-

AuthorSearch Results

-

April 1, 2025 at 8:44 am #21774

In reply to: Forex Forum

DAX – ger30

DAX opened with a gap to the upside.

Facing resistance at 22.500, with another one at 22.700

Unless some miracle happens it should fail and go for 21.750

Even if it is meant to continue being bullish, it has to take some time in yoyo-ing , and to form a new base for continuation of the uptrend.

I am mostly interested to see how 21.750 will act.

March 31, 2025 at 1:56 pm #21738

March 31, 2025 at 1:56 pm #21738In reply to: Forex Forum

March 28, 2025 at 5:20 pm #21641In reply to: Forex Forum

DAX Index Closes Lower Amid German Labor Market Focus

Closes 0.96% Lower

Frankfurt’s DAX dropped 0.9% to close at 22,460 on Friday, marking its third straight session of declines and underperforming its European peers.Local equities were in the red on Friday after latest data showed continued weakness in the German labor market, weighing on the already-cautious market sentiment due to US tariff concerns.

Technically, DAX went below channel trend line that indicates more losses on a horizon

Close below 22.400 would be very bearish sign and opens a way for 21.700

Resistances above the head: 22.600, 22.750 & 23.0150

March 28, 2025 at 2:23 pm #21626

March 28, 2025 at 2:23 pm #21626In reply to: Forex Forum

March 27, 2025 at 4:08 pm #21554In reply to: Forex Forum

DAX Slumps as Auto Tariffs Take a Toll

Frankfurt’s DAX fell more than 1.5% to trade below 22,500 on Thursday, underperforming its regional peers, with auto stocks pushing down the index.

US President Donald Trump announced 25% tariffs on all car imports, exacerbating the trade dispute with the European Union.

He also warned that he would impose substantially higher tariffs on the EU and Canada if they coordinated efforts to counter trade tariffs.

