-

AuthorSearch Results

-

February 17, 2025 at 9:07 pm #19678

In reply to: Forex Forum

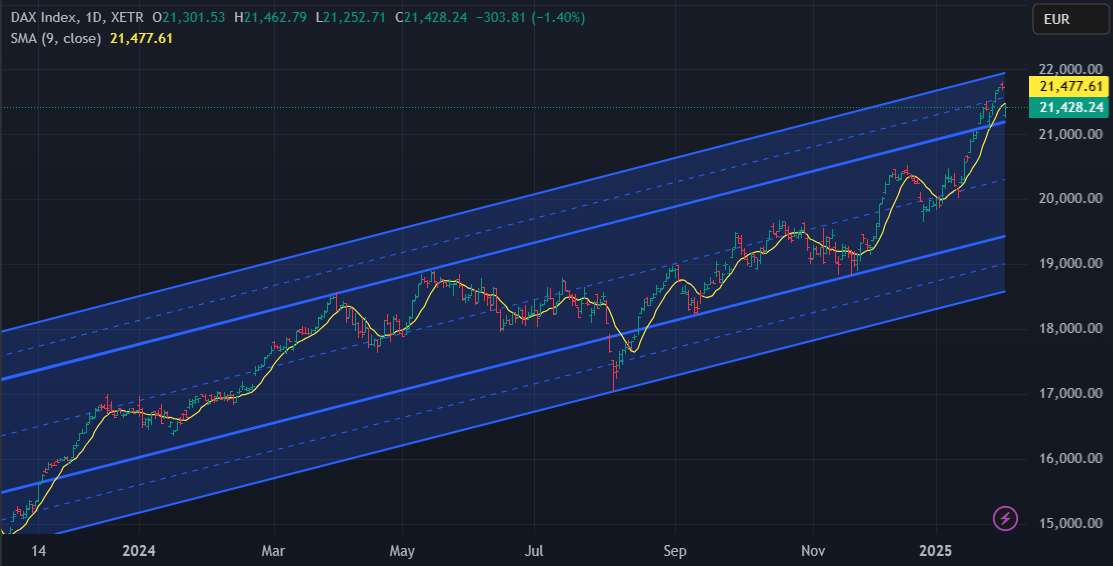

DAX – GER 30

The DAX Index Closes 1.26% Higher

In Frankfurt, the DAX Index went up by 285 points or 1.26 percent on Monday.

Top gainers were Rheinmetall (14.67%), Siemens Energy (3.74%) and Munich RE (2.50%).

Now headlines aside, what can we expect next?

Frankly, this is an uncharted territory and so far it behaved very technical.

Having that fact on mind, now we have to use something that many would laugh at – Thumb analysis…after you laughed long and loud, pay attention :

– Whenever I want to avoid that laughing I call it Time-Space analysis, and so far it worked like a charm

– No rally can go on for ever

– Without a decent correction, we have to assume that any instrument that goes so sharply Up will go down the same way

– So either a correction soon or it is going to be a classic Blow of Rally

I would like to see DAX testing 22K again

I wouldn’t like to see Savage Profit taking that might end up changing the trend at the end.

