Tagged: S

- This topic has 24 replies, 3 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

March 28, 2025 at 5:43 pm #21645

Trading Tip 15: When to Fade a Correction *repeat of Trading Tip 1 with an

The key to any strategy is to be able to put it into practice in real time. We all know that trading rarely operates like a textbook so it is important to understand the logic behind a strategy and why it works so you will know when to employ it. I call this common sense approach and you will see why as I explain when you should fade a correction.

The Strategy

You will be hard-pressed to find this in a trading book or course as this trading tip comes from my many years of experience trading in the forex market.

Simply put it is better to fade a correction or counter-trend move that takes place early in a session (i.e. European or NY session) than one that occurs later in the day, One reason is the market is better able to absorb flows earlier in a session when there is full liquidity and participation. In other words, the trend is not likely to reverse unless key technical levels are taken out. Unless this occurs, buyers are likely to be found below the market in an uptrend and sellers are likely to step in above the market in a downtrend.

Here is the logic: Once a correction runs out of steam and the weak longs or shorts taken with the prevailing trend (i.e. longs in an uptrend or shorts in a downtrend) are squeezed out, the market has less capacity to absorb fresh buying or selling, as the case may be, with the existing trend. This is why you often see the market snap back in the direction of the trend after a correction runs out of steam. It is also why looking to fade an early in the session correction tends to be a high-odds trading strategy. .By fade I mean looking for levels to buy when an uptrend corrects lower or sell when the downtrend corrects higher. .

On the other hand, a retracement that occurs later in the day, especially in the NY session, is more difficult to fade as the market has less capacity to absorb the flows and fresh buyers or sellers are less likely to emerge. In this case, those looking to fade a correction should be prepared to hold the trade into the next trading day.

Summary:

Early in the session correction => Look to fade the move => Expect a snapback.

Late in the day retracements => harder to fade unless you plan to hold the position into the next trading day.

As with any trading pattern, the overall picture needs to be taken into account and whether key technical levels and/or indicators have been violated that would change the risk. As long as this does not occur, corrections that take place early in a session offer trading opportunities for the reasons explained above.

This is a strategy you can put into action as you understand the logic behind why and under what conditions it should work.

Here is a real-time illustration of when to fade a correction and when to avoid it.

ADDENDUM:

Why did XAUUSD surge higher?

The obvious reason is a run to safety ahead of the April 2 reciprocal tariff announcement.

The other reason is applying the same logic of when to fade a correction to longermterm charts,

‘

3 day retracement attempt.

• Shook out erak longs

• Left market with lkess abikity to absorb fresj buying,

• Rest is historyPlease feel free to contact me with any questions or comments.

March 21, 2025 at 1:06 pm #21234Trading Tip 14: Why Do Retracements Work?

As those who have followed my thinking know, I believe trading is common sense. When you think of trading this way you can make sense of what many take as blind faith.

Take retracements as an example. Why do FIBO levels work? Is it because they are magic levels? There is no magic. These levels work because many traders, both technical and other, use the same retracement levels, such as 38.2%, 50%, and 61.8% and thus they increase in importance.

Using a common sense approach, retracements work because trends, no matter what the timeframe, need to shake out the weak positions with the trend (e.g. longs or shorts) to setup the next high or low.

The reason this works is that once a retracement runs out of steam, the market has less ability to absorb fresh buying (in case of an uptrend) or selling (in case of a downtrend) after weak longs (or shorts) have been shaken out.

Tip: FIBO levels give the market reference levels for retracements and can be a self-fulfilling prophecy because many use them more than magic levels and react once they hold. When you think of trading in these terms, trading is common sense.

March 14, 2025 at 3:29 pm #20925Trading tip 13: Stay Alert! Markets Move When There is a Surprise

It does not take a rocket scientist to quickly realize that global markets move when there is a surprise vs. expectations. This is true for key economic reports as well as other key market events.