March 27, 2025 at 1:29 pm #21530In reply to: Forex Forum

March 26, 2025 at 11:28 am #21439In reply to: Forex Forum

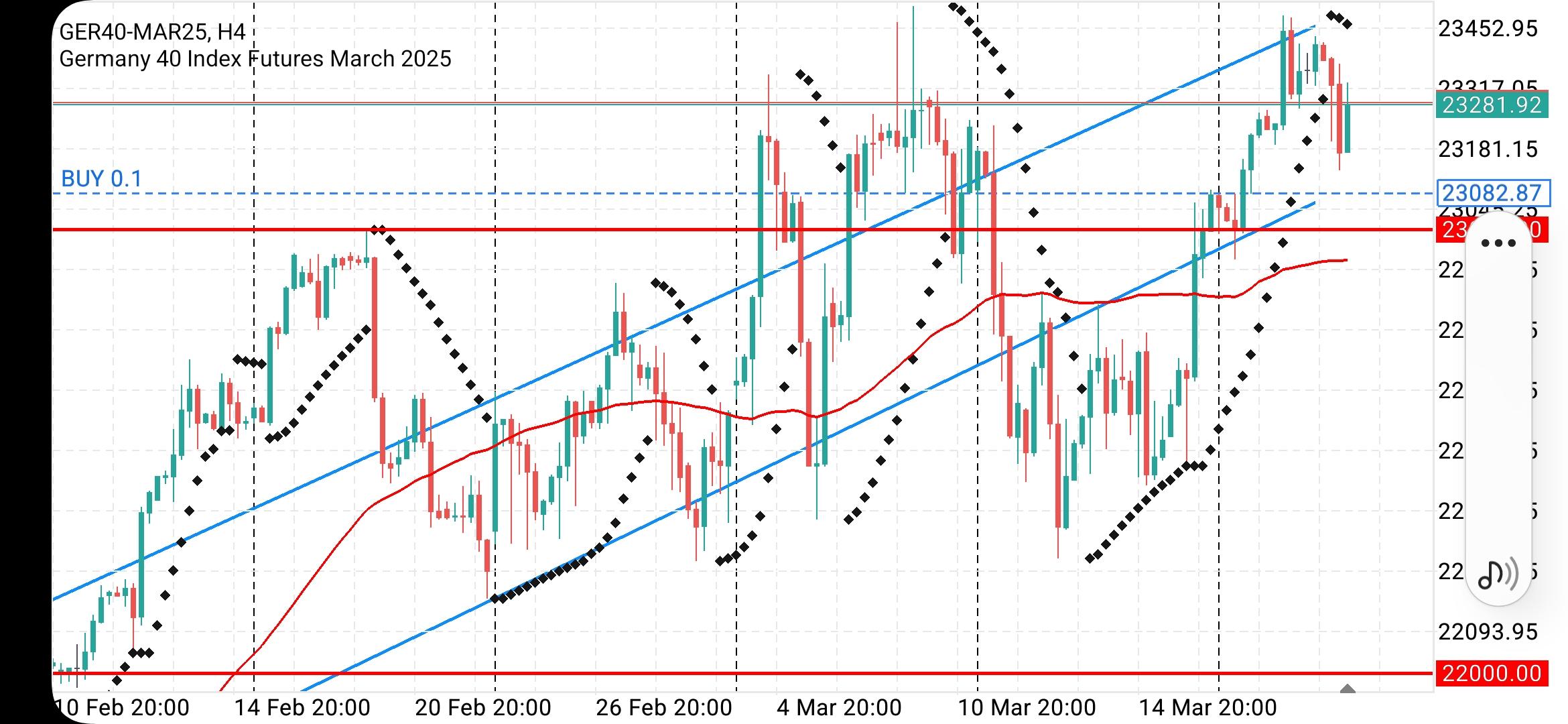

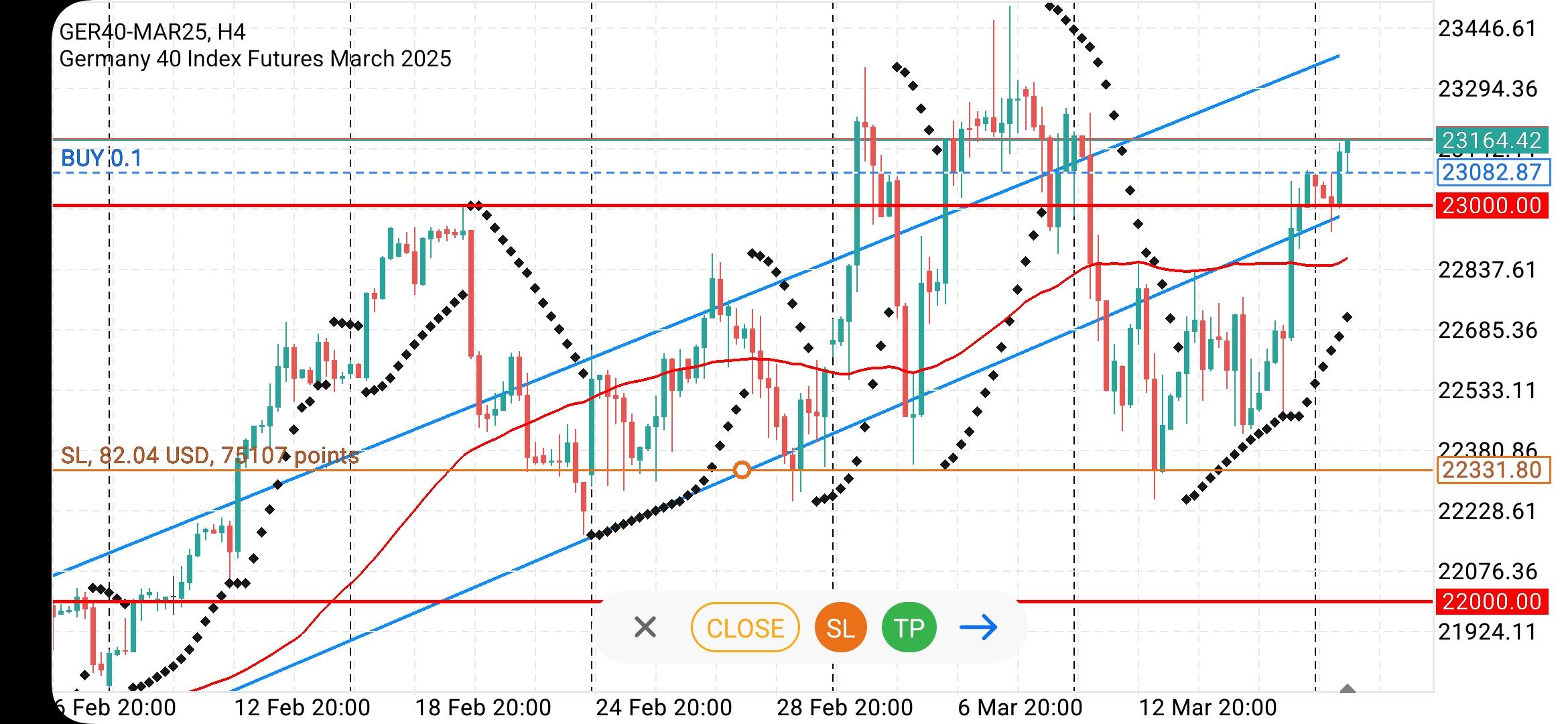

DAX – ger30 4H

Resistance at 23.200 held firmly and sent DAX towards supports : 22.950 & 22.700

So far they are holding.

Next 4h bar opens in cca 50 min, and depending on the close of this one we’ll have following:

– Above 22.970 will give a chance for DAX to try Up again

– Below 22.950 DAX might dive seriously

Last support is at 22.725 – loss of opens a way for 22.425

March 25, 2025 at 9:03 pm #21409

March 25, 2025 at 9:03 pm #21409In reply to: Forex Forum

March 24, 2025 at 2:07 pm #21301In reply to: Forex Forum

Futures buoyant ahead of data-driven week

S&P 500 futures rise over 1%

Traders brace for news on tariff barrage

PMIs, US PCE, China earnings in focus

Wall Street shares looked set to open higher on Monday and the dollar firmed at the start of a data-driven week, while the threat of U.S. tariff hikes made investors cautious in Europe.

S&P 500 futures ES1! were up about 1.2% and Nasdaq 100 futures NQ1! were 1% higher at 1218 GMT.

U.S. President Donald Trump’s administration is likely to exclude a set of sector-specific tariffs while applying reciprocal levies on April 2, according to media reports over the weekend that helped sentiment in early trading.

The pan-European STOXX 600 SXXP ticked down 0.1%, with most of the region’s indexes lower except for Germany’s DAX, which rose 0.2% after data showed manufacturing output there increased for the first time in almost two years.

This week’s data releases include global purchasing managers’ surveys, the U.S. Federal Reserve’s preferred inflation reading, inflation data in Australia and Japan, a budget update in Britain, and major earnings in China.