February 17, 2025 at 1:36 pm #19651

February 17, 2025 at 1:36 pm #19651In reply to: Forex Forum

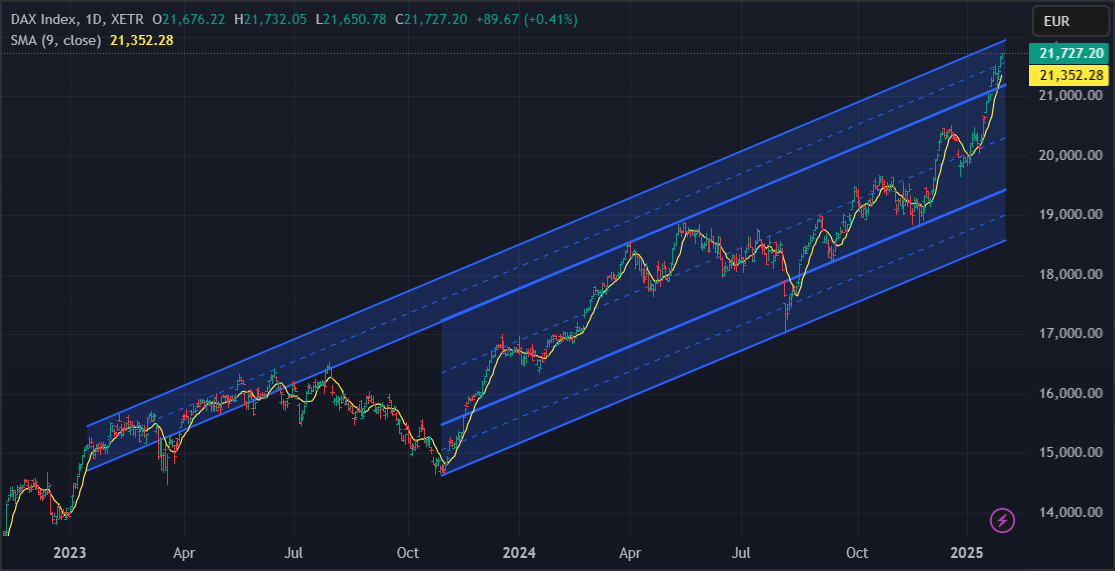

DAX – GER 30

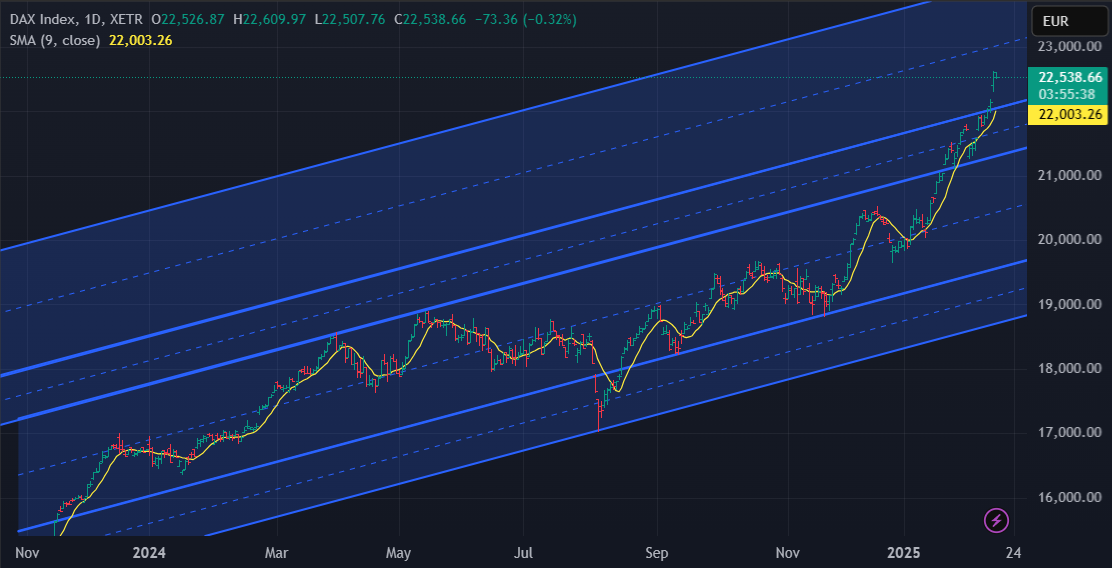

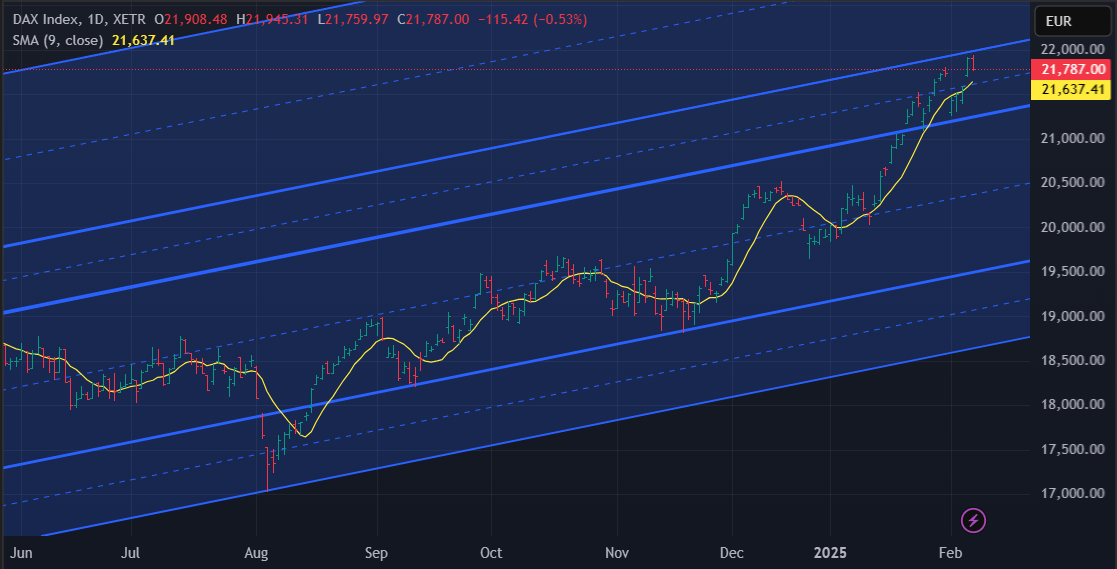

Dax continues to hit new highs – trend that started in late 2024.

And it goes stronger and faster.

So what might be behind this latest run – last 8 days?

Reuters claims : European stocks hover near record high on defence boost

European shares hovered near a record high on Monday, boosted by defence stocks amid growing U.S. calls for the region to amplify military spending for security.But in my own view – this was all “written” on charts months ago, and especially after DAX broke above 22.000

