-

AuthorSearch Results

-

March 14, 2025 at 7:05 pm #20932

In reply to: Forex Forum

March 14, 2025 at 2:23 pm #20920In reply to: Forex Forum

DAX Up Over 1% on Optimism from Fiscal Agreement

Frankfurt’s DAX gained ground to trade more than 1% higher around 22,890 on Friday, outperforming peers, on reports that Germany’s chancellor-in-waiting Friedrich Merz reached an agreement with the Greens today on a massive increase in state borrowing.This comes just days ahead of a parliamentary vote next week.

Meanwhile, trade continued to monitor trade tensions, geopolitical events and corporate news.

March 14, 2025 at 2:10 pm #20918In reply to: Forex Forum

German stocks lead European shares rally after report of massive debt deal

Key points:· German debt deal needs two thirds majority for plans, vote slated for Tuesday

· STOXX 600 up 0.8%, Germany’s DAX set to erase weekly losses

· UMG falls after Ackman’s Pershing reduces its stake

· Kering plunges after Gucci appoints Demna as artistic director

· BMW falls on soft auto margin guidance for 2025

German shares led a broad rally in European stocks on Friday, after a report of a historic deal to raise state borrowing in the region’s largest economy.

The pan-continental STOXX 600 SXXP climbed 0.8% as of 1200 GMT, with banks (.SX7P) and defence stocks (.SXPARO) among the top gainers, jumping 1.9% and 2.9% respectively. Germany’s benchmark DAX DAX rose 1.9%, erasing its losses for the week.

Conservative Chancellor-in-waiting Friedrich Merz reached an agreement with the Greens on Friday on a massive increase in state borrowing ahead of a parliamentary vote next week, a source close to the negotiations told Reuters. A debt deal compromise was now being examined by finance ministry officials, parliamentary sources said.

March 13, 2025 at 1:35 pm #20859In reply to: Forex Forum

DAX Slides 1% as Trade War Escalates

Frankfurt’s DAX index extended its losses in afternoon trading, sliding 1% to 22,450, as escalating trade tensions between the U.S. and the EU dampened investor sentiment.

U.S. President Donald Trump threatened to impose 200% tariffs on European wines, champagnes, and other alcoholic beverages after the EU moved to slap a 50% tariff on American whiskey in retaliation for previous U.S. duties on European imports.

Meanwhile, concerns over prolonged conflict in Ukraine deepened after Russia dismissed the proposed U.S. ceasefire deal as merely a “temporary respite,” accusing Washington of imitating peace efforts.

Investors also remained cautious as the German parliament continued debating reforms to the country’s debt brake.