Positions are often tilted to one side or the other based on market expectations ahead of a key event. You need to stay alert to consensus forecasts so you know how to react to a surprise, either one that exceeds or misses expectations.

As with any trade, you need to be aware of the overall technical picture in any decision to go with or fade a reaction to a surprise and whether there are any levels that would accelerate or reverse the prevailing trend. As always, it is the reaction to news that will tell you more than the news itself.

The key is not to become complacent before a key event as it is easy to get lulled into a feeling that it will be a non-event, especially when a market is trading in a tight range. While this may sound like an obvious tip, you would be astounded how many ignore it.

Tip: Stay in touch with market expectations so you know how to react in case of a surprise.

March 8, 2025 at 10:49 pm #20619Trading Tip 12: Why News Matters!

News drives markets and it is the surprise in news or economic data that triggers the larger reaction. Most traders look forward to key news events as it more often than not is followed by some volatility.

While some technical traders say news does not matter anyone who trades these days knows better. So don’t trade with blinders on. You need to stay on top of what news is due and what is expected as markets move most when there is a surprise (i.e. miss vs. market expectations.

Tip: Remember, it is the reaction to news more than the news itself that gives us clue to a currency’s (or any instrument’s) strength or weakness.

February 28, 2025 at 3:02 pm #20241Trading tip 11: Take a Pause and Review: Stops as They Drive the Forex Market

Let me start by saying the forex market is on a never-ending quest to run stops. Master this concept and you can learn to beat the market.

Look at this chart and tell me whether you woud have been able to identify in advance where stops werel ying.

Ad in this chart you can see where there were stops (i.e. low of the day)

While there are stops in all markets, it is easier to identify those in forex and use that knowledge to your advantage.

One reason is that the only rate feed used by everyone is in forex. The only difference one might see is in the spread quoted by a broker. Otherwise, everyone involved in forex are essentially looking at the same chart levels.

The more who look at a specific level the more significant it becomes.

It is therefore easier to identify where stops might be lying vs.CFDs, where rate feeds can vary between brokers, ecen those uswing thw same symbol.

In this tip, I am going to refer you to previous tips: (scroll down)

Trading Tip 3: Use stops and Live to Trade Another Day

Trading Tip 3A: Watch Out for Stops and Use Them to Your Advantage!

And to this video, which I suggest watching or watching again.

If you then have any quextions, postask away.

February 21, 2025 at 12:28 pm #19907Trading Tip 10: Treat Forex Trading as Being in Episodes Not Trends

Most technical traders refer to momentum moves as trends. I prefer to look at the price moves as trading in episodes.

Like a streaming television show, an episode has a beginning and an end. It is no difference in trading except that is where the similarity ends.

The Forex Market trades in episode

The forex market trades in episodes on all time frames. The longer the time frame, the longer the episode is likely to be and vice versa.

What I mean by an episode is a period on a chart where a currency, for example, is trading in an uptrend, downtrend or in a consolidation range.

Don’t get caught trading an old episode

This is a critical concept to understand for if you are trading an old episode when a new episode has begun then you will find yourself on the wrong side of the market.

Anyone who has traded in the forex market, knows how fickle the price action can be. By getting in sync with the current episode, you can take advantage of this knowledge rather than having it take advantage of you.

With that said, many traders find themselves trading the old episode as it is often hard to switch gears, even when charts tell you it is time to do so. An example is looking to sell a rally after a currency has bottomed or looking to buy a currency after it has topped out.

What a difference a day makes

Look at this chart and ask yourself whether you would have been able to switch gears from an up episode to a down episode.

It is important to identify when a new episode begins and when it ends. It is also important to be aware of the broader trend as counter trend moves (e.g. retracements) tend to end more abruptly than moves with the overall trend.

So, the question you should be asking is how to stay one step ahead of the market rather than one step behind.

Think if it this way. Getting in sync with the current episode will find you swimming with the current rather than fighting it by swimming against it.

