-

AuthorSearch Results

-

March 13, 2025 at 11:12 am #20839

In reply to: Forex Forum

US OPEN

US equity futures are mixed & USD steady ahead of US PPI & geopolitical updates

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses opened lower but have gradually picked up; US futures are modestly lower/flat.

USD is steady ahead of PPI metrics, fleeting EUR softness as German political tensions mount.

Bunds are modestly lower awaiting the Bundestag debate while USTs look to PPI and shutdown developments.

Industrial commodities softer on tariff woes; spot gold inches closer to all-time-highs

.

March 13, 2025 at 8:30 am #20827In reply to: Forex Forum

March 13, 2025 at 7:50 am #20823In reply to: Forex Forum

EURUSD 4 HOUR CHART – Out of steam

What caught my eye is the failure to trade above 1.09 (high 1.0897) after past two days testing above it.

This chart shows a classic AT (Amazing Trader) down ladder pattern (falling blue lines) with a risk for 1.0800-35 while below 1,0875. BUT would have to first get through the pivotal 1.050 level first.

Back above 1.09 would be needed to restore the BID.

March 13, 2025 at 7:39 am #20821In reply to: Forex Forum

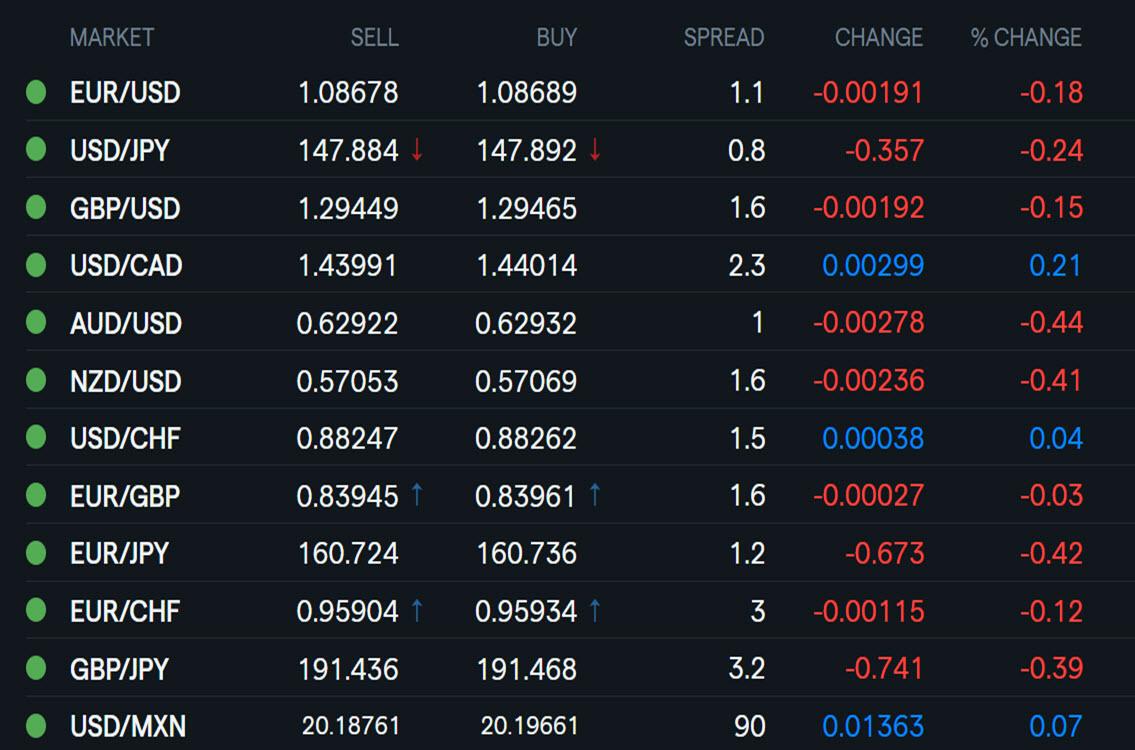

Using my platform as a HEATMAP shows

A reversal of fortune from this time yesterday

JPY firmer, both vs the dollar (USDJPY back below 148) and on its crosses (note EURJPY weaker) as mood turns back to risk off.

Dollar a touch firmer elsewhere. EURUSD so far failed to trade 1.09+ after 2 days testing above it Commodity currencies trading weaker.