March 24, 2025 at 1:04 pm #21294In reply to: Forex Forum

March 21, 2025 at 1:17 pm #21235In reply to: Forex Forum

March 21, 2025 at 10:29 am #21227In reply to: Forex Forum

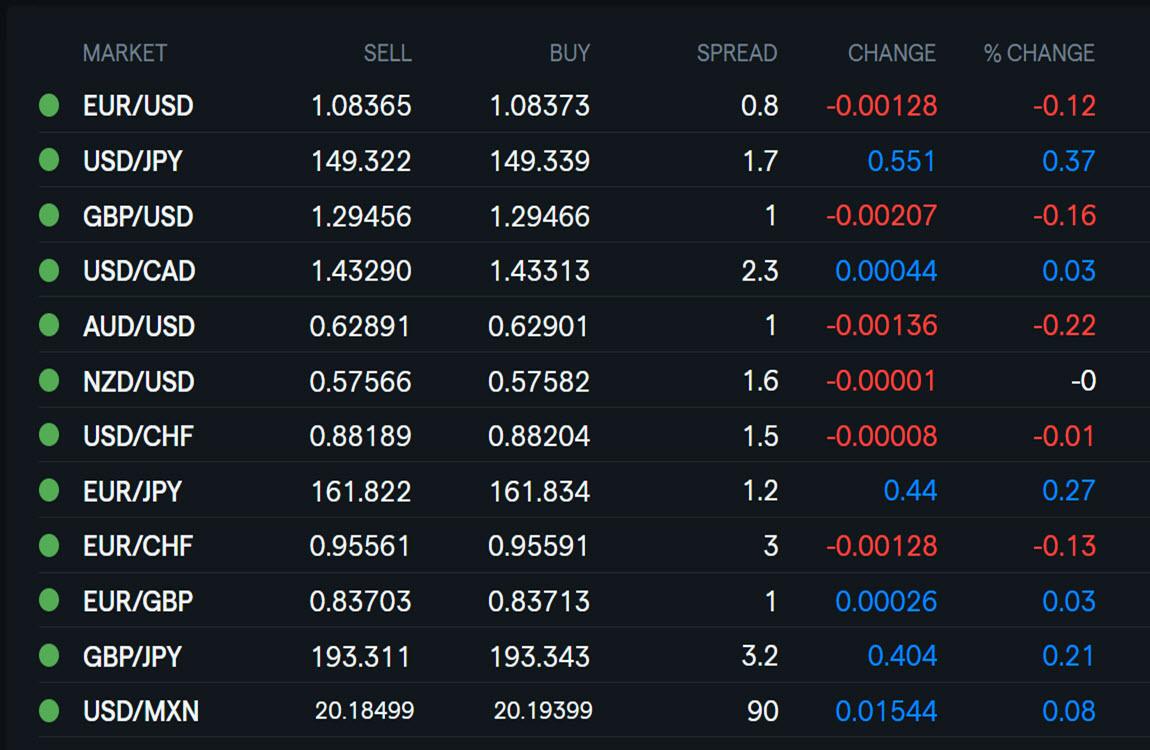

Using my platform as a HEATMAP shows..

… the dollar trading firmer although except for USDJPY, all are still below Thursday’s highs

Another case where news reports look for some excuse to explain the price action

This time it is the Fed being in no rush to cut rates

EURUSD: Looks like it will break an 8 day pattern around 1.09 (bearish)… needs to stay above 1.0805 to avoid an outside week

Stocks a touch lower, US bond yields. steady, DAX is weaker

XAUUSD: Lower after no new record high today

Light news day

March 20, 2025 at 8:42 pm #21218In reply to: Forex Forum

DAX – GER 30

Supports: 22.800, 22.600 & 22.400

Resistances: 23.350 & 23.480

Yoyo behaviour continues – I wouldn’t be surprised to see a new high tomorrow.

Technical analysis can do as much, and right now I follow it using my feelings….so not tradable any more.

Technically , DAX should now turn south and test the supports at 22.400 and even 21.700

We’ll need few days to get clearer picture.

March 20, 2025 at 2:29 pm #21192

March 20, 2025 at 2:29 pm #21192In reply to: Forex Forum

March 19, 2025 at 8:50 pm #21152In reply to: Forex Forum

March 19, 2025 at 4:54 pm #21136In reply to: Forex Forum

March 19, 2025 at 1:10 pm #21110In reply to: Forex Forum

March 18, 2025 at 6:40 pm #21091In reply to: Forex Forum

March 17, 2025 at 6:37 pm #21033In reply to: Forex Forum

March 17, 2025 at 5:17 pm #21031In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View