Why You Should Treat Forex Trading as Being in Episodes Not Trends

For a further discussion, sign up for the Global-View Trading Club membership is free).

To get Your Free Trial of The Amazing Trader Charting Algo Click HERE

February 13, 2025 at 4:38 pm #19507Trading Tip 9: The Monday Effect

This is a trading pattern I doubt you will find elswhere

This is a term I coined to identify a forex trading pattern that I watch out for each week. I call it the Monday Effect and when it plays it, there are usually significant moves in the market. So, you need to be aware of the Monday Effect, which I reveal in the following article…

The Monday Effect occurs when the low or high for a currency is set on Monday and the market reverses direction in the latter part of the week (i.e. Thursday-Friday). This “Effect” can be especially strong when the low or high is set in early Far East trading but it can work no matter what time of day it occurs.

Whatever the reason, Monday Effects do work. I jot down the highs and lows each Monday and leave it next to my platform as the week winds on. If the high or low is broken or occurs on a non-Monday, I cross off the risk of this pattern for the week.

If the market starts to distance from the high or low, I raise my alert as you often see stops build from those underwater. Think about it. The farther a market moves from a Monday low/high for the week, the less likely to see major stops being run unless those levels are taken out, leaving the other side more exposed.

Note, the Monday Effect is like a setup and as with any setup, you look for signs that it will materialize into a trading pattern

Classic Monday Effect Week

..February 13, 2025 at 3:42 pm #19501

..February 13, 2025 at 3:42 pm #19501Trading Tip 9: Change Muscle Memory and See the Difference in Your Trading

One of the obstacles any trader has to overcome if he/she wants to move to the next level is muscle memory.

For me, it is like trying to improve my golf swing. I take a lesson but have so much muscle memory built into my swing that trying to change is an uphill battle. I make a change in my swing but the more I play the more muscle memory takes over. I find myself reverting to what feels comfortable, which is my old swing. It takes commitment and discipline to make a lasting change.

It is no different in trading. You learn something new but have to fight muscle memory and old habits to put it into practice.

Now I can give you a list of tips or strategies you might use but let’s focus on just one It is a ‘tip” you may have seen me mention before but I cannot emphasize enough that it can make the difference between success and failure.

I call it the “hard trade is more often than not the right trade.”

What does this mean?

It means the nard to find a good entry forex trade (with the flow) is more often than not the right trade while the easy-to-enter trade (looks cheap/expensive so you buy/sell) it is often the sucker bet.

I am sure we have all been guilty of trying to catch a falling knife because it looks overdone only to see it continue moving against you. One reason is that the farther a currency or any asset moves, the harder it is to find a good entry-level where you can place a reasonable stop. Human nature then takes over, which is to try and pick a bottom or top prematurely, often with negative results.

How do you change muscle memory?

So, the question is how do you change muscle memory and start taking what looks like the hard trade in real-time but the easy trade after the fact?

One way is to take a deep breath rather than acting emotionally by trying to pick a bottom or top before there is some technical reason to do so. It is like taking a step back before acting so you can see the price action clearly.

I call it stepping out of body). You will be amazed at how losses from sucker bet trades (even if small but fatal if large) can accumulate and impact your P&L and capital.

Another step is to find a system or strategy that gets you in sync trading with the momentum and tells you when the move has run out of steam. If the purpose of this report is to publicize The Amazing Trader, I would be encouraging you to subscribe.

However, the aim is to make you aware of a trader’s tendency to look to pick bottoms or tops (most want to be swing traders) = the easy trade rather than fighting muscle memory to do so and take the hard (to find a good entry) trade.

Like my golf swing and breaking old habits, changing muscle memory is not easy but worth the effort to do so.

This only scratches the surface but if you find yourself with muscle memory as described above, the first step is awareness. The second step is to keep fighting the tendency and see if it makes a difference in your trading.

i can show yiu away using ny Amazing Trader charting algo.

