-

AuthorSearch Results

-

January 29, 2025 at 3:48 pm #18644

In reply to: Forex Forum

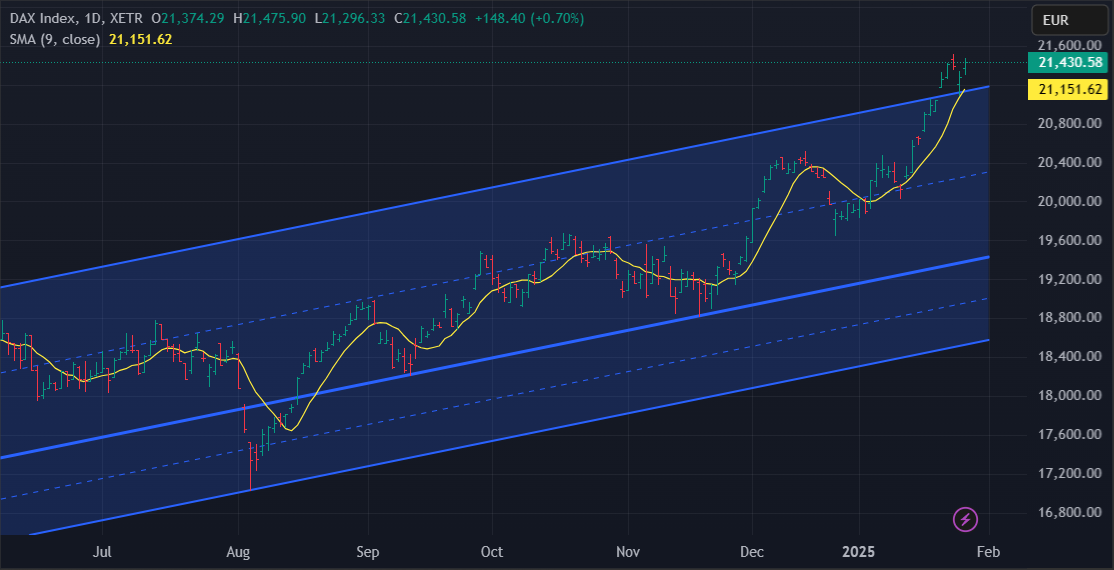

DAX – GER30

DAX Hit New Record Peak

Stocks in Germany Hit All-time High

The DAX rose toward 21650 on Wednesday, hitting fresh record highs, in line with other European indices, fuelled by strong quarterly results from ASML. Market sentiment was also helped by easing concern over the impact of DeepSeek on AI demand.

Interesting technical fact : Previous Resistance line acted as a perfect Support to underpin this renewed Rally.

Now the sky is the limit – 22.200/400 might be in reach. January 29, 2025 at 10:16 am #18613

January 29, 2025 at 10:16 am #18613In reply to: Forex Forum

January 28, 2025 at 7:55 pm #18579In reply to: Forex Forum

DAX Rebounds and Hits New Peak

Germany’s DAX Index Jumps on Corporate Earnings Boost

The blue-chip DAX index ended Tuesday 0.70% higher as market watchers digest the latest wave of earnings results from major companies, boosting investor sentiment.Sartorius SRT was the top-performing stock during the trading session, gaining 11.47% at closing. The German life sciences group said its preliminary sales revenue for 2024 was broadly in line with the prior-year level and issued a “deliberately cautious” outlook for 2025. January 27, 2025 at 8:24 pm #18524

January 27, 2025 at 8:24 pm #18524In reply to: Forex Forum

DAX – GER30 – XETR

Dax holding above 21.000 and looks like as defining a gravity .

Based on time-space analysis and some common sense, we might be in line for some nice correction.

Unless it manages to consolidate in sideways correction, we should be seeing levels around 20.500 if not even 19.350.

Next couple of days watch for double top formation – and if so, deeper correction will be on its way

January 26, 2025 at 9:21 pm #18453

January 26, 2025 at 9:21 pm #18453In reply to: Forex Forum

In our blog

Here is a question? Why has the EURUSD recovered and DAX at record levels given the risk of Trump tariffs. prospect of lower interest rates, an underperforming German economy and political uncertainty in Germany (and France)?

