-

AuthorSearch Results

-

June 25, 2024 at 11:35 am #8088

In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

In an glimpse at how megacap tails wag the dog, a near half-trillion dollar shakeout in AI-bellwether Nvidia’s (.NVDA), opens new tab market cap in just a week continued to drag on the entire market even though most S&P500 (.SPX), opens new tab stocks ended higher on Monday.

Morning Bid: Nvidia’s half trillion hiccup; Bitcoin, China slide

June 21, 2024 at 7:25 pm #7950In reply to: Forex Forum

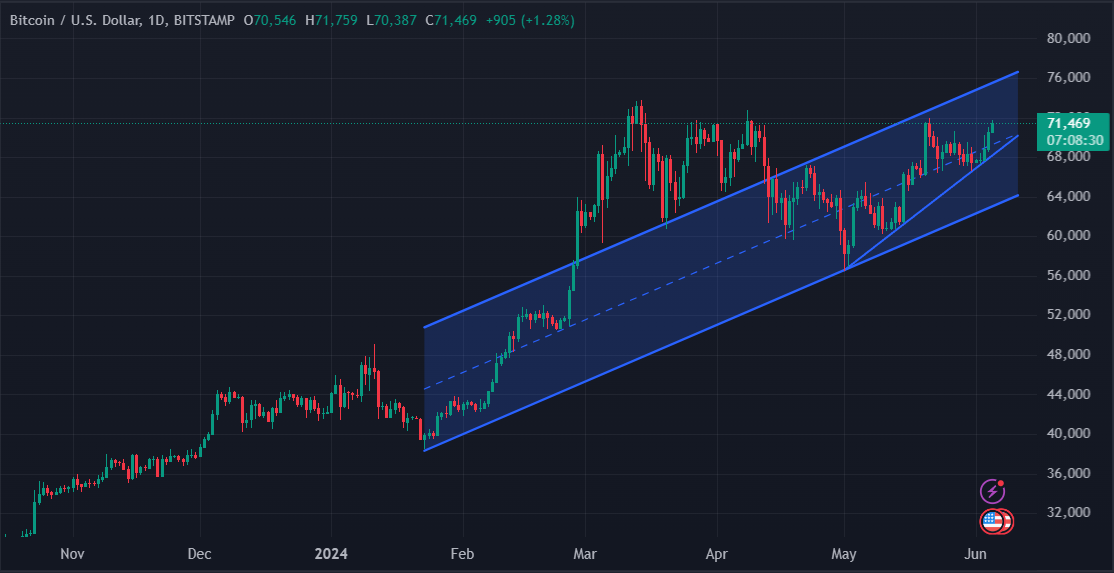

BTCUSD Daily

Bitcoin continues to slide further down and first support that might come handy is at around 60K.

Leave the dreams, hopes and good wishes out of this – we are talking strictly technical.

This is not a miracle toy, but just a commodity of a kind that lots of people got hot on…but some wants also to take their profits…

Reality is that it should be heading to 56K and then we can talk about changing the direction