Feel free to contact jay@localhost

February 6, 2025 at 4:11 pm #19124Trading Tip 8:A Warning to All Traders: Your Stop May Not Be a Stop

Anyone who has survived the forex trading wars and is still trading knows how important stops are to preserve capital and staying in the game.

As I noted in Use stops and Live to Trade Another Day

Stops are a necessary evil for any trader who wants to stay in the game. Some traders may try to avoid using stops but all it takes is one surprise headline and the game is over..

Stops are like an insurance policy to protect against a trade not working out. A stop is also protection against a surprise or an unexpected event

When a stop is not a stop

However, there are times when a stop is not a stop but an invitation to lose more than planned or even to see an account wiped out.

In the history of trading there are times when a currency, for example, gaps in a straight line and stops are executed far away from where they are placed. While not the norm, there are enough instances to have left the floor littered with blown accounts.

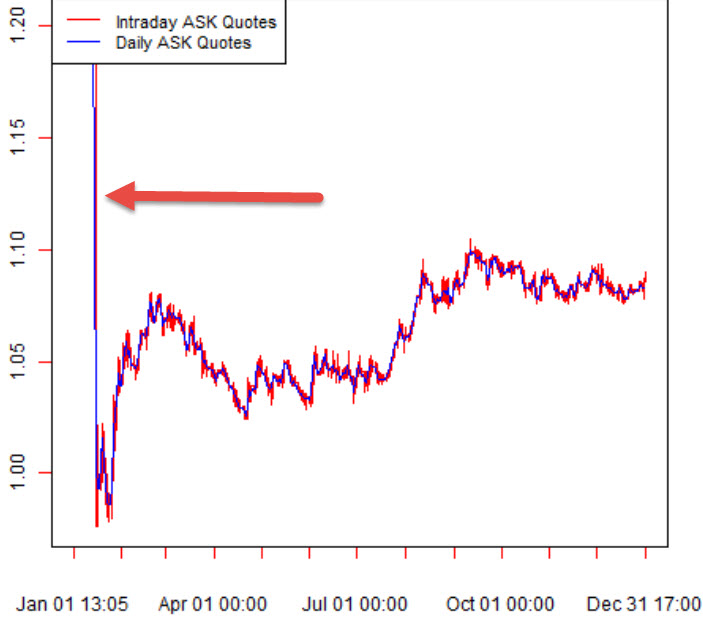

The one that comes to mind occurred on January 15, 2015 when the Swiss National Bank pulled its bid supporting EURCHF at 1.20 and what followed was a true black hole. No stop was safe and in fact many traders found themselves with negative margins when their positions were closed out, some as much as 20+% away from their stop level.. The range for that day was 1.2020-.8643 with most of the move occurring in minutes although there is a debate as to where the actual low was depending on the broker.

Source Quantitative Finance

While this was an extreme case to say the least it underscores when a stop is not a stop. Whether a stop is executed 50 pips, 100 pips, 200 pips or more from where it is placed, the results can be disastrous depending on the amount of leverage used

Time for traders to beware

This brings us to today’s market where attention is clearly focused on the results of the US election. As liquidity thins with trading driven by election headlines, even if you call the vote correctly you could easily get stopped out on a false start as news algos will rule the market. The issue is not getting stopped out but at what price.

A Warning to All Traders: Your Stop May Not Be a Stop

Now, to be clear, I am not suggesting to trade without a stop loss. Just be aware that the next few days will not be business as usual. There is a reason why implied options volatility has soared in currencies like the EURO and Mexican Peso to levels not seen since the 2016 U.S. presidential election.

So as a warning to all traders, especially those relatively new to the game, your stop may not be a stop as you are used to but don’t trade without one. Either reduce your leverage and widen your stop or sit back, enjoy the fireworks and look to trade once the dust settles.

Addendum: Feb 3, 2025

This USDCAD 5 minute chart is a good illustration of when a stop isn’t a stop in a news headline driven market.

Note, the last candle where stops were likely run on both sides.

