-

AuthorSearch Results

-

February 24, 2025 at 10:19 am #19995

In reply to: Forex Forum

February 21, 2025 at 8:32 pm #19949In reply to: Forex Forum

February 21, 2025 at 5:11 pm #19930In reply to: Forex Forum

February 21, 2025 at 9:41 am #19896In reply to: Forex Forum

February 20, 2025 at 5:01 pm #19880In reply to: Forex Forum

February 19, 2025 at 5:57 pm #19807In reply to: Forex Forum

February 18, 2025 at 5:21 pm #19742In reply to: Forex Forum

February 18, 2025 at 7:56 am #19710In reply to: Forex Forum

February 17, 2025 at 8:19 am #19639In reply to: Forex Forum

February 14, 2025 at 5:26 pm #19587In reply to: Forex Forum

February 14, 2025 at 5:22 pm #19586In reply to: Forex Forum

February 14, 2025 at 6:27 am #19552In reply to: Forex Forum

February 13, 2025 at 6:26 am #19466In reply to: Forex Forum

February 12, 2025 at 9:38 pm #19449In reply to: Forex Forum

Robinhood Markets Inc. – HOOD

Is this frenzy coming to the end?

Robinhood posts record profit as post-election trading frenzy lifts volumes

Trading platform Robinhood HOOD reported a surge in fourth-quarter profit on Wednesday, fueled by frenetic activity in equity and crypto markets following Donald Trump’s presidential election victory.

Robinhood’s transaction-based revenue, or income generated from fees for facilitating trading in options, cryptocurrency and equities, in the quarter jumped 236% to $672 million from a year earlier.

Nearly half of those gains came from a 700% rise in revenue related to crypto trading as bitcoin continued its rapid march towards the $100,000 mark during the quarter on hopes of favorable policies under the new Trump administration.