March 13, 2025 at 1:33 pm #20858In reply to: Forex Forum

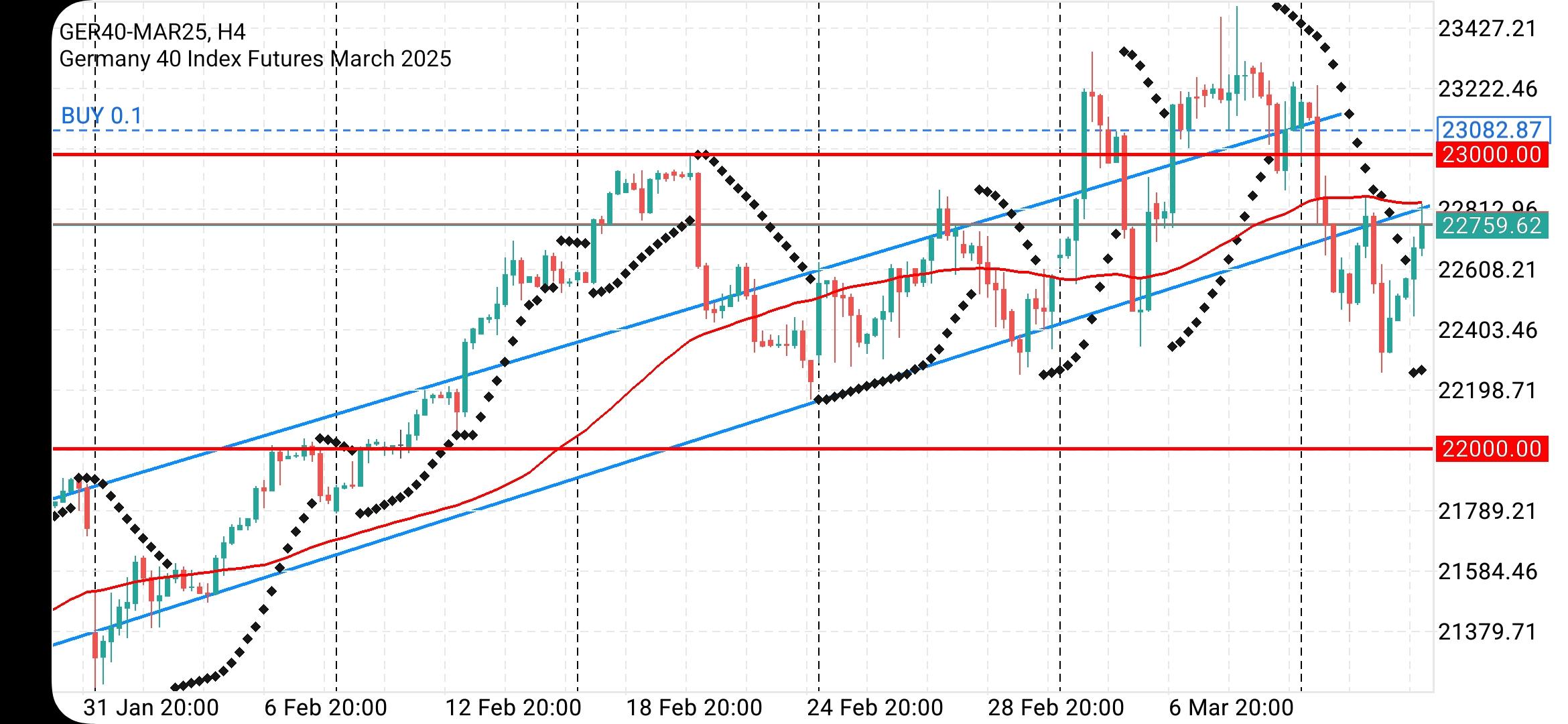

DAX COULD BE GOING TO DISAPPOINT MILESTONE LOVERS

It’s been a roller-coaster ride for German shares in the last few weeks – you’ve probably noticed – as traders try to price major uncertainties in tariffs, domestic politics and grand geopolitical strategy.

And Deutsche Bank have a good stat. They note Wednesday was the eighth consecutive session where the DAX has moved by at least 1% in either direction.

If the blue chip benchmark manages a ninth, that’d be the first time since the pandemic turmoil of early 2020.

Will it make it? Well it’s down 0.4% after morning trading, so it might have to get a move on.

March 13, 2025 at 1:24 pm #20855In reply to: Forex Forum

March 12, 2025 at 1:18 pm #20790In reply to: Forex Forum

I am using Daily charts when giving a general direction and sometimes even Clear signals, but for those you have to wait sometimes for days…

It is possible to trade DAX, Gold, Bitcoin on small time frames, but I use very small time frames…15 min and smaller.

But be aware that only high liquidity pairs are behaving nicely….

March 12, 2025 at 1:13 pm #20789In reply to: Forex Forum

March 12, 2025 at 1:10 pm #20787In reply to: Forex Forum

March 12, 2025 at 1:07 pm #20786In reply to: Forex Forum

March 12, 2025 at 12:55 pm #20780In reply to: Forex Forum

DAX – GER 30

DAX rebounded straight to the Resistance at 22.860 ( a bit short of it) and it is not out of woods.

To have a sustainable move, it has to test the support again at least , and if holds it can go Up.

Close below 22.860 will be Bearish and we should see that test of 22.250

If DAX continues to try Up , this is going to be one big Top, and then you know how it goes…down for weeks if not months…

So, I would like to see deeper correction in coming days, in which case it would be able to regain the strength and continue Up.