Ask where stops were filled in this 5 minute candle.?

1.4584 => 1.4g24 _. 1.4520 => 1.4572 (close)

A Warning to All Traders: Your Stop May Not Be a Stop

Get Your FREE Trial of The Amazing Trader HERE

February 3, 2025 at 10:56 am #18929February 3, 2025 at 10:36 am #18925January 30, 2025 at 9:21 pm #18769January 30, 2025 at 4:08 pm #18753Trading Tip 7: Why You Should Drill Down on Your Charts

As I have noted many times, identifying the side to trade is more than half the battle in putting on successful trades. In this regard, one way to do this is by drilling down on your charts as I will explain in the following:

The term “drilling down” means starting at longer time frame charts and then moving down to shorter time frames to find opportunities to trade on what I call the “strong side” of the market.

In this article I will show how I drill down using my Amazing Trader (AT) charting algo

The process is designed to look for confirmation of a trend or episode on multiple time frames, and then find an AT ladder pattern to trade. Note, an AT ladder pattern is characterized by rising red lines (uptrend) or falling blue lines (downtrend)

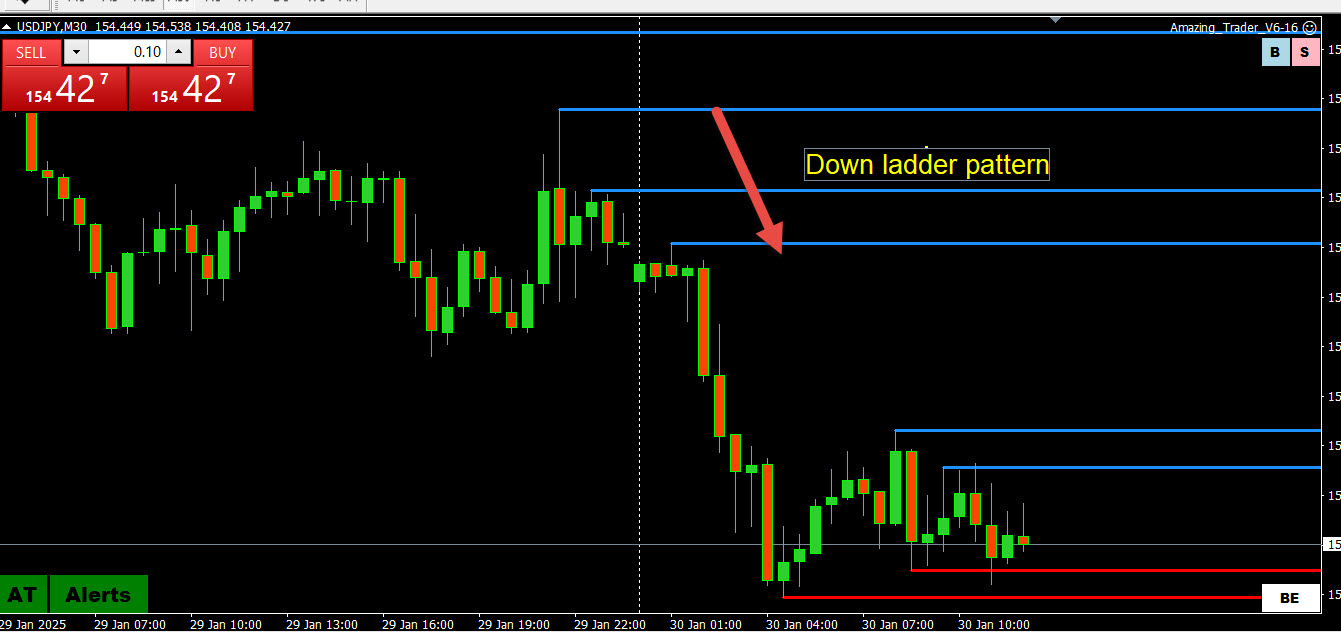

Down AT Ladder Pattern: USDJPY 30 minite chart

Drilling down time frames:

Daily => 4 hour => 1 hour => 30 minute > 15 minute => 5 minute depending on what time frame you prefer to trade.

