply to: Forex Forum

March 9, 2025 at 7:06 pm #20621In reply to: Forex Forum

March 7, 2025 at 10:13 pm #20600In reply to: Forex Forum

March 7, 2025 at 9:52 pm #20598In reply to: Forex Forum

March 7, 2025 at 4:06 pm #20582In reply to: Forex Forum

EURUSD pops on peace headline but not enough to test the post-jobs report 1.0888 high

March 7, 2025 at 2:35 pm #20569

March 7, 2025 at 2:35 pm #20569In reply to: Forex Forum

March 7, 2025 at 2:08 pm #20563In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View