June 20, 2024 at 6:55 pm #7917

June 20, 2024 at 6:55 pm #7917In reply to: Forex Forum

June 15, 2024 at 5:28 pm #7749In reply to: Forex Forum

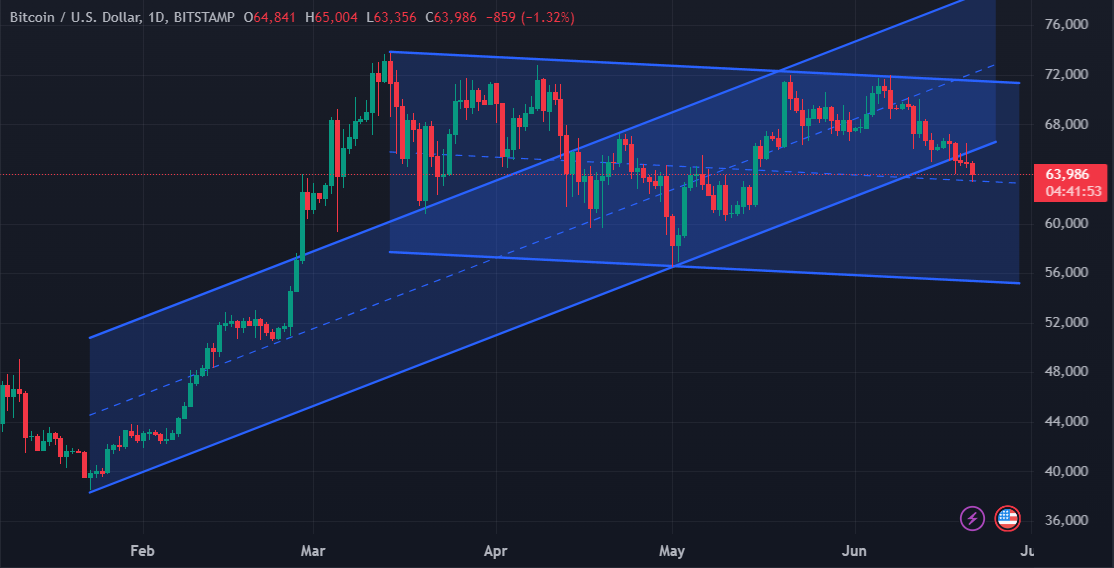

BTCUSD Daily

Bitcoin crashes below $66K, More pain ahead?

Bitcoin dropped more than 2% in the last 24 hours to drop the $65,000 price level during the US trading session straight down from around $67,000. Over the past seven days, BTC has declined by 7.5%, marking its weakest price in four weeks.Technical support comes at 64.850

June 7, 2024 at 6:06 pm #7441

June 7, 2024 at 6:06 pm #7441In reply to: Forex Forum

Regarding GameStop. I converse with various people about the subject and similar. Most of the enthusiasts are younger generation. Rebellious and trying to change the world and shove it to the elders. Some of the outcome is awesome, some is insanely stupid. That crowd included “influencers.” There are literally now millions of them in China now, lines of them on bridges next to eachother making videos for money. The problem is 2% of them control 94% of the revenue stream. The rest are wasting time. Learn how to spell the word – broke.

Couple that with the increasing influence of AI and mass job replacement, these generations are in for a rough time. Not a good time to be both ignorant and arrogant simultaneously.

There is value in the US Dollar. Bitcoin will never replace it kids. StableCoin (US government version to arrive within a year or so) will to an extent, but likely primarily as a transaction vehicle. For the Dollar.

June 5, 2024 at 5:21 pm #7332In reply to: Forex Forum

Yesterday job openings showed decline and today the services index showed expansion. Services, not manufacturing. An argument could be made the S/P 500 stops dead near 5350 coming up. Dxy is still bid factually today overall despite the intra-day pause. That would transfer to Bitcoin as well since some people amazingly consider it an asset to trade like stocks right now.

June 5, 2024 at 4:54 pm #7326In reply to: Forex Forum

June 4, 2024 at 10:45 am #7239In reply to: Forex Forum

June 2, 2024 at 4:50 pm #7146In reply to: Forex Forum

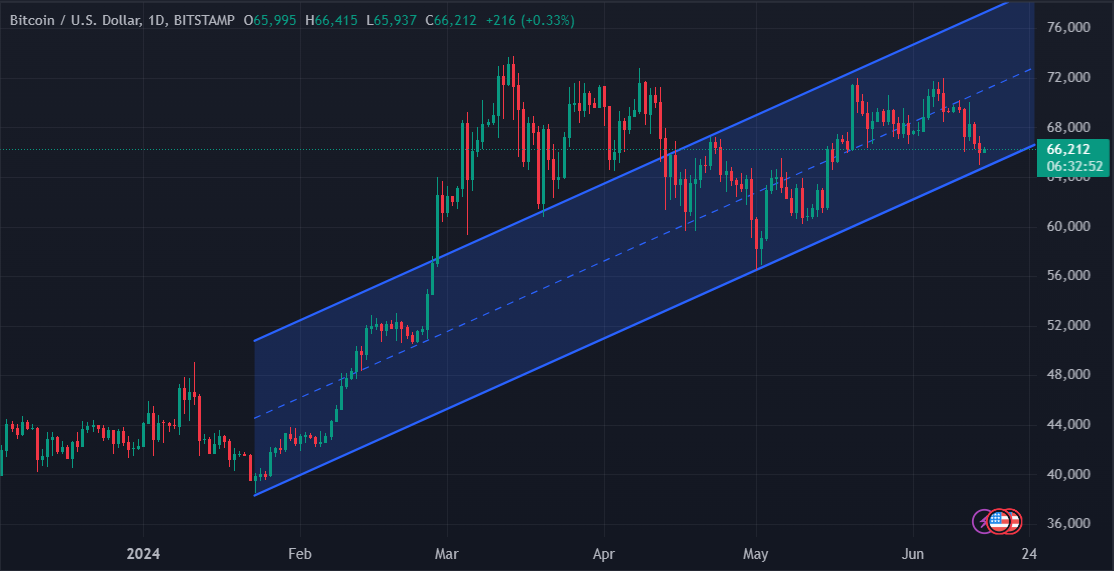

BTCUSD – Bitcoin

The price of Bitcoin appears to have returned to a choppy market condition, quashing any hopes of a breakout to new highs soon. However, the good news is that the current bull cycle may still not be over, even though it is taking a while for the premier cryptocurrency to resume its upward momentum.