So Targets are at 23 & 24 K

February 14, 2025 at 12:52 pm #19567

February 14, 2025 at 12:52 pm #19567In reply to: Forex Forum

February 13, 2025 at 8:26 pm #19525In reply to: Forex Forum

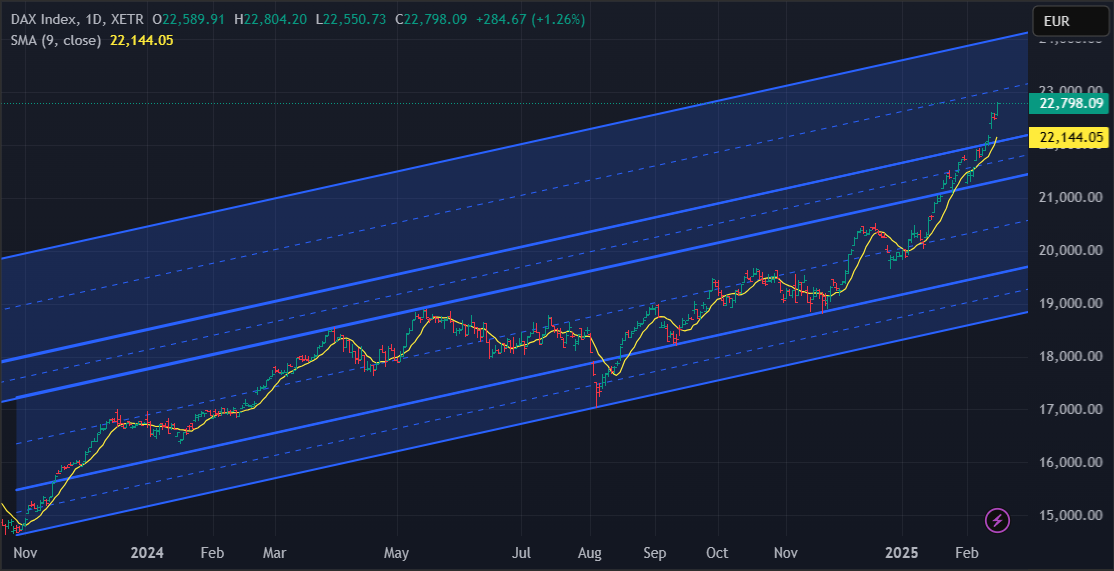

DAX – GER 30

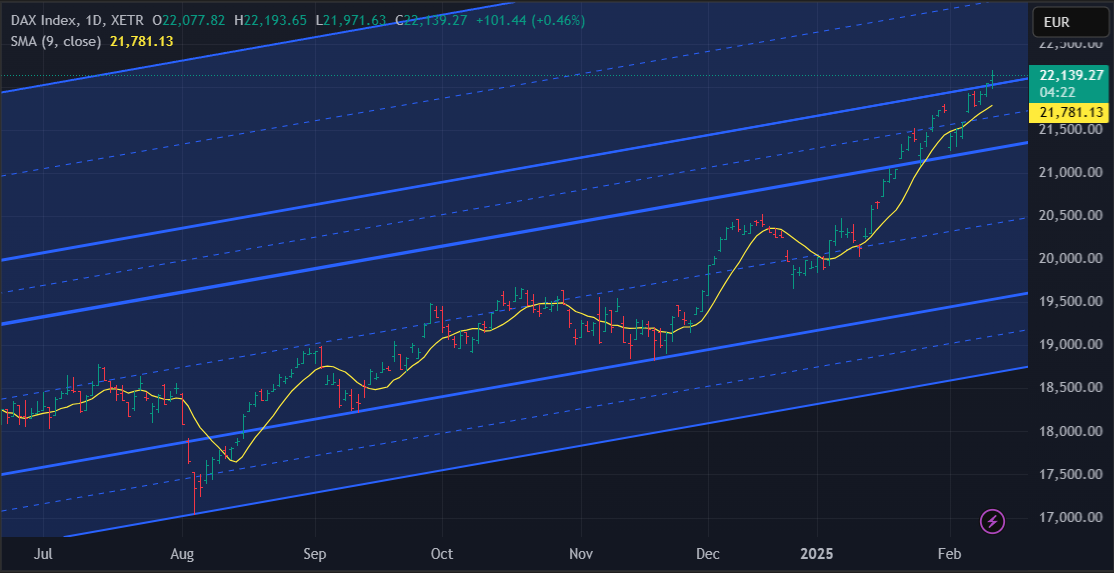

DAX Surges to New High

Nice move away from support at 22.000 and making it very clear now where it tends to go.First target in 23.000 area, next 24K

Market sentiment remained upbeat amid strong corporate earnings and optimism over a potential end to the war in Ukraine, though caution persisted over US trade policy.

February 13, 2025 at 10:45 am #19471

February 13, 2025 at 10:45 am #19471In reply to: Forex Forum

It is rare that we like toi give ourselves credit but I poated this article nearly 3 weeks ago and it took time for the markets to catch up to my puzzle.

Is the Trump Effect Impacting the EURUSD and the DAX?

Here is a question? Why has the EURUSD recovered and DAX at record levels given the risk of Trump tariffs. prospect of lower interest rates, an underperforming German economy and political uncertainty in Germany (and France)?

February 12, 2025 at 4:44 pm #19430In reply to: Forex Forum

February 11, 2025 at 9:30 pm #19382In reply to: Forex Forum

February 11, 2025 at 7:42 pm #19379In reply to: Forex Forum

After reading this headline and seeing EURUSD spike higher it reminded me of this blog artcile (see below) which is worth A READ

Source: Newsquawk.com

Is the Trump Effect Impacting the EURUSD and the DAX?

Here is a question? Why has the EURUSD recovered and DAX at record levels given the risk of Trump tariffs. prospect of lower interest rates, an underperforming German economy and political uncertainty in Germany (and France)?