If you see AT ladders building in the same direction on say daily, 4 hour and 1 hour charts, you can assume there is an imbalance tilted in that direction

What the means for trading is that the institutional type traders who trade larger size and use longer term time frames will be looking to buy dips (ladder up) or sell blips (ladder down).

What this means for you is when multiple longer-term time frames confirm each other (I.e. AT ladders pointed in the same direction), you can identify the side to trade from, which is where big money traders are looking to do the same.

You then drill down time frames until you see an AT ladder pattern on the time frame you prefer to trade (e.g. 30, 15, 5 minute) and employ the ladder strategy to trade (explained in detail when you subscribe).

Here is an illustration from a video I created awhile ago with insights that have stood the test of time.

NOTE, you don’t trade blindly as you need to be aware of any levels, especially on longer term time frame charts, that would dampen or reverse the current episode.

Get more tips like this when you Join GTA – for FREE – CLICK HERE

January 24, 2025 at 3:56 pm #183716: Trading Tip: Why the Hard Trade is Often the Right Trade

This is a great tip because this is one of the keys to trading. It is the most logical approach but in the heat of battle, often the most difficult to implement. Master this and you will see a difference in your trading.

I will explain why.

Many traders look to take the easy way out by looking to buy low or sell high but as I will show you, this is often the wrong way to trade. This is not a way to trade with the odds on your side and the way to become a successful trader.

Have you ever been sitting in front of your screen and all of a sudden a currency dips or spikes by 30-50 pips?

My gut reaction and I assume yours as well is to buy the dip or sell the rally hoping for a quick turn.

It is a gut reaction that I have to fight to this day, which is to take what looks like the easy trade that often turns out to be the wrong trade.

Have you ever had the right position, say in a downtrend, take your profits only to see the currency fall another 50 pips?

What do you do then?

Do you re-establish the short position 50 pips below where you just got out or look for a level to buy for no other reason that you cannot sell at the lower level?

Many traders look to do the latter, which is again the easy to enter but often the wrong side to trade.

In these cases, you may find out the hard (to find a good entry with a reasonable stop) trade is often the right trade.

What is the hard trade?

- The hard to find a good entry level trade

- The hard to find a trade with a good stop

- The hard for you to pull the trigger trade.

Markets rarely give you an ideal entry level and when in a trend, finding a good one may be even harder to find.

This lures many into buying or selling at what looks like a bargain price only to see it turn out to be a sucker bet.

Of course, there are exceptions but as a rule, the hard (to find a good entry) trade is more often the right trade.

Look at these charts. There was a nearly straight line move up with no obvious place to put a stop. The farther it moved from the low the harder it was to find an entry with a reasonable stop. The second chart shows a oine way move wiuth no retracement.

The easy trade would be to try and pick a top before there is a reason to do so.

This may sound simple but I believe it is one of the keys to trading. Master this and you will see a difference in your trading.In future articles we will discuss how to find an entry with the hard trade that in hindsight afterwards will in fact turn out to be the right trade.

Contact jay@localhost

January 18, 2025 at 10:19 pm #180475. Trading Tip: When Trading Against a Trend Don’t Overstay Your Welcome

This is an important tip because many traders treat both sides of the market the same way.

Have you ever had a winning trade and held out for the last pip only to see your target miss by a fraction, the market reverse and give back everything you made, sometimes more?

It has happened to me and I am sure it has happened to you as well.

There is nothing more frustrating than having a winner and then giving it all back.

Have you ever asked the question why?

Many traders like to fade moves and trade against a trend. They love to try and pick bottoms or tops.

This is often referred to as contra-trading.

When trading contra, you need to be faster to take profits than when trading with a trend.

While there is no set rule, more times than not a contra move does not reach a target level for the trade and is quicker to reverse once the buying (or selling) runs out of steam than a move with the prevailing trend.