Specifically, the latest on-chain observation shows that Bitcoin has been going through a “euphoria wave” over the past few months.

May 25, 2024 at 6:37 pm #6853

May 25, 2024 at 6:37 pm #6853In reply to: Forex Forum

May 22, 2024 at 6:50 pm #6684In reply to: Forex Forum

Monedge found the interview with the CEO of Strike this morning on Bloomberg television interesting. His playing field is the crypto space. He said, wearing a baseball cap and a tee shirt, he wants to “fix” the world and “fix” the monetary system and “do away with the dollar.” The younger generation is rebellious and cute that way. We would like to know how he intends to do that being that the crypto space is the very most attractive market in existence for international mob money, fraud, and deception at present in the infancy stages of the “asset.”

Monedge believes crypto has a bit of work to do first in upholding its sales pitch that it would be “impervious to fraud due to its structure.” Right now it is a trading vehicle and nothing more. Eventually there will be a regulated US crypto vehicle, a stablecoin type of vehicle. Until then, it is a very incomplete engine leaking oil badly. We bought Bitcoin at 20k and are waiting for 40k to be in again. If it never sees 40k, so be it. There is at present the US dollar and other actual currencies in which to participate.

May 22, 2024 at 11:55 am #6633In reply to: Forex Forum

May 15, 2024 at 11:28 am #6314In reply to: Forex Forum

May 6, 2024 at 12:49 pm #5826In reply to: Forex Forum

I am impressed with the durability of Bitcoin to sustain waves of apprehension before and after the “halving.” Enthusiasts were sure it would cause the not-yet viable instrument which is a not-yet viable asset to bolt to 100,000. Seeing how the non-instrument is the most ripe non-instrument for fraud and crime, such as terrorist money being transferred without roadblocks, one might expect the next major case of fraud similar to the FTX matter to cause some strong decline into the 30,000 area. Would like to see that as I would put money into it again down there if so. At this point it appears the 50,000 area might hold for a while.

May 1, 2024 at 7:38 am #5504In reply to: Forex Forum

A look at the day ahead in European and global markets from Kevin Buckland

The marquee markets event for the week is almost upon us, and needs little introduction: The outlook for U.S. interest rates continues to be the elephant in the trading room for all asset classes, responsible not only for recent peaks in Treasury yields and the dollar, but also forming the backdrop for record runs and subsequent declines in the likes of gold and bitcoin.

April 30, 2024 at 4:00 pm #5485In reply to: Forex Forum

Bitcoin – I won’t consider buying until it gets into the 50’s or lower. And since it is not actually a real asset I will cash in near the highs in the 70’s and call it good. Until StableCoin becomes an actual regulated asset utilized on an increasingly widespread basis. Bitcoin is a GenZ “I told you I was smarter than you grandpa” fad so far. The leading source for fraud and criminal activity. So after the buy cashes in I can wait for something real.

April 20, 2024 at 12:42 pm #4925In reply to: Forex Forum

April 19, 2024 at 1:45 am #4857In reply to: Forex Forum

Tonights military stikes against Iran and other countries is causing a high degree of volatility across the Usd, Gold, Oil, Treasuries, Stocks et al. This could strongly affect the macro picture across the board over time. It could even cause alternate items such as bitcoin. Commodities as well. Depending on severity.

April 17, 2024 at 4:39 pm #4778In reply to: Forex Forum

April 2, 2024 at 5:58 pm #3924In reply to: Forex Forum

XAUUSD 4 HOUR CHART – NEW HIGH

XAUUSD holding off an attempt at a retracement to set another record high. As I have been saying, with a void on top, the new high becomes key resistance.

Why> Perhaps some switching out of Bitcoin or just some risk-off flows.

On this chart, it needs to trade/hold above the former high (2266) to the new high at risk.

Key support is not a thought at 2228 as long as it stays above 2250.

-

AuthorSearch Results

© 2024 Global View