February 11, 2025 at 2:25 pm #19360

February 11, 2025 at 2:25 pm #19360In reply to: Forex Forum

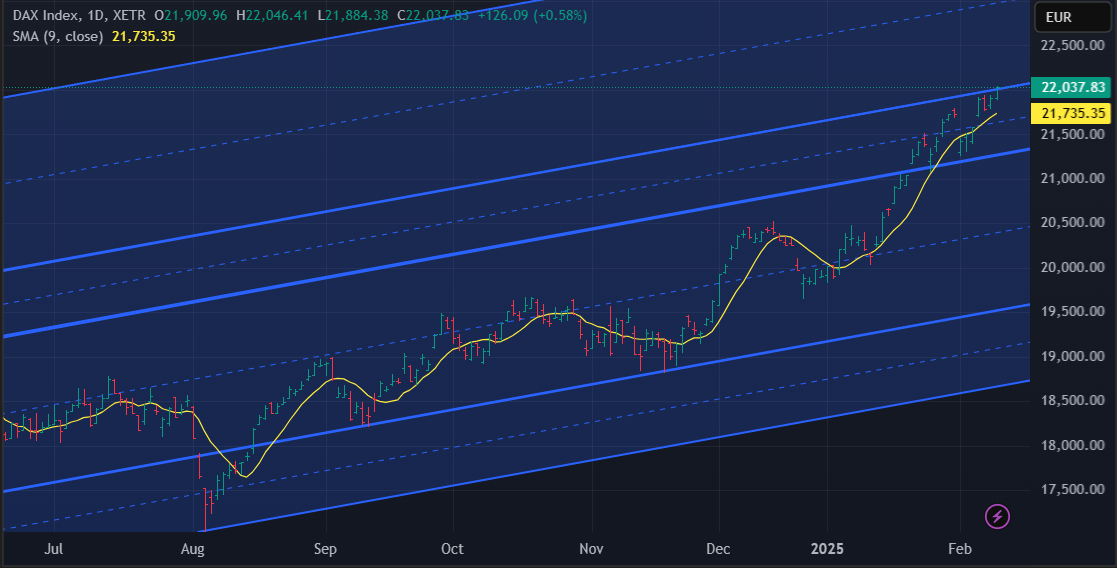

GER30 4 HOIUR CHART – Back on the march higher

With the opening week gap filled, DAX is on the march again into record high territory.

So, the question is if tariffs and the threat of a trade war are such a risk, why is the DAX continuing its move higher.

22000 is the next obvious target.

‘Keeps a bid while above 21726

February 10, 2025 at 7:01 pm #19302In reply to: Forex Forum

February 10, 2025 at 10:55 am #19270In reply to: Forex Forum

GER30 4 HOUR CHART – TAKING A PAUSE?

The DAX (GER30) has been a star performer, up each week so far this year. This winning streak will be a key focus this week.

In this regard, the record high set last week at 21946 had yet to be touched today so consolidation while below it.

On the downside, only below 21386 would dent momentum and suggest a pause.