February 12, 2025 at 9:15 pm #19443

February 12, 2025 at 9:15 pm #19443In reply to: Forex Forum

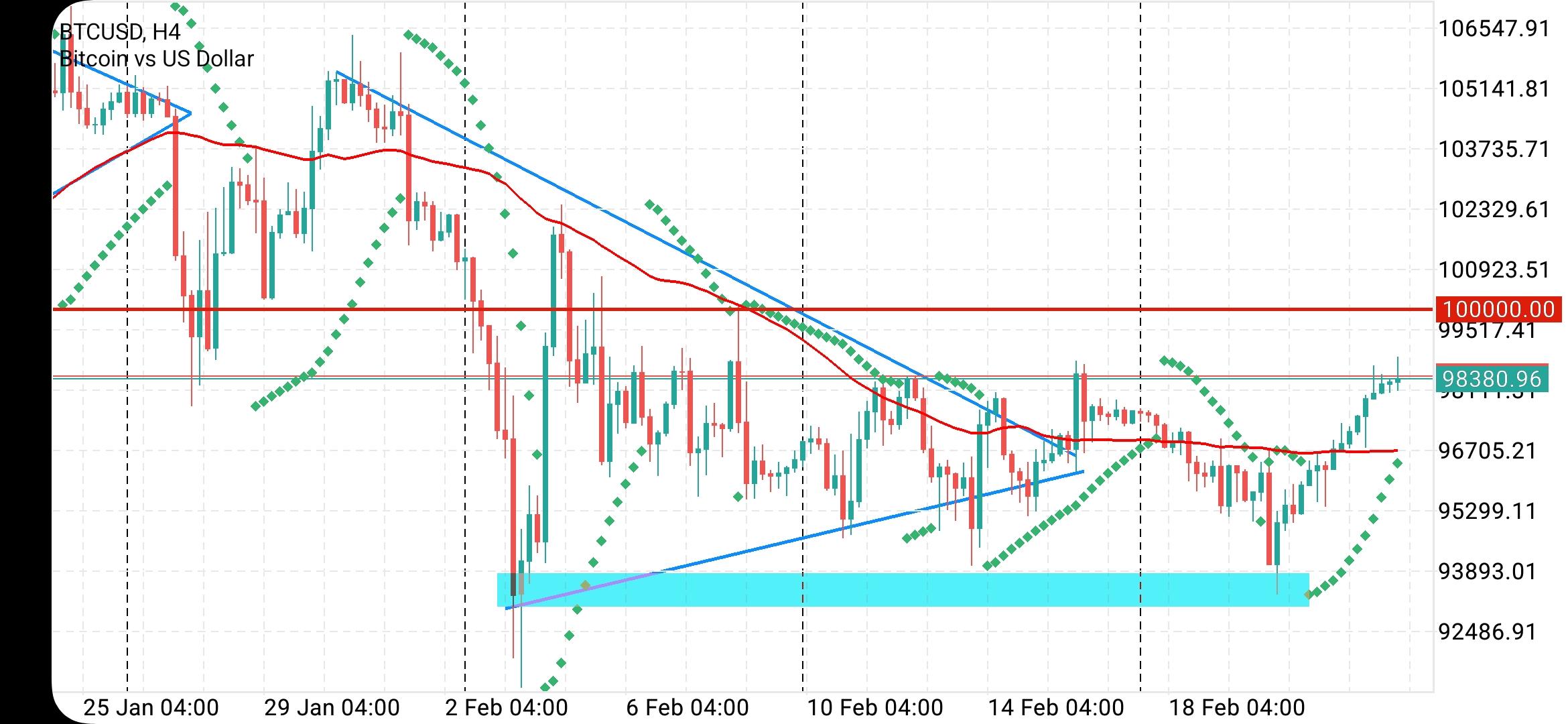

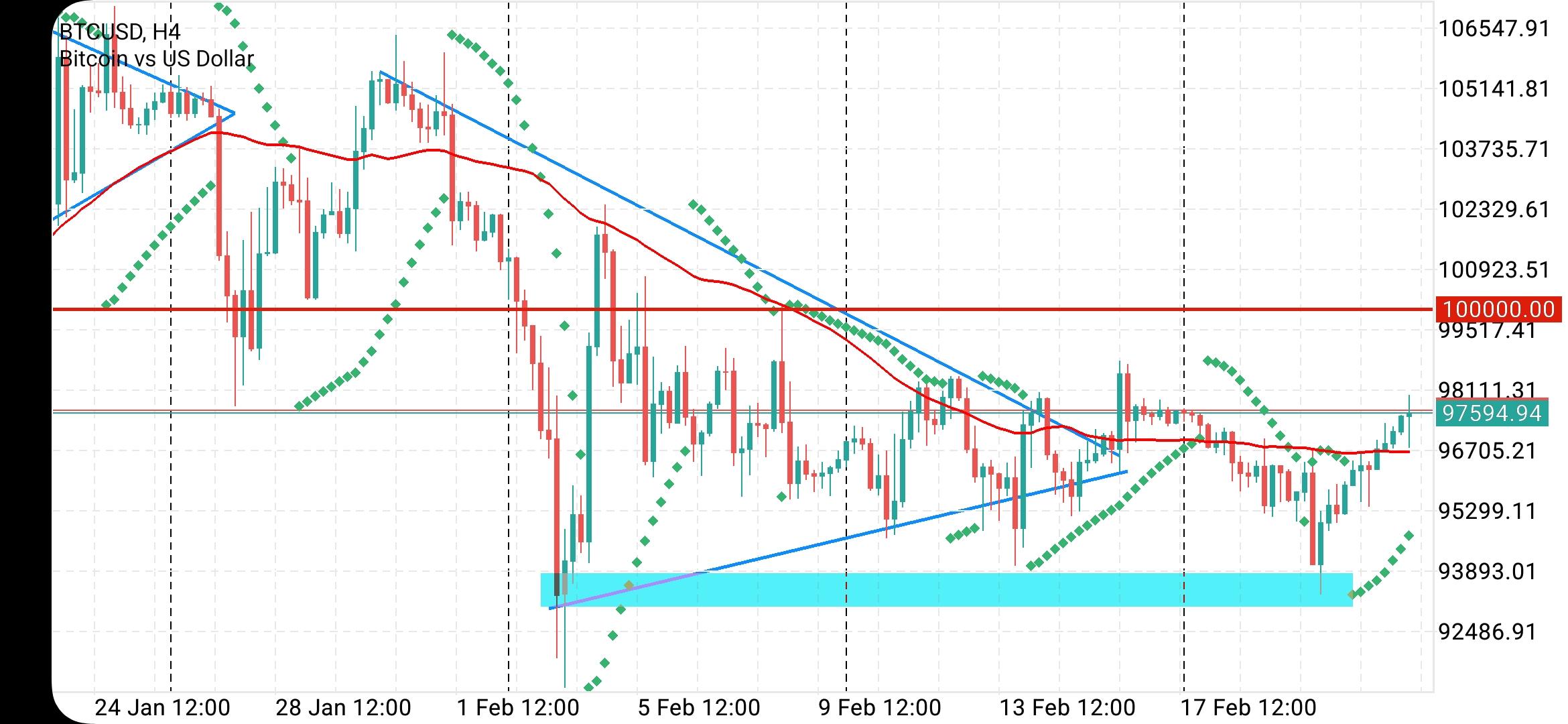

BTCUSD – Bitcoin

Has the time come for Bitcoin to surge again?

Supports: 96.610, 95.500 & 94.000

Resistances: 97.715, 98.550 & 100.200

Even the blind chicken would see that BTC has found a support above 95.000 and now only question that remains is if/when it is going to start rallying again.

Next 48h it should happen if nothing unexpected happens ( like someone talks in his sleep, someone else wants a world peace suddenly and so on – however it is not the news, but how the market will digest it…)

February 12, 2025 at 7:06 am #19406

February 12, 2025 at 7:06 am #19406In reply to: Forex Forum

February 11, 2025 at 3:29 pm #19370In reply to: Forex Forum

Your field Bobby…hope you don’t mind

GME: GameStop Stock Pops 10% as Traders Jump to Conclusions Again—This Time It’s Bitcoin

Retail traders rushed to GME shares after CEO Ryan Cohen posted a picture of him and the world’s biggest Bitcoin maxi Michael Saylor.🚀 GME Shares Pump 10%

· GameStop stock GME rallied 10% Monday as retail traders scooped up the shares after speculations that the video game retailer might be venturing into Bitcoin. The reason? GameStop chief executive Ryan Cohen posted a picture with the co-founder of Strategy (former MicroStrategy) Michael Saylor.