Looking ahead

US PPI and Weekly jobless claims

G7 foreign ministers meet in Quebec amid rising trade/tariff tensions

Looming U.S. shutdown at 12:01 AM Saturday unless there is an agreement to extend funding the government

March 12, 2025 at 6:47 pm #20805In reply to: Forex Forum

March 12, 2025 at 3:56 pm #20799In reply to: Forex Forum

With stocks bouncing from the lows, bond yields following, the FX market is not sure whAT PATH TO FOLLOW while USDJPY remains well of the 149+ high but still up on the day above 148.

EURUSD is back to about unchanged on the day in what seems to be setting up to be an FX range afternoon with the focus mainly on US rquities.

March 12, 2025 at 2:39 pm #20795In reply to: Forex Forum

March 12, 2025 at 1:01 pm #20782In reply to: Forex Forum

ECB Facing ‘Exceptionally High’ Levels of Uncertainty, Lagarde Says

The European Central Bank is confronting a new, more volatile world in which it must combine agility in responding to shocks with clarity in outlining how it is likely to react to a range of possible outcomes, President Christine Lagarde said Wednesday.

Much of that new volatility was traceable to U.S. President Trump’s administration.

“Established certainties about the international order have been upended,” she said. “We have seen political decisions that would have been unthinkable only a few months ago. Our expectations have indeed been swept aside in the last few years, and in the last few weeks in particular.”

March 12, 2025 at 12:56 pm #20781In reply to: Forex Forum

March 12, 2025 at 12:45 pm #20779In reply to: Forex Forum

March 12, 2025 at 12:09 pm #20776In reply to: Forex Forum

US OPEN

US equity futures higher & USD incrementally gains ahead of US CPI; JPY modestly lags

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

· European bourses are in the green as sentiment in the complex improves; US futures are also higher with the NQ slightly outperforming.

· USD is a little firmer ahead of US CPI data, JPY lags peers.

· Bonds are bearish overall amid supply, inflation updates & German fiscal developments.

· Oil and base metals firmer, gold trades sideways ahead of US CPI.

March 12, 2025 at 9:27 am #20767In reply to: Forex Forum

USDJPY 4 HOUR CHART – Back above 148

It is hard to fight real money flows that seem to be driven by JPY crosses, such ad EURJPY, which is building on yesterday’s breakout above 161.27 and helping to pull USDJPY above 148.

While damage is not fatal (i.e. it would need to move above 151.30 for an outside week), the solid move through 148.00-40 has broken the downward momentum

So, expect support if 148+ holds bit would need to get through 150.00-20 to suggest anything more than a retracement.

Watch the risk on/off mood as the former seems to be a factor today.

–

March 11, 2025 at 8:01 pm #20757In reply to: Forex Forum

March 11, 2025 at 6:10 pm #20752In reply to: Forex Forum

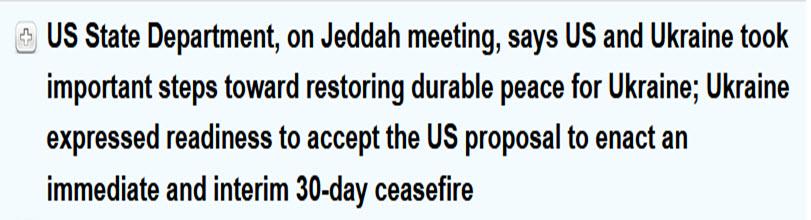

EURUSD may have gotten a lift from Ukraine news (stocks popped as well).

March 11, 2025 at 6:02 pm #20751

March 11, 2025 at 6:02 pm #20751In reply to: Forex Forum

March 11, 2025 at 2:51 pm #20742In reply to: Forex Forum

March 11, 2025 at 2:12 pm #20740In reply to: Forex Forum

March 11, 2025 at 1:48 pm #20739In reply to: Forex Forum

March 11, 2025 at 1:34 pm #20738In reply to: Forex Forum

March 11, 2025 at 1:17 pm #20737In reply to: Forex Forum

EURJPY 161.55, USDJPY 148, EURUSD 1.0815

Large order to buy EURJPY

EURUSD running into resistance above 1.0820

Since EURJPY = EURUSD x USDJPY

If EURUSD can’t move higher, the only way for EURJPY to move higher is via a firmer USDJPY

If 148+ proves tough, then the only way EURJPY can move higher is via a firner EURUSD

Note, stocks backing off earlier highs.

-

AuthorSearch Results

© 2024 Global View