This trading tip suggests not to hold out for the last pip when contra-trading and why I say don’t overstay your welcome when trading that side of the market.

To sum up, as a general rule, be quicker to take your profit when trading against a trend than when trading with it.

Contact jay@localhost with any questions or comments

January 10, 2025 at 3:20 pm #175824. Trading Tip: How to Use Retracements to Your Advantage

Retracements are a necessary evil. They are a market’s mechanism to shake out weak longs or shorts when positions get too over extended on one side or the other.’

See why retracements are important

Let’s say we are in a trend. The market gets overbought or oversold. It needs a shakeout. By shakeout I mean the market needs to squeeze out the weak hands, the weak shorts or weak longs before it can go after a new high or low….

…the currency (or any market) needs to do now is make a new retracement low or high (as the case may be) before buyers/sellers come in and resume the trend.

The point here is when you have a retracement and it stalls, beware of the move back in the direction of the overall trend as the market has less ability to absorb the flows than before the market corrected.

Textbook case: EURUSD Retracement

As this chart shows, it was a textbook case in the EURUSD, which plunged to a 1.0682 low after the U.S. election results. It then retraced sharply to 1.0833 but did not go far enough to break the downtrend. It then reversed in favor of the trend to break to a new low.

The key takeaway is when in a mature trend or one that has moved too far, too fast a retracement is necessary to setup a move to a new low or high. Keep this in mind when trading in a trend. View a retracement as a necessary evil that is needed before a trend can resume. BUT don’t ignore what charts are saying when a market retraces.

In this regard , keep an eye on longer term technical levels that would either keep the current trend intact or break a level that would change the technical picture. Following this logic will allow you to take advantage of retracements rather than letting them take advantage of you.

Addendum: November 13, 2024

To further prove the logic of what I discussed, See the following chart where a mini retracement that took out stops and weak short EURUSD positions was followed by a move down to a new low.

January 6, 2025 at 2:35 pm #17232I would like to add one of my own insights into this issue:

The forex market is driven by a constant quest to run stops. This may be just my opinion but it is as close to fact as I can tell.

To make it simple :

Big banks are behind the Forex market – they drive the demand and supply day and night and provide liquidity…

Explanation for running stops is the fact that those banks make money mostly by executing orders by their clients .

These orders are combination of Buy/Sell orders and Stop Loss orders – and they don’t care which one is it…they just have to execute and collect the commission ( spread ) .

So be it a human or a Bot , they have the same task – to execute as much as possible during the day ( all at best) , and every order counts.

So stop losses are legitimate targets – orders like any other…so they are not after your little stop, but after bunch of it….

Without showing you exactly how the bidding goes , this is the closest to the truth .

So when positioning your Stop, you should avoid some obvious levels , as sometimes they can just go through it and come back afterwards…like nothing happened .

Sometimes they do count on stops to let them reach lower/higher levels where they see some big orders – example :

Support is on 1.02700 , but they go through it as they see huge orders at 1.02500 – so they execute that huge orders and in the process they execute additional Stops on the way down…and then same on the way Up…so just a Collateral damage…nothing personal…

January 6, 2025 at 1:15 pm #17223Trading Tip 3A: Watch Out for Stops and Use Them to Your Advantage!

This is one of my favorite forex trading tips and the basis for much of my trading.

The forex market is driven by a constant quest to run stops. This may be just my opinion but it is as close to fact as I can tell.

I cannot emphasize enough how important this is to understanding how the forex market works.

While I am not privy to the way all of the algos work, I assume some are programmed to be on a seek-and-destroy mission, which is to probe for stops.

I am not talking about your stop but stops in general as they tend to be bunched around the same levels.

Master this concept and it may change the way you look at trading.

The point is once you recognize that the forex market is on a never-ending quest to run stops, you can put the price action in perspective.

Think about it.

If you have a feel for where the market will look to run stops, it can give you a clue which side of the market is more at risk.