· And there you have it — GameStop’s market value soared more than a billion dollars on a photo posted on social media. It’s not unusual — the stock is highly sensitive to social-media posts, especially those from Keith Gill, a.k.a. Roaring Kitty.

February 11, 2025 at 5:28 am #19326In reply to: Forex Forum

February 10, 2025 at 2:39 pm #19289In reply to: Forex Forum

February 8, 2025 at 6:16 pm #19225In reply to: Forex Forum

XAUUSD: I checked out gold and the targets are wayyyy out… I don’t wanna post them and cause wild global panic… There may be some corrections along the way but the trend on gold is simply just too strong…

2025 is a geopolitical year. Hence all I can say for now is hang on to your gold… It’s pretty likely that we can range at this level, which is a good opportunity to keep adding like as in a SIP…

However on a global long term outlook the targets are way wayyyy out and higher than the markets can imagine… And I just won’t say it simply out of concern that it might cause markets to go cowabunga.

And believe me when I say BTC is a mouse when compared to Gold, as Gold will surpass the wildest Bitcoin prediction with lot more room left for it to soar…. wayyy out like I say…

In the PF in the early years I had a discussion with BC and my call on gold was 5000 (from those early days) when gold was at USD$200, before that I called 1000+,… now 20 years later gold is closer to USD$3000, and in those days I was told that I was talking my book… lol…

-

AuthorSearch Results

© 2024 Global View