March 11, 2025 at 7:38 pm #20755

March 11, 2025 at 7:38 pm #20755In reply to: Forex Forum

March 10, 2025 at 1:00 pm #20639In reply to: Forex Forum

DAX – GER 30

So option No1 came through : Break below 22.900 would lead Dax to around 22.350

Watch closely that Support as it is the Major base for any Up move.

As Yoyo behaviour continues, be ready for anything !

Keep in mind that if DAX fails to penetrate support at 22.350 it will turn Up again and it can be violently….

March 7, 2025 at 3:00 pm #20572

March 7, 2025 at 3:00 pm #20572In reply to: Forex Forum

DAX – GER 30

Dax reached support at 22.900 , and based on the pattern it creates there are two options for Monday:

– Break below it would lead Dax to around 22.350

– Straight Up from the open

This kind of Yoyo behaviour makes it similar to Crypto coins…so some are taking their profits on any new high, but more are buying it on any dip.

It is still in Bullish formation , and for now target stays at 24.200

March 6, 2025 at 3:42 pm #20517

March 6, 2025 at 3:42 pm #20517In reply to: Forex Forum

March 5, 2025 at 1:44 pm #20462In reply to: Forex Forum

DAX – GER 30

Major Support at 22.200 wasn’t even touched yesterday – low was 22.320 , and DAX opened today with a sizeable gap to the upside.

Resistances now at 23.200 & 23.310

Supports at : 22.790 & 22.650

I was clear yesterday while warning of this possible development .

DAX is still not out of woods, and needs to hold on today’s gains to be able to reach new highs.

March 5, 2025 at 11:38 am #20459

March 5, 2025 at 11:38 am #20459In reply to: Forex Forum

US OPEN

Global Sentiment lifted on tariff optimism, European stocks at highs & Bunds hammered on German spending plansGood morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

Sentiment lifted after the US Commerce Secretary suggested Trump could potentially reduce tariffs on Canada and Mexico, perhaps as soon as Wednesday.

European bourses at session highs; DAX 40 +3% outperforms; US equity futures broadly higher with the RTY +1.2%.

EUR surges on German spending plans, DXY around 1.05 after breaking below its 200DMA.

Bunds battered by Merz’s fiscal reform, USTs await data and tariff updates.

Crude subdued continuing recent action & failing to benefit from China’s support which has bolstered base metals.March 5, 2025 at 9:30 am #20444In reply to: Forex Forum

Using my platform as a HEATMAP shoes

The dollar trading weaker, led by the EURUSD, which is in a breakout mode.\

EUR firmer on crosses as well.

USDJPY failed to hold a move above 150.

German bond yields are sharply higher after deal to ease debt restraints (otherwise known as the debt brake)

DAX is up sharply as well.

Zelensky kisses up to Trump by showing a willingness to negotiate a peace deal.

Trump’s address to Congress unveiled no new policies.

.Trade war still on but CAD and MXN rebound suggest caution and hope it may be a negotiating tactic

Date calendar: US ADP employment and ISM services PMI.

March 4, 2025 at 7:24 pm #20418In reply to: Forex Forum

DAX – GER 30

22.200 – Major support needs to hold if DAX is to continue Up right now.

Current pattern signals a Sell off , but in my experience stranger things happened then if DAX is to continue Up from around here. Just saying what I know…

If this drop was a result of a savage profit taking, it wouldn’t surprise me to see 22.200 holding and DAX continuing its trip…

But we can’t know that, so we have to be ready for trend change.

21.450 is another strong point that can provide footing to it.

March 4, 2025 at 12:39 pm #20404

March 4, 2025 at 12:39 pm #20404In reply to: Forex Forum

DAX – GER 30

DAX opened with a Gap – to the downside.

Current support is at 22.550

Carefully now – I said yesterday that fundamentals will drive DAX Up in the future, but this might be a perfect time for profit taking and some correction – be it a sideways or more deeper…

As long as DAX stays above 22.550 , 22.400 & later on 22.200 it is extremely Bullish.

-

AuthorSearch Results

© 2024 Global View