This is true across all time frames but especially true for intra-day trading. You do not need an order book to get a sense of where stops may be resting. It is a skill you can develop over time.

When stops are run

When you see a large wick in a candle or an outsized long bar on a chart, more times than not it is caused by a run-through stops.

On the other hand, when you see an obvious level for stops that trades and quickly reverse without a large wick or long bar, it may, and I emphasize the word “may,” indicate either there were no stops or that they were easily absorbed.

When there are no more stops to run

When there are no stops left to run, a currency will either reverse the direction of trade sideways in a narrowing range. This may explain why the market tends to die off during the US afternoon as there are no stops left nearby to go after.

This is not to suggest basing your trading on guessing where stops are resting and hoping that they get triggered.

However, adding this to your trading mix should help you assess the risk and the strong side of the market at any point in time.

Addendeum:

Look at this EURUSD chart from Jan 6, 2025 to see wherestops were run on a news headline.

‘

January 3, 2025 at 3:21 pm #17057

January 3, 2025 at 3:21 pm #170573. Trading Tip: Use stops and Live to Trade Another Day

Stops are a necessary evil for any trader who wants to stay in the game. Some traders may try to avoid using stops but all it takes is one surprise headline and the game is over.

I recall one of our old-time Global-View.com Forex Forum members saying something like this:

Use a stop and that is exactly what you will find the next morning when you are stopped out.Of course, he was being factious but the reality is that you are damned if you do and damned if you don’t use a stop. However, with that said, in the end, as the title of this article says, use a stop and you will live to trade another day.

Use Stops: Live to Trade Another Day

One of the major flaws that retail forex traders have is a reluctance to take a loss. Losing is part of the trading business and many traders, especially new ones, do not like to admit they are wrong. This may sound obvious but I have also seen experienced traders get stubborn, lose discipline, and override their stops.

This leads many to not use stops on the assumption (or hope) that the market will come back to them. This may work during range markets or consolidation but when the pattern changes to a trend or sharp move in one direction, those trading based on hope can see their accounts wiped out.

Don’t underestimate what I am saying. I have seen it happen too many times.

So, traders beware. Don’t think you can outlast the market, especially when in a leveraged trade as your pockets are not deep enough. Accept losses as a cost of doing business and hopefully your gains will exceed your losses. In any case, using stops to protect your capital means you can live to trade another day.

But there is something you can do about it by learning how to trade on the strong side of the market where your stop is less likely to get triggered. Stay tuned for another article where this will be discussed.

December 29, 2024 at 11:28 am #168202. Trading Tip: Beware of a New Year Whipsaw

While this year may turn out to be different given the new U.S. president and policies (e,g, tariffs, tax cuts, etc) could impact the bond and global markets, I would be remiss not to give a warning to beware of start of a New Year whipsaws.

It is also a good warning to keep in mind at other times of the year, such as the start of a new quarter and end of summer. In any case, it might not be until the end of the following week when the U.S. December jobs report is released that the picture going forward gets confirmed. In the meantime, stay on guard for whipsaw type trading as the market returns to full liquidity

What do I mean by a whipsaw?

In trading, a “whipsaw” refers to a situation where the price rapidly moves in one direction, only to quickly reverse and move sharply in the opposite direction, often catching traders off guard and potentially leading to significant losses if they are not properly positioned to handle such volatility; essentially, the market appears to be “sawing” back and forth rapidly?

Trading Tip: Beware of a New Year Whipsaw

As a rule, I am wary of start of the year moves. There are times I do not look to trade until a full week is in or otherwise just take it one day at a time.

One reason may be muscle memory from a long time ago where I got caught in a whipsaw during the first week and it took a long time to dig out of that hole. I have seen too many New Year false starts not to keep me cautious betting on early trends continuing.

So, my Tip of the Week is to be aware of early in the year moves and a risk of false starts/whipsaws, and to keep it close to the vest until full liquidity returns to markets.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View