February 9, 2025 at 4:26 pm #19235In reply to: Chart of The Week

Trading Charts of the Week: XAUUSD and DAX

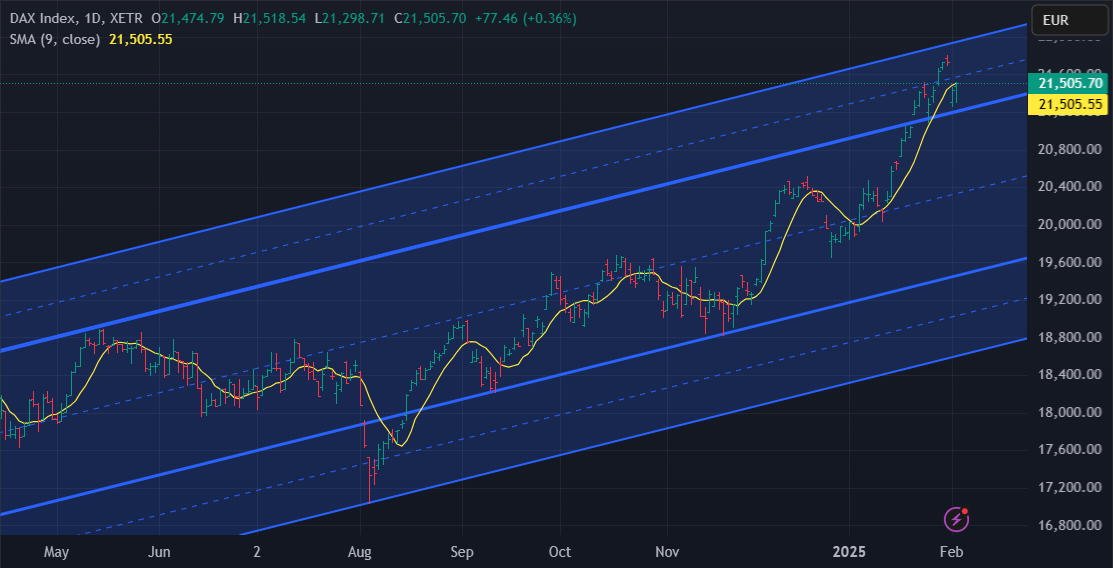

I am always on the lookout for patterns and what would extend them and what would end them. The longer the time frame the stronger the pattern, especially when there is a trend, which should give a clue for shorter-term traders what is the strong side of the marlet.

Both the DAX and XAUUSD have similar patterns, each has 5 up (green)( candles (6 for XAUUSD including Dec) and record highs since the start iof the year.

Watch the low/high for the coming week tk see if this pattern is broken, is broken, or takes a pause Iinside week).

XAUUSD Weekly Chart

GER30 Weekly Chart

February 7, 2025 at 8:26 pm #19221

February 7, 2025 at 8:26 pm #19221In reply to: Forex Forum

DAX – GER 30

21.945 – new high – close enough to 22K and in my opinion Hero can get some rest now.

Supports : 21.500 & 21.250

I am not a guy to call for a change of trend – ever, until I get some charting facts to support such a claim, but I have to warn you once again – This might be the top and buying it now for some imagined coming Rally is not a way to go.

In the case DAX breaks 22K , it will have to stay above it – so enough time to get some action.

Otherwise you might end up buying a top….

February 6, 2025 at 9:43 pm #19137

February 6, 2025 at 9:43 pm #19137In reply to: Forex Forum

DAX – GER30

And here it comes – Hero is just below 22.000 ( high so far 21.921 )

Now things are going to become very tricky.

I must repeat aout probability – more and more probability goes in favour of a sizeable correction.

I have started calling for 22K from the moment DAX broke above 21K – hope it is clear from my charts what was the logic.

Last night I mentioned this possibility , with a great probability for a sudden drop from here – so let’s see what happens tomorrow.

Technically – if it breaks above 22.000 and stays above for couple of days, this top channel will be in play.

February 5, 2025 at 8:53 pm #19080

February 5, 2025 at 8:53 pm #19080In reply to: Forex Forum

DAX – GER30

Hero holding Up.

Now joke aside, this is what can happen in coming days:

– Another test of previous high and failure – simple and everyone would see it ( at least I hope you would)

– More dangerous variant – New high ( somewhere around 21.900-22.000) and sudden sell off – this kind of development is responsible for at least 50% of clean ups of accounts – pay attention : probability that reaching new high will fuel more of Uptrend is less than 5%

– 95% – this is going to be the top for quite some time

Now you got an idea – control your impulses and don’t daydream.

February 4, 2025 at 8:30 pm #19011

February 4, 2025 at 8:30 pm #19011In reply to: Forex Forum

February 3, 2025 at 8:52 pm #18974In reply to: Forex Forum

January 31, 2025 at 11:05 am #18800In reply to: Forex Forum

January 31, 2025 at 9:59 am #18797In reply to: Forex Forum

Using my platform as a HEATMAP

It’s month end and with stocks up this month, there should be some rebalancing of fx hedges. While I am not privy to such flows, given the surge in the DAX this month, rebalancing would see EUR selling and could account for some of the early EURUSD weakness.

Whatever the case, just be aware of month end erratic price action, especially heading into the 4PM London fix.

With US stocks up this month as well there could be some rebalancing of fx hedges here as well but so far any such flows have been adsorbed.

January 30, 2025 at 11:12 pm #18778In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View