January 26, 2025 at 4:03 pm #18415In reply to: Forex Forum

Swiss stocks closed higher on Friday as the World Economic Forum in Davos comes to a close and markets shift their attention to next week’s key monetary policy decisions in Europe and the US.

The Swiss Market Index edged up 0.18% at the end of the trading day.

In corporate news, Baader Europe raised its price target on Sandoz SDZ to 46.6 francs from 44.2 francs, primarily driven by the Swiss pharmaceutical company’s strong growth in biosimilars and initiatives to improve margins. The stock was up 1.26% at closing.

Of course Swiss market index is lagging ( a lot) behind the DAX, but is more stable .

January 24, 2025 at 10:10 pm #18378In reply to: Forex Forum

January 23, 2025 at 8:34 pm #18313In reply to: Forex Forum

DAX Futures – FDAX1!

Dax going wild – The DAX Index Closes 0.74% Higher

In Frankfurt, the DAX Index went up by 157 points or 0.74 percent on Thursday.Top gainers were Siemens Energy (6.27%), Fresenius Medical Care (4.91%) and Zalando (4.77%).

Biggest losses came from Puma (-22.43%), Qiagen NV (-2.88%) and BMW (-0.95%).

January 22, 2025 at 9:13 pm #18245

January 22, 2025 at 9:13 pm #18245In reply to: Forex Forum

DAX futures – FDAX1!

DAX Sets Fresh Record, Outperform European Peers

The DAX closed about 1% higher at a new record high of 21,259 on Wednesday, outpacing its European peers.The index was bolstered by Adidas’ strong earnings and optimism over massive AI investments proposed by US President Donald Trump, which helped offset concerns about his tariff policies.

January 22, 2025 at 10:47 am #18203

January 22, 2025 at 10:47 am #18203In reply to: Forex Forum

January 21, 2025 at 10:43 am #18139In reply to: Forex Forum

GER30 DAILY CHART – WHEN MIGHT IT PAUSE?

DAX continues to set record highs despite German economic woes.

So, the question now is what might derail the relentless march higher… in this regard, wild card may be any Trump tariffs.

In any case, only resistance is the new record high, keeps a bid while above 20537 (see chart).

January 8, 2025 at 10:29 am #17326In reply to: Forex Forum

AnonymousEUROPE – Very Strange

The German Dax is rising, but there is no economic-funamental reason there, except a DEXIT risk upon the upcoming German Election on February 23d.

In case of DEXIT it is said the EURO might loose 40% sharp, there will be problems in devalued assets all over and those not market to market might require huge capital inflows.

The New Deutsche Mark would rise 40%. So probably some German Equities are now considered partly a safe have. Just partly and just some.

All other EUROPEAN INDEXES WOULD CRASH

December 17, 2024 at 4:40 pm #16385In reply to: Forex Forum

November 8, 2024 at 10:31 am #14168In reply to: Forex Forum

October 22, 2024 at 10:41 am #13194In reply to: Forex Forum

Newsquawk US Open

Oil surges on recent geopolitical updates; speakers & earnings ahead

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses are entirely in negative

territory, with initial outperformance in the DAX 40 (due to strong SAP results) now entirely erased; US futures are also lower.Dollar is flat, Antipodeans outperform attempting to recoup some of its recent losses.

Bonds remain on the backfoot in a continuation of the pressure seen in the prior session

Crude was initially subdued, giving back some of the prior day’s gains; however, following two key geopolitical updates, the complex soared to session highs.

1) Israeli PM Netanyahu will hold consultations tonight with various cabinet ministers,

2) Iranian embassy officials were reportedly involved in the drone attempt on NetanyahuNot signed up to our squawk service yet?

Listen to our team of analysts broadcast the news that will impact the markets as it happens, and never be caught off guard again.

September 16, 2024 at 5:38 pm #11725In reply to: Forex Forum

May 15, 2024 at 1:17 